The IMF

Pakistan’s economy is in the intensive care unit as we continue to focus on Imran Khan’s yatra and Reham Khan’s apparitions. Our current account deficit is projected to be $17 billion.

Add that to around $8 billion in debt repayments and the financing gap (in plain English: the dollars that we need to borrow) stands at a tall $25 billion. The real budgetary deficit (in plain English: the difference between government revenues and expenditures) is at least eight percent of GDP.

Who’s going to lend us a wholesome $25 billion? China, under its ‘debtbook diplomacy’, could throw in a couple of billions and so could Saudi Arabia. But the only entity on the face of the planet that could fill the ever-widening gap is the IMF. On June 7, Christine Lagarde, the managing director of the IMF, reached an agreement with Argentine President Mauricio Macri; a three-year, $50 billion rescue package.

According to Alan Reynolds of the Independent Institute, the California-based think tank, “over the past two decades, the IMF has promised cheap loans to foreign governments in order to bribe them into pursuing suicidal economic policies designed by IMF technocrats, rather than by their own elected representatives”.

To be certain, the IMF is the most opaque of global financial institutions and the strings attached to rescue packages are never fully disclosed. Reynolds’ research reveals that: “There is, in fact, no commonly recognised group of IMF ‘success stories’ at all. Indeed, we have been unable to find a single example of IMF intervention unambiguously improving an economy’s performance over a sustained period… Many regular patients of the IMF – such as Yugoslavia, Haiti, Peru, Nicaragua, Zaire, Papua, New Guinea, Somalia, Uganda and the Ivory Coast – have been on the critical list for many years.

“The long list of obvious failures, and the absence of any clear successes, raises the central question: what is the nature and effect of the package of economic policy ‘reforms’ or ‘conditionality’ that accompanies most IMF loans?”

The answer to Reynolds’ central question is: the IMF hates loosing clients; once a client always a client. For the IMF, loosing a client means budget constraints and a reduction in staff. It is actually in the IMF’s interest to broaden its client list and in order to do that the IMF has been broadening its menu.

Remember, the Poverty Reduction and Growth Facility (PRGF), the Structural Adjustment Facility (SAF), the Enhanced Structural Adjustment Facility (ESAF) and the Extended Fund Facility (EFF). Now comes the Flexible Credit Line (FCL) – a “new lending facility designed for large, credit-worthy economies”.

For Pakistan, a new IMF package would mean four things: currency devaluation; increases in the electricity tariff; increases in gas tariffs, and increasing the tax burden. Lo and behold, cheap loans for Pakistan in order to bribe Pakistan into pursuing suicidal economic policies.

We are in a mess because our electricity tariff is the highest in the region. Our textile sector is going down the drain because our gas tariff is the highest in the region. Our industrial sector is shrinking because we are the most taxed country in the world.

The cost of doing business in Pakistan is going through the roof. We need to renegotiate our contracts. We need to renegotiate our contracts because we have been cheated. And we need expert international help to prove that we have been cheated.

Our only way out is to reduce the cost of doing business in Pakistan. The only way out is the wholesale renegotiation of contracts throughout our energy sector. Yes, Tanzania, Ecuador, Costa Rica and India have all renegotiated.

The writer is a columnist based in Islamabad.

Email: farrukh15@hotmail.com

Twitter: @saleemfarrukh

-

Dolly Parton Ready To Marry Again?

Dolly Parton Ready To Marry Again? -

Savannah Guthrie Breaks Cover As Search For Mom Nancy Intensifies

Savannah Guthrie Breaks Cover As Search For Mom Nancy Intensifies -

Jennifer Lopez Shares Emotional Post After Discussing Split With Marc Anthony

Jennifer Lopez Shares Emotional Post After Discussing Split With Marc Anthony -

Andrew's Escape Plan Just Hit Unexpected Roadblock: 'Huge Blow'

Andrew's Escape Plan Just Hit Unexpected Roadblock: 'Huge Blow' -

Jessica Alba And Danny Ramirez Send Strong Message: Ignore Joe Burrow Rumours

Jessica Alba And Danny Ramirez Send Strong Message: Ignore Joe Burrow Rumours -

Dakota Johnson Leaves Fans Speechless With Calvin Klein Ad

Dakota Johnson Leaves Fans Speechless With Calvin Klein Ad -

Stephanie Faracy Talks About Her Role In 'Nobody Wants This' Season 3

Stephanie Faracy Talks About Her Role In 'Nobody Wants This' Season 3 -

Princess Eugenie, Beatrice Receive Fresh Warning

Princess Eugenie, Beatrice Receive Fresh Warning -

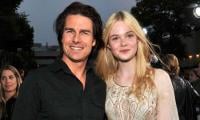

Tom Cruise's Reunion With Elle Fanning Thrilled Him At Saturn Awards

Tom Cruise's Reunion With Elle Fanning Thrilled Him At Saturn Awards -

Jennifer Runyon's 'Charles In Charge' Co-star Pays Tribute After She Loses Battle To Cancer

Jennifer Runyon's 'Charles In Charge' Co-star Pays Tribute After She Loses Battle To Cancer -

Paul Bettany Gets Honest About Voldemort Casting Rumours In 'Harry Potter' Series

Paul Bettany Gets Honest About Voldemort Casting Rumours In 'Harry Potter' Series -

Kim Kardashian, Kylie Jenner Show Support As Brody Jenner Reveals Big News

Kim Kardashian, Kylie Jenner Show Support As Brody Jenner Reveals Big News -

King Charles Plans Emotional Reunion With Lilibet, Archie

King Charles Plans Emotional Reunion With Lilibet, Archie -

Royal Expert Shares Exciting Update For Princess Eugenie, Beatrice

Royal Expert Shares Exciting Update For Princess Eugenie, Beatrice -

Epstein Files: New Photos Of Former Prince Andrew With Woman On His Lap Emerge

Epstein Files: New Photos Of Former Prince Andrew With Woman On His Lap Emerge -

WhatsApp Hacked: Russia-backed Group Breaches Accounts Of Journalists, Officials, Military Personnel

WhatsApp Hacked: Russia-backed Group Breaches Accounts Of Journalists, Officials, Military Personnel