Gold prices soar by Rs10,000 per tola to all-time high

KARACHI: Gold prices surged by a staggering Rs10,000 per tola on Friday in the local market, reaching an all-time high amid growing global economic uncertainty, intensifying trade tensions and a flight to safe-haven assets. The price of gold per tola reached Rs338,800, according to the All Pakistan Sarafa Gems and Jewellers Association.

This marks the second-highest single-day increase in the country’s history, just Rs500 short of the record set on July 28, 2022, when prices jumped by Rs10,500 per tola. Gold has now gained a remarkable Rs66,200 per tola since the beginning of the year, up from Rs272,600 on December 30, 2024, reflecting a 24 per cent year-to-date increase.

In tandem, 10-gram gold prices rose by Rs8,573, reaching Rs290,466. The surge mirrored international markets, where gold prices climbed by $100 in a single day to reach $3,218 per ounce. From the end of December 2024, global gold prices have increased by $604 per ounce, a 23 per cent jump.

Gold prices in Pakistan are typically adjusted with a $20 per ounce premium above global rates, reflecting import costs and domestic market conditions.

According to analysts, several international developments have combined to create ideal conditions for gold’s rapid rise. The primary driver has been the escalation of a global trade war, particularly following the return of former President Donald Trump’s administration and the reintroduction of aggressive tariff policies. These trade restrictions have rattled global supply chains and heightened fears of economic slowdown.

In addition, geopolitical tensions in Eastern Europe and the Middle East, along with fears of currency devaluation across multiple emerging economies, have spurred investors to pull back from traditional financial markets and park their money in precious metals. Gold, long considered a safe-haven asset, has benefited immensely from this shift.

“People are worried about the global economy,” said Muhammad Shafi Khan, a senior goldsmith in Karachi. “Trump’s tariffs, trade disputes, and an unstable financial outlook are pushing investors away from currencies and into gold. There’s less interest in jewellery and more demand for raw gold as an investment.”

Khan added that the rising demand was not just from local consumers but from institutional investors and central banks, many of which have been increasing their gold reserves in response to global volatility. “With central banks around the world diversifying away from the U.S. dollar, gold is becoming even more attractive,” he noted.While gold has soared, silver prices remained unchanged on Thursday. Silver held steady at Rs3,234 per tola, with the 10-gram rate also unchanged at Rs2,772. The divergence between gold and silver movements is not unusual, as gold typically leads during periods of extreme market uncertainty. Market participants believe that gold prices may continue their upward trajectory in the coming weeks unless there is a significant calming of geopolitical and economic tensions.

-

‘Entitled’ Andrew Mountbatten-Windsor Is Still Winding People Up: ‘That’s What He’s Used To’

‘Entitled’ Andrew Mountbatten-Windsor Is Still Winding People Up: ‘That’s What He’s Used To’ -

Why Sarah Ferguson Will Not Leave Andrew Despite Ultimate Humiliation

Why Sarah Ferguson Will Not Leave Andrew Despite Ultimate Humiliation -

Sylvester Stallone Stuns Internet In New Video

Sylvester Stallone Stuns Internet In New Video -

Sophie Turner Talks About ‘nesting’ In Early 20s: ‘Big Break’

Sophie Turner Talks About ‘nesting’ In Early 20s: ‘Big Break’ -

Brooklyn Beckham Claims Family Blocked Him First In Bombshell Statement

Brooklyn Beckham Claims Family Blocked Him First In Bombshell Statement -

Sarah Ferguson Resorts To A Cynical Attempt At Survival And Runa Out Of Lives

Sarah Ferguson Resorts To A Cynical Attempt At Survival And Runa Out Of Lives -

Nicole Kidman 'calm' And Focused After Keith Urban Split

Nicole Kidman 'calm' And Focused After Keith Urban Split -

Prince Harry Deserves UK Security: ‘Didn’t Choose His Fate’

Prince Harry Deserves UK Security: ‘Didn’t Choose His Fate’ -

Brooklyn Beckham Goes Public With His Side Of The Story Amid Feud With Family

Brooklyn Beckham Goes Public With His Side Of The Story Amid Feud With Family -

Sarah Ferguson & Andrew Turn Volatile And Makes Buckingham Palace’s Biggest Fear Come True

Sarah Ferguson & Andrew Turn Volatile And Makes Buckingham Palace’s Biggest Fear Come True -

Meghan Markle’s Laundry List Of Demands Finally Gets Answer By King Charles?

Meghan Markle’s Laundry List Of Demands Finally Gets Answer By King Charles? -

Brooklyn Beckham Finds It 'hard' To Keep Contact With Sister Harper

Brooklyn Beckham Finds It 'hard' To Keep Contact With Sister Harper -

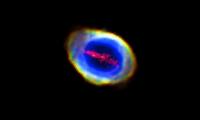

New Mystery About 'Ring Nebula' Shock Astronomers: Here's Why

New Mystery About 'Ring Nebula' Shock Astronomers: Here's Why -

Prince Harry Picks PR Photos In Fear Of ‘bald Spots’

Prince Harry Picks PR Photos In Fear Of ‘bald Spots’ -

Saying Prince Harry Will ‘probably Be Fine Isn’t Good Enough’, Expert Speaks Out

Saying Prince Harry Will ‘probably Be Fine Isn’t Good Enough’, Expert Speaks Out -

Inside Meghan Markle’s Plans ‘With Love, Meghan’: Season 3 And Valentines Day Specials

Inside Meghan Markle’s Plans ‘With Love, Meghan’: Season 3 And Valentines Day Specials