Relief elusive for salaried class, crackdown on non-filers

Growth for the current fiscal year is expected to be 2.7%, which is lower than the budgeted target of 3.6%

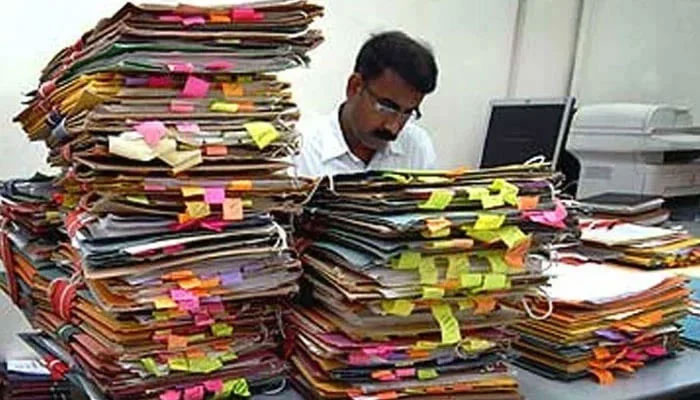

KARACHI: Pakistan’s 2025-26 budget, unveiled on Tuesday, offered little to cheer the salaried class and included stricter measures for non-filers.

Finance Minister Muhammad Aurangzeb presented Pakistan’s annual budget for the next fiscal year, which begins in July. This budget underscores the government’s commitment to fiscal consolidation, a key requirement of the International Monetary Fund’s loan programme. Aurangzeb announced plans to achieve a 4.2% economic growth rate, with inflation projected at 7.5% for FY26, while also reducing overall spending, increasing defense expenditures, and tightening tax measures.

Growth for the current fiscal year is expected to be 2.7%, which is lower than the budgeted target of 3.6%. The budget deficit, which was close to 8% a few years ago, is now targeted to be 3.9% of GDP for FY26, down from a revised 5.6% for the current fiscal year.

Pakistan will increase defense spending by a substantial 20%, even as it cuts overall federal expenditure by 7%, bringing the total to Rs17.57 trillion. The budget proposed by Prime Minister Shehbaz Sharif’s government allocates Rs2.55 trillion for defense in FY26, an increase from Rs2.12 trillion in the previous year.

Dr. Khaqan Najeeb, a former advisor to the Ministry of Finance, stated that, at first glance, the budget appears to be reasonable and done with caution. He noted that salaried individuals receive some symbolic relief, along with a slight reduction in the super tax and a decrease in the federal excise duty on real estate.

He mentioned that the budget seems to aim for at least minimal relief. However, it also seeks to restrict the non-filer community from making significant purchases or traveling.

Assad Hameed Khan, the head of ACCA Pakistan said the 2025–26 budget introduces notable fiscal consolidation and new tax measures, including the carbon levy and digital enforcement systems.

“At ACCA, we welcome steps aimed at widening the tax base and enhancing compliance through technology. These are important building blocks towards a more resilient, equitable, and transparent tax ecosystem,” Khan added.

“We continue to advocate for sustained, policy-consistent reforms. Particularly those that ensure regionally competitive taxation for the salaried class to help retain talent and stem brain drain,” he said.

“Equally important are efforts to support export competitiveness, attract investment, and build public trust by enhancing predictability, ease of doing business, and inclusive human capital development,” he added.

Ehsan A Malik, the CEO of the Pakistan Business Council said despite repeated statements on the importance of exports, there is nothing in the budget to provide immediate support.

“Exporters will continue to be subject to tax under the normal tax regime on profit or a minimum tax on turnover, whichever is higher. Additionally, they must stand in line for refunds of advance tax deducted from export receipts and GST levied on imports now under the Export Facilitation Scheme in this budget,” Malik said.

“The small reduction in super tax will be of little consolation to them or for the corporate sector, which would have appreciated, even a nominal reduction in the corporate tax of 29%, acknowledged by the Finance Minister as the highest in the region,” he added.

He said given the constraints of a fragile economy, the need to remain within the tramlines of the IMF program, deliver fiscal balance, and avoid a repeat of the boom-and-bust cycle, it was unrealistic to expect major relief from the budget. Yet, we should be grateful for small mercies. The salaried employees, especially the lower paid will benefit. Another major positive is the proposed restriction on non-filers from conducting high value transactions or travel abroad.

He believes the clear winner from the budget is the real estate sector. He said the government was convinced by their case for reducing taxes to boost transaction activity. I wish, they did the same for businesses that pay much higher taxes. Also, Real Estate Investment Trusts, which is the formal part of real estate did not benefit from the changes in the budget.

“The formal sector will continue to bear a disproportional burden of taxes for the foreseeable future, while people, process and technology take time to broaden the tax base and the government realigns the fiscal policy strategically with those of export, industrial and investment policies.”

-

Eric Dane's Girlfriend Janell Shirtcliff Pays Him Emotional Tribute After ALS Death

Eric Dane's Girlfriend Janell Shirtcliff Pays Him Emotional Tribute After ALS Death -

King Charles Faces ‘stuff Of The Nightmares’ Over Jarring Issue

King Charles Faces ‘stuff Of The Nightmares’ Over Jarring Issue -

Sarah Ferguson Has ‘no Remorse’ Over Jeffrey Epstein Friendship

Sarah Ferguson Has ‘no Remorse’ Over Jeffrey Epstein Friendship -

A$AP Rocky Throws Rihanna Surprise Birthday Dinner On Turning 38

A$AP Rocky Throws Rihanna Surprise Birthday Dinner On Turning 38 -

Andrew Jokes In Hold As BAFTA Welcomes Prince William

Andrew Jokes In Hold As BAFTA Welcomes Prince William -

Sam Levinson Donates $27K To Eric Dane Family Fund After Actor’s Death

Sam Levinson Donates $27K To Eric Dane Family Fund After Actor’s Death -

Savannah Guthrie Mother Case: Police Block Activist Mom Group Efforts To Search For Missing Nancy Over Permission Row

Savannah Guthrie Mother Case: Police Block Activist Mom Group Efforts To Search For Missing Nancy Over Permission Row -

Dove Cameron Calls '56 Days' Casting 'Hollywood Fever Dream'

Dove Cameron Calls '56 Days' Casting 'Hollywood Fever Dream' -

Prince William, Kate Middleton ‘carrying Weight’ Of Reputation In Epstein Scandal

Prince William, Kate Middleton ‘carrying Weight’ Of Reputation In Epstein Scandal -

Timothée Chalamet Compares 'Dune: Part Three' With Iconic Films 'Interstellar', 'The Dark Knight' & 'Apocalypse Now'

Timothée Chalamet Compares 'Dune: Part Three' With Iconic Films 'Interstellar', 'The Dark Knight' & 'Apocalypse Now' -

Little Mix Star Leigh-Anne Pinnock Talks About Protecting Her Children From Social Media

Little Mix Star Leigh-Anne Pinnock Talks About Protecting Her Children From Social Media -

Ghislaine Maxwell Is ‘fall Guy’ For Jeffrey Epstein, Claims Brother

Ghislaine Maxwell Is ‘fall Guy’ For Jeffrey Epstein, Claims Brother -

Timothee Chalamet Rejects Fame Linked To Kardashian Reality TV World While Dating Kylie Jenner

Timothee Chalamet Rejects Fame Linked To Kardashian Reality TV World While Dating Kylie Jenner -

Sarah Chalke Recalls Backlash To 'Roseanne' Casting

Sarah Chalke Recalls Backlash To 'Roseanne' Casting -

Pamela Anderson, David Hasselhoff's Return To Reimagined Version Of 'Baywatch' Confirmed By Star

Pamela Anderson, David Hasselhoff's Return To Reimagined Version Of 'Baywatch' Confirmed By Star -

Willie Colón, Salsa Legend, Dies At 75

Willie Colón, Salsa Legend, Dies At 75