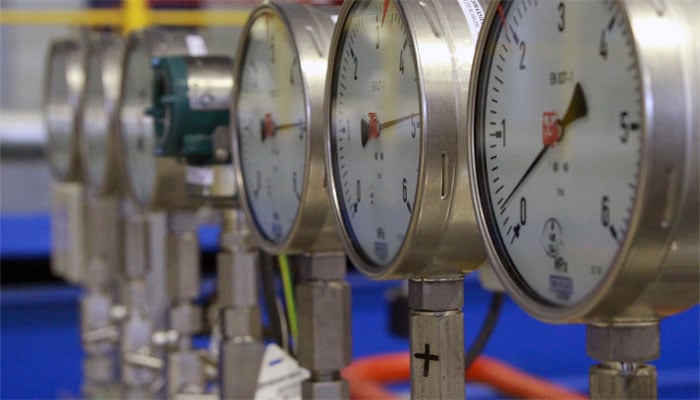

Country to face worst gas shortage in winter

Pakistan is set to face the worst ever gas shortage in winter season, particularly in December and January, as the state-owned Pakistan State Oil (PSO) and Pakistan LNG Limited (PLL) will be importing just eight LNG vessels per month from October.

ISLAMABAD: Pakistan is set to face the worst ever gas shortage in winter season, particularly in December and January, as the state-owned Pakistan State Oil (PSO) and Pakistan LNG Limited (PLL) will be importing just eight LNG vessels per month from October.

The import of just eight vessels per month is mainly on account of less demand from the power sector evidently influenced by the furnace oil lobby.

Top sources say some unscrupulous elements influenced by the powerful furnace oil lobby have managed to provide to the Petroleum Division less LNG demand of 800-850mmcfd for power generation.

The government of Shahid Khan Abbasi, they said, had decided to phase out power generation based on furnace oil and had done away with furnace oil based electricity in the winter season. The rationale behind the decision was that power generation based on LNG was cheaper than the costlier power generation based on furnace oil, and more importantly power based RLNG was environment-friendly.

"Last winter, furnace oil-based power plants were closed down, but this time the Power Division has planned to run furnace oil power plants as an alternative to LNG-based plants." This means, officials say, end power consumers will pay more for electricity in winter season, as the furnace oil-based power plants generate electricity that’s about Rs5 per unit costlier that the electricity generated through the RLNG.

Zargham Eshaq Khan, Joint Secretary Power said: “We will run the power plants as per merit order according to which the power plants which have dedicated local gas supplies will run first, then come the RLNG power plants.”

He said the demand of provision of 800-850mmcfd LNG had been extended to the Petroleum Division not to accommodate furnace oil based power plants. “However, we have arranged furnace oil for 60 days consumption as an alternative but after first running coal based power plants and nuclear power plants.”

The PSO is importing six LNG vessels a month through Engro LNG terminal while the PLL will be importing two through PGPL terminal knowing the fact that the power sector system has the capacity to absorb LNG of 1.2 bcfd, but the furnace oil lobby has prevailed.

This means the PGPL terminal will run 33 percent of its capacity from October 2018 to January 2019, as it was earlier running on 54 percent of its capacity mainly because of the less demand of Power Division.

In the winter season the demand for gas escalates manifold and the system gas ranging between 3.8 bcfd and 4 bcfd is even not enough to cater to the needs of domestic sector. In the last winter excess LNG was diverted to domestic sector to cater to the kitchen needs as well as to save people from the adverse impacts of winter.

However, this time the domestic consumers, particularly in the Punjab, will suffer the most because of plan to import less LNG. The Power Division has extended the demand for 800-850 mmcfd gas knowing the fact that the power sector system can absorb 1.2 bcfd, official document of Sui Northern reveals.

According to another document arranged from the Petroleum Division, the PLL will be importing two LNG cargoes per month during October 2018 to January 2019 which translate into 200-220 mmcfd.

The total RLNG available in the country will be approximately 800-850 mmcfd (PSO and PLL). Document says it is anticipated that there will be an RLNG deficit during coming winters, owing to the factor that include 1) low generation from hydel and renewables; 2) Thermal (coal, RLNG, RFO, HSD based) power generation will need to be ramped up.

It also says that currently the arranged supplies are insufficient to generate power equivalent to last year’s gas-based generation and the deficit will need to be met through costlier alternatives.

The PLL document further argues that limited supply of indigenous gas will be diverted to high-priority domestic sector resulting in even lesser availability of local system gas for industrial, CNG and power sector.

The document also says the PLL top management will not be in a position to arrange LNG in haste as the process takes three to four months to be initiated in advance considering the PPRA timelines and LNG market trends.

-

James Van Der Beek's Friends Helped Fund Ranch Purchase Before His Death At 48

James Van Der Beek's Friends Helped Fund Ranch Purchase Before His Death At 48 -

King Charles ‘very Much’ Wants Andrew To Testify At US Congress

King Charles ‘very Much’ Wants Andrew To Testify At US Congress -

Rosie O’Donnell Secretly Returned To US To Test Safety

Rosie O’Donnell Secretly Returned To US To Test Safety -

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day -

King Charles Butler Spills Valentine’s Day Dinner Blunders

King Charles Butler Spills Valentine’s Day Dinner Blunders -

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life -

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day -

Harry Styles Opens Up About Isolation After One Direction Split

Harry Styles Opens Up About Isolation After One Direction Split -

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying -

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism -

Leighton Meester Reflects On How Valentine’s Day Feels Like Now

Leighton Meester Reflects On How Valentine’s Day Feels Like Now -

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile -

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First'

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First' -

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically -

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus'

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus' -

Marco Rubio Sends Message Of Unity To Europe

Marco Rubio Sends Message Of Unity To Europe