Supporting women-led micro-enterprises

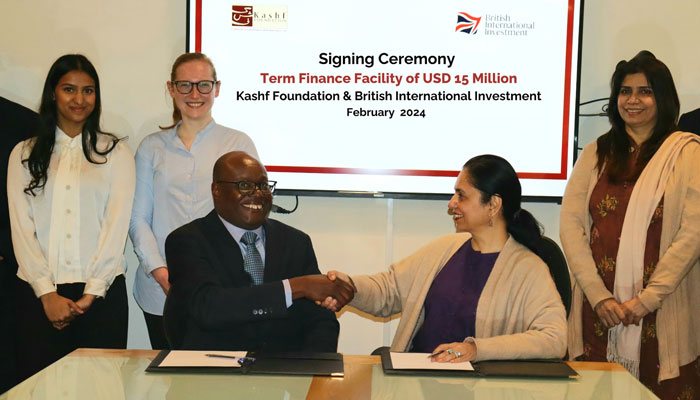

Islamabad : On Thursday, both British International Investment (BII), the UK’s development finance institution and impact investor, and Finnfund announced their continuing support to Kashf Foundation (Kashf), one of the leading microfinance institutions in Pakistan. BII has committed $15 million while Finnfund has committed $10 million as follow on investments.

In 2021, Finnfund and BII made their initial investment in Kashf. Since then, Kashf has grown to become the largest distributor of micro-insurance solutions in Pakistan and also introduced health insurance products aimed at underserved women who did not have access to insurance before.

Pakistan has one of the lowest financial inclusion rates in the world, with 79% of its 231 million people operating outside of the formal banking system, according to World Bank’s Global Findex Database. Only 13% of Pakistani women have bank accounts, compared to 28% of men.

Most low-income households in Pakistan lack access to formal safety nets and are highly vulnerable to shocks such as the death of the head of the household, an illness, or a disease. The foundation currently serves over 750,000 customers and over 70 per cent of its loans are deployed to micro-enterprises owned by women. Its services are offered via over 380 branches and the target is to grow the network to 450 in two years supported by the BII-Finnfund facility.

Roshaneh Zafar, Managing Director of Kashf Foundation, said: “Investing in women's economic empowerment not only enhances their earning potential but also has far-reaching effects on their families and communities. When women succeed in generating income, they often prioritize education for their children, thus laying the groundwork for future generations. This creates a positive cycle of empowerment that reshapes gender dynamics and fosters stronger communities. Moreover, ensuring access to health insurance through social safety nets is essential from a woman's perspective, ensuring their well-being and contributing to overall societal stability.”

Kashf is committed to the internationally recognised Client Protection Principles and universal standards for social performance management and is working towards the gold-level certification.

-

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile -

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time -

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight?

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight? -

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown -

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling -

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl -

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein -

Miranda Kerr Shares The One Wellness Practice She Does With Her Kids

Miranda Kerr Shares The One Wellness Practice She Does With Her Kids -

Czech Republic Supports Social Media Ban For Under-15

Czech Republic Supports Social Media Ban For Under-15 -

Khloe Kardashian Shares How She And Her Sisters Handle Money Between Themselves

Khloe Kardashian Shares How She And Her Sisters Handle Money Between Themselves -

Prince William Ready To End 'shielding' Of ‘disgraced’ Andrew Amid Epstein Scandal

Prince William Ready To End 'shielding' Of ‘disgraced’ Andrew Amid Epstein Scandal -

Chris Hemsworth Hailed By Halle Berry For Sweet Gesture

Chris Hemsworth Hailed By Halle Berry For Sweet Gesture -

Blac Chyna Reveals Her New Approach To Love, Healing After Recent Heartbreak

Blac Chyna Reveals Her New Approach To Love, Healing After Recent Heartbreak -

Royal Family's Approach To Deal With Andrew Finally Revealed

Royal Family's Approach To Deal With Andrew Finally Revealed -

Super Bowl Weekend Deals Blow To 'Melania' Documentary's Box Office

Super Bowl Weekend Deals Blow To 'Melania' Documentary's Box Office -

Meghan Markle Shares Glitzy Clips From Fifteen Percent Pledge Gala

Meghan Markle Shares Glitzy Clips From Fifteen Percent Pledge Gala