Pakistan eyes EV boom, funds subsidies through new car levies

FBR Chairman Rashid Langrial says sales tax would only be implemented once approved by parliament

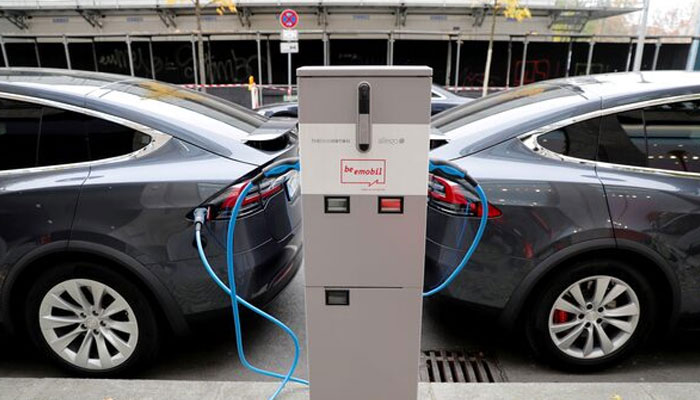

ISLAMABAD: Pakistan plans to ramp up electric vehicle (EV) production to 2.2 million units over the next five years — mostly electric motorcycles — as part of its global climate commitments. But to fund these ambitious subsidies, the government is turning to new levies on conventional car buyers, a move that took lawmakers by surprise on Wednesday.

The National Assembly’s Standing Committee on Finance learned during its session that a tiered levy structure will be introduced: 1 percent on the buyer of new vehicles up to 1300cc, 2 percent for 1301–1800cc, and 3 percent for cars above 1800cc. Committee members were stunned to hear these levies were not included in the official Finance Bill 2025-26.

“The levy detail is missing from the bill,” observed Committee Chairman Naveed Qamar. A law ministry official responded that it was “an omission.”

The committee also approved the government’s proposal to impose a 10 percent sales tax on solar equipment, in a policy reversal that committee Chairman Naveed Qamar says originated from the National Assembly, not the Senate. “It was our recommendation, not the Senate,” Qamar clarified, despite earlier efforts to shield renewable energy from taxation.

FBR Chairman Rashid Langrial said the sales tax would only be implemented once approved by parliament. He added that efforts are also underway to expand the sales tax net — non-registered individuals will be forced to register or risk having their bank accounts frozen. “A non-registered person will not be able to operate a bank account,” he warned. Once registered, the account will be restored within 48 hours.

Langrial said the Federal Board of Revenue (FBR) would identify non-registered businesses using data such as electricity consumption and income tax filings, starting with industrial units, especially in Karachi.

In a parallel effort to rein in mounting power sector circular debt, the Power Division said that Rs1.275 trillion is being borrowed from commercial banks at 0.9 percent below the 3-month KIBOR. The funds will be used to retire liabilities of IPPs and the Power Holding Company over six years and Rs683 billion will immediately cover PHC dues, with Rs323 billion repaid annually. This debt retirement and financing will be met through Rs3.23/unit Debt Service Surcharge (DSS) from consumers in their bills — exempting lifeline electricity consumers. “This is an IMF condition, and we must fulfill it,” said the power secretary.

Additionally, officials from the Petroleum Division said a carbon levy of Rs2.5/litre on petroleum products will be starting July 1, doubling to Rs5 next year. The levy will extend to furnace oil, which continues to be used in Independent Power Producers’ plants despite being phased out from public facilities. The petroleum levy currently stands at Rs77/litre on petrol and Rs78/litre on diesel, and the government plans to raise the cap to Rs90/litre.

Finance Minister Muhammad Aurangzeb, addressing the committee, firmly stated that “the era of tax exemptions and amnesties is over.” He emphasized the need to bring more people into the tax net, stressing enforcement over leniency. “We must now ensure compliance, not continue offering carrots,” he concluded.

-

Everything We Know About Jessie J's Breast Cancer Journey

Everything We Know About Jessie J's Breast Cancer Journey -

Winter Olympics 2026: What To Watch In Men’s Hockey Today

Winter Olympics 2026: What To Watch In Men’s Hockey Today -

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer'

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer' -

Apple Martin Opens Up About Getting 'crazy' Lip Filler

Apple Martin Opens Up About Getting 'crazy' Lip Filler -

Why Did OpenAI Remove One Crucial Word From Its Mission Statement?

Why Did OpenAI Remove One Crucial Word From Its Mission Statement? -

Prince William Warned His Future Reign Will Be Affected By Andrew Scandal

Prince William Warned His Future Reign Will Be Affected By Andrew Scandal -

Amy Madigan Reflects On Husband Ed Harris' Support After Oscar Nomination

Amy Madigan Reflects On Husband Ed Harris' Support After Oscar Nomination -

Is Studying Medicine Useless? Elon Musk’s Claim That AI Will Outperform Surgeons Sparks Debate

Is Studying Medicine Useless? Elon Musk’s Claim That AI Will Outperform Surgeons Sparks Debate -

Margot Robbie Gushes Over 'Wuthering Heights' Director: 'I'd Follow Her Anywhere'

Margot Robbie Gushes Over 'Wuthering Heights' Director: 'I'd Follow Her Anywhere' -

'The Muppet Show' Star Miss Piggy Gives Fans THIS Advice

'The Muppet Show' Star Miss Piggy Gives Fans THIS Advice -

Sarah Ferguson Concerned For Princess Eugenie, Beatrice Amid Epstein Scandal

Sarah Ferguson Concerned For Princess Eugenie, Beatrice Amid Epstein Scandal -

Uber Enters Seven New European Markets In Major Food-delivery Expansion

Uber Enters Seven New European Markets In Major Food-delivery Expansion -

Hollywood Fights Back Against Super-realistic AI Video Tool

Hollywood Fights Back Against Super-realistic AI Video Tool -

Meghan Markle's Father Shares Fresh Health Update

Meghan Markle's Father Shares Fresh Health Update -

Pentagon Threatens To Cut Ties With Anthropic Over AI Safeguards Dispute

Pentagon Threatens To Cut Ties With Anthropic Over AI Safeguards Dispute -

Samsung Galaxy Unpacked 2026: What To Expect On February 25

Samsung Galaxy Unpacked 2026: What To Expect On February 25