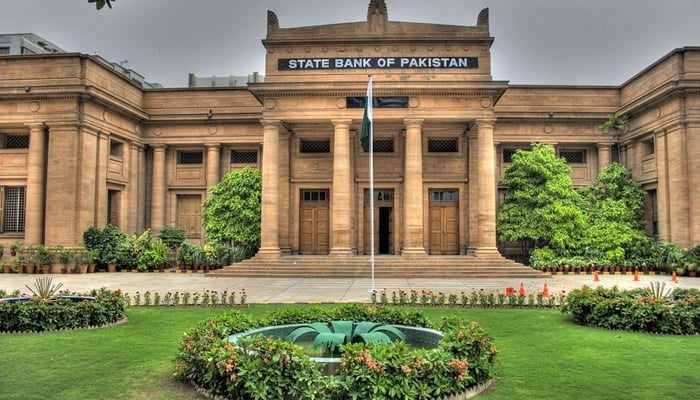

SBP releases Raast access rules

KARACHI: The State Bank of Pakistan released the Raast participation requirements for banking and non-banking entities on Friday to promote the digitisation of the economy and facilitate efficient, secure and near real-time payment transactions for individuals and companies.

Raast, Pakistan's instant payment system, enables rapid and secure digital fund transfers, addressing diverse payment needs of individuals, businesses and government departments through multiple applications, including bulk payments, person-to-person (P2P) transactions, person-to-merchant (P2M) payments and payment initiation service (PIS) transactions.

“In order to facilitate the applicants desirous of becoming Raast participants, SBP has decided to issue the Raast Participation Criteria", the central bank said in a circular, adding that this will "enhance the Raast accessibility for promoting digital payments and stimulate innovation and competition in the payments market".

According to the SBP, the following entities are eligible to apply for participation in Raast: banks, microfinance banks, non-bank financial institutions, federal or provincial governments and their departments, public sector organisations, private-sector corporations (including small and medium-sized enterprises), business platforms, payment aggregators, educational institutions, incubators, fintech companies, and any other service providers.

Entities that are currently undergoing the licensing process with the SBP and possess valid in-principle approval can also apply for Raast participation. Access to Raast will be categorised into four types of participants: direct settlement participants, direct non-settlement participants, payment initiation service providers, and indirect participants.

-

Princess Beatrice, Eugenie Are ‘not Innocent’ In Epstein Drama

Princess Beatrice, Eugenie Are ‘not Innocent’ In Epstein Drama -

Reese Witherspoon Goes 'boss' Mode On 'Legally Blonde' Prequel

Reese Witherspoon Goes 'boss' Mode On 'Legally Blonde' Prequel -

Chris Hemsworth And Elsa Pataky Open Up About Raising Their Three Children In Australia

Chris Hemsworth And Elsa Pataky Open Up About Raising Their Three Children In Australia -

Record Set Straight On King Charles’ Reason For Financially Supporting Andrew And Not Harry

Record Set Straight On King Charles’ Reason For Financially Supporting Andrew And Not Harry -

Michael Douglas Breaks Silence On Jack Nicholson's Constant Teasing

Michael Douglas Breaks Silence On Jack Nicholson's Constant Teasing -

How Prince Edward Was ‘bullied’ By Brother Andrew Mountbatten Windsor

How Prince Edward Was ‘bullied’ By Brother Andrew Mountbatten Windsor -

'Kryptonite' Singer Brad Arnold Loses Battle With Cancer

'Kryptonite' Singer Brad Arnold Loses Battle With Cancer -

Gabourey Sidibe Gets Candid About Balancing Motherhood And Career

Gabourey Sidibe Gets Candid About Balancing Motherhood And Career -

Katherine Schwarzenegger Shares Sweet Detail From Early Romance Days With Chris Pratt

Katherine Schwarzenegger Shares Sweet Detail From Early Romance Days With Chris Pratt -

Jennifer Hudson Gets Candid About Kelly Clarkson Calling It Day From Her Show

Jennifer Hudson Gets Candid About Kelly Clarkson Calling It Day From Her Show -

Princess Diana, Sarah Ferguson Intense Rivalry Laid Bare

Princess Diana, Sarah Ferguson Intense Rivalry Laid Bare -

Shamed Andrew Was With Jeffrey Epstein Night Of Virginia Giuffre Assault

Shamed Andrew Was With Jeffrey Epstein Night Of Virginia Giuffre Assault -

Shamed Andrew’s Finances Predicted As King ‘will Not Leave Him Alone’

Shamed Andrew’s Finances Predicted As King ‘will Not Leave Him Alone’ -

Expert Reveals Sarah Ferguson’s Tendencies After Reckless Behavior Over Eugenie ‘comes Home To Roost’

Expert Reveals Sarah Ferguson’s Tendencies After Reckless Behavior Over Eugenie ‘comes Home To Roost’ -

Bad Bunny Faces Major Rumour About Personal Life Ahead Of Super Bowl Performance

Bad Bunny Faces Major Rumour About Personal Life Ahead Of Super Bowl Performance -

Sarah Ferguson’s Links To Jeffrey Epstein Get More Entangled As Expert Talks Of A Testimony Call

Sarah Ferguson’s Links To Jeffrey Epstein Get More Entangled As Expert Talks Of A Testimony Call