Profit rates on savings schemes raised by up to 2.3 percent

The government on Thursday increased profit margins on all national savings schemes by up to 2.3 percent to bring the NSS rates in line with recent hike in the central bank’s interest rate.

KARACHI: The government on Thursday increased profit margins on all national savings schemes by up to 2.3 percent to bring the NSS rates in line with recent hike in the central bank’s interest rate.

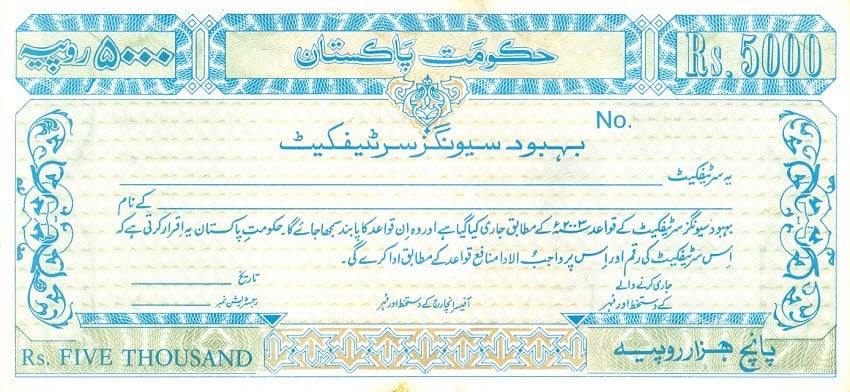

Profit on Pensioners’ Benefit Account, Behbood Savings Certificates, and Shuhuda’s Family Welfare Account has been increased by 48 basis points to 14.76 percent per annum from 14.28 percent in January 2019.

This translates into a profit of Rs61.50/month on minimum purchase of Rs5,000 Behbood Savings Certificates with effect from July 1. The revised rate sheets showed that the Defence Savings Certificates went up 54 basis points to 13.01 percent from 12.47 percent since January 2019.

According to the notices issued to the directors of Central Directorate of National Savings (CDNS), Pakistan Post Office, and BSC (Bank) State Bank of Pakistan (SBP), the NSS rates would be implemented from July 1, 2019 until further notice.

This move could improve the domestic savings rate and inflows due to attractive returns. The National Savings Schemes rates are connected to the central bank benchmark interest rate and its subsequent impact on the long-term Pakistan Investment Bonds.

The central bank had increased its interest rate by 150 basis points to 12.25 percent back on May 20, 2019. It had taken the measure to address the inflationary pressures from higher month-on-month headline and core inflation outturns and rupee depreciation. The government announced the rates of National Savings Schemes after every two months. It was the sixth raise since June 2018.

Likewise, return on Regular Income Certificates has been increased by 96 basis points, with the new rate of profit standing at 12.96 percent from 12.0 percent previously. This will translate into a payable profit of Rs540/month on Rs50,000 denomination.

Average profit payable on Special Savings Certificates (Registered) / Accounts went up by 1.33 percent to 12.90 percent from 11.57 percent (average) at the start of the calendar year. Also, the return on Short-Term Savings Certificates with 3-12 month tenure was increased by 2.3 percent to 12.08 percent from 9.80 percent.

The CDNS notice said that the profit rate on Savings Accounts would now be 10.25 percent, up from 8.50 percent. This shows an increase of 1.75 percent. The CDNS has instructed all regional offices that existing stock of blank Special Savings Certificates, Regular Income Certificates and Defence Saving Certificates would now be used by affixing rubber stamps with “Issue 49”, “Issue 46” and “Issue 45”, respectively, along with revised rates before issuance.

-

Murder Suspect Kills Himself After Woman Found Dead In Missouri

Murder Suspect Kills Himself After Woman Found Dead In Missouri -

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files -

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence -

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar -

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’ -

Poll Reveals Majority Of Americans' Views On Bad Bunny

Poll Reveals Majority Of Americans' Views On Bad Bunny -

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death -

Man Convicted After DNA Links Him To 20-year-old Rape Case

Man Convicted After DNA Links Him To 20-year-old Rape Case -

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice -

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’ -

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday -

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival -

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating -

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew -

Will AI Take Your Job After Graduation? Here’s What Research Really Says

Will AI Take Your Job After Graduation? Here’s What Research Really Says -

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner