KCCI urges SBP to cut policy rate by 400bps

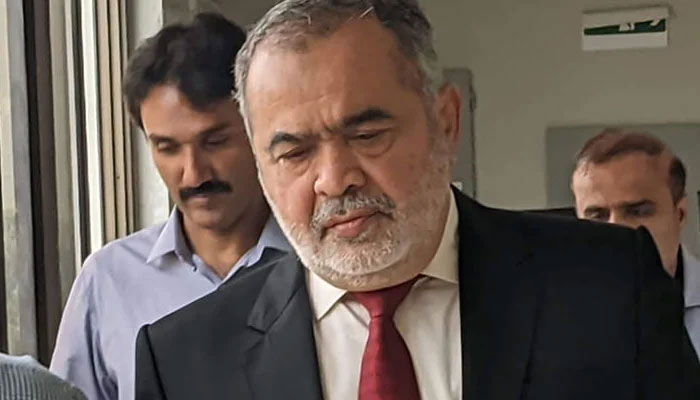

KARACHI: President of the Karachi Chamber of Commerce and Industry (KCCI) Muhammad Jawed Bilwani has urged the State Bank of Pakistan (SBP) to reduce its policy rate by 400 basis points (bps), citing the recent decline in inflation to a multi-year low of 4.86 per cent in November 2024.

In a statement on Thursday, Bilwani argued that a significant rate cut would not only bring real interest rates closer to sustainable levels but also make borrowing more affordable for businesses and consumers, thereby stimulating economic activity. He said that lower interest rates align with global best practices, where central banks utilise rate adjustments to foster growth during periods of low inflation.

He noted that while the SBP has reduced the policy rate from 20.5 per cent to 15 per cent since the beginning of the current fiscal year, it remains considerably higher than those of regional peers such as India (6.5 per cent), Vietnam (4.5 per cent) and Bangladesh (10 per cent). This, he asserted, continues to suppress private sector credit growth and stifle economic activity, placing Pakistan at a competitive disadvantage.

Bilwani highlighted that credit to the country’s private sector has reached one of the lowest levels among emerging markets, accounting for only 12 per cent of GDP in 2023, significantly lagging behind India (50.1 per cent), Turkiye (50.3 per cent) and Bangladesh (37.6 per cent).

This growing gap between public and private sector lending hinders private sector access to credit. As of October 2024, the private sector received only 24.7 per cent of total credit, down from 28.1 per cent in January 2023, while public sector borrowing now accounts for a disproportionate 75.3 per cent.

While acknowledging the government’s efforts in stabilising the economy, reflected in the reduction of the current account deficit and the strong performance of the stock market (with the KSE-100 index surging 77.5 per cent since January 2024), Bilwani expressed concern over the decline of the Large-Scale Manufacturing Index (LSMI) by 0.76 per cent during July-September 2024 compared to the same period in FY24. He attributed this to the continued strain of high interest rates, which elevate borrowing costs, limit credit access and impose excessive collateral requirements on businesses.

Per Bilwani, high interest rates have driven the country’s domestic debt servicing costs to unsustainable levels. In FY24, domestic debt servicing surged by 50.4 per cent, from Rs4.8 trillion to Rs7.2 trillion, placing significant pressure on the national budget and widening fiscal imbalances.Bilwani stressed that a significant rate cut is now crucial to ease the burden on the real economy and fiscal front, unlock private sector credit and stimulate new investment.

-

James Van Der Beek's Quiet Sacrifice Before Death Comes To Light

James Van Der Beek's Quiet Sacrifice Before Death Comes To Light -

Suspect Kills Six Across Florida Before Taking His Own Life

Suspect Kills Six Across Florida Before Taking His Own Life -

AI Helps Researchers Identify 2,000-year-old Roman Board Game Stone

AI Helps Researchers Identify 2,000-year-old Roman Board Game Stone -

Inside Kate Middleton, Prince William’s Nightmare Facing Andrew Mountbatten-Windsor

Inside Kate Middleton, Prince William’s Nightmare Facing Andrew Mountbatten-Windsor -

Margaret Qualley Shares Heartfelt Confession About Husband Jack Antonoff: 'My Person'

Margaret Qualley Shares Heartfelt Confession About Husband Jack Antonoff: 'My Person' -

Savannah Guthrie Shares Sweet Childhood Video With Missing Mom Nancy: Watch

Savannah Guthrie Shares Sweet Childhood Video With Missing Mom Nancy: Watch -

Over $1.5 Million Raised To Support Van Der Beek's Family

Over $1.5 Million Raised To Support Van Der Beek's Family -

Paul Anthony Kelly Opens Up On 'nervousness' Of Playing JFK Jr.

Paul Anthony Kelly Opens Up On 'nervousness' Of Playing JFK Jr. -

Diana Once Used Salad Dressing As A Weapon Against Charles: Inside Their Fight From A Staffers Eyes

Diana Once Used Salad Dressing As A Weapon Against Charles: Inside Their Fight From A Staffers Eyes -

Video Of Brad Pitt, Tom Cruise 'fighting' Over Epstein Shocks Hollywood Fans

Video Of Brad Pitt, Tom Cruise 'fighting' Over Epstein Shocks Hollywood Fans -

Jelly Roll's Wife Bunnie Xo Talks About His Huge Weight Loss

Jelly Roll's Wife Bunnie Xo Talks About His Huge Weight Loss -

Margot Robbie Reveals Why She Clicked So Fast With Jacob Elordi

Margot Robbie Reveals Why She Clicked So Fast With Jacob Elordi -

Piers Morgan Praised By Ukrainian President Over 'principled Stance' On Winter Olympics Controversy

Piers Morgan Praised By Ukrainian President Over 'principled Stance' On Winter Olympics Controversy -

Halsey's Fiance Avan Jogia Shares Rare Update On Wedding Planning

Halsey's Fiance Avan Jogia Shares Rare Update On Wedding Planning -

Instagram Head Adam Mosseri Says Users Cannot Be Clinically Addicted To App

Instagram Head Adam Mosseri Says Users Cannot Be Clinically Addicted To App -

James Van Der Beek Was Working On THIS Secret Project Before Death

James Van Der Beek Was Working On THIS Secret Project Before Death