FBR radar detects eight tax-evading sugar mills

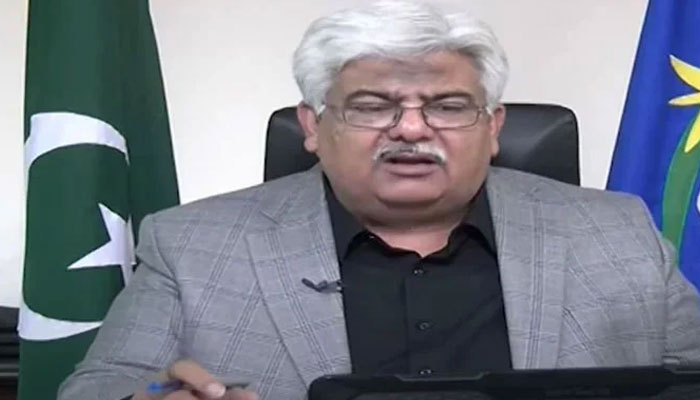

Langrial says he can produce video showing how these sugar mills did not comply

ISLAMABAD: Eight sugar mills — many of them belonging to political elites — have been found involved in tax-evasion of billions of rupees.

The FBR’s tax revenue appreciated to billions of rupees in the outgoing fiscal year after the tax machinery tightened the screw on the sugar sector.

During the proceedings of the National Assembly’s Standing Committee on Finance here on Wednesday, Opposition Leader Omar Ayub Khan sought the details of those sugar mills which were found involved in tax-evasion and preferred to remain non-compliant.

The meeting was also attended by Minister for Finance and Revenue Muhammad Aurangzeb and State Minister for Finance Bilal Azhar Kiyani.

This whole episode triggered when FBR Chairman Rashid Mehmood Langrial informed the committee that tax collection from sugar mills had increased after the FBR took action.

Langrial said he could produce the video showing how these sugar mills did not comply. However, Omar Ayub Khan reminded during the committee proceedings that the list of sugar mills evading taxes was yet to be shared.

On Langrial’s instruction, the FBR staff furnished the list of sugar mills after two hours when Omar again sought the list. The FBR chairman shared a closed envelope with the committee chairman Naveed Qamar who then handed it over to the opposition leader.

At the end of the committee proceedings, when Langrial was asked about the imposed penalty on the non-compliant sugar mills, he responded that he did not know the exact amount.

However, the question arises why criminal proceedings were not initiated against the sugar mills evading taxes.

Israr Khan reports: One of the sugar mills had installed a concealed chute designed to divert sugar production and evade official monitoring. The FBR sealed the chute and seized 1,200 metric tons of sugar from the premises.

Similarly, another mill disconnected its production lines from the FBR’s digital monitoring system – a move interpreted as a deliberate attempt to conceal output. As a result, 150 metric tons of untaxed sugar and five vehicles used in transport were seized.

One mill was completely sealed after it failed to hand over the custody of Network Video Recorder (NVR) system to the FBR officials, violating compliance protocols.

One of the non-compliant mills was caught dispatching sugar bags without the mandatory Track-and-Trace System (TTS) stamps – a key tool for ensuring tax compliance.

The FBR sealed the mill’s godowns and conducting a comprehensive stocktaking exercise.

Another mill was found with incomplete CCTV camera installations – a violation of surveillance requirements. The weighbridge at the site was sealed by the FBR. Additionally, the same mill faced another action for frequent malfunctions and errors in its shooters —automatic bagging machines — leading the FBR to seal the defective shooter.

Similarly, one mill was found diverting sugar supplies to an area that lacked TTS monitoring, bypassing official oversight. The FBR sealed the entire bagging area in response.

One of mills also came under scrutiny after officials detected errors in its shooter systems and a mismatch in sugar bag counting. The shooters were sealed to prevent further unregulated production.

Langrial assured the committee that the FBR teams would continue monitoring sugar mills using technology and on-ground inspections to ensure full compliance with tax laws and regulatory mechanisms.

-

King Charles' Andrew Decision Labelled 'long Overdue'

King Charles' Andrew Decision Labelled 'long Overdue' -

Timothee Chalamet 'forever Indebted' To Fan Over Kind Gesture

Timothee Chalamet 'forever Indebted' To Fan Over Kind Gesture -

Columbia University Sacks Staff Over Epstein Partner's ‘backdoor’ Admission

Columbia University Sacks Staff Over Epstein Partner's ‘backdoor’ Admission -

Ozzy Osbourne's Family Struggles Behind Closed Doors

Ozzy Osbourne's Family Struggles Behind Closed Doors -

Dua Lipa Claims Long-distance Relationship 'never Stops Being Hard'

Dua Lipa Claims Long-distance Relationship 'never Stops Being Hard' -

BTS Moments Of Taylor Swift's 'Opalite' Music Video Unvieled: See Photos

BTS Moments Of Taylor Swift's 'Opalite' Music Video Unvieled: See Photos -

Robin Windsor's Death: Kate Beckinsale Says It Was Preventable Tragedy

Robin Windsor's Death: Kate Beckinsale Says It Was Preventable Tragedy -

Rachel Zoe Shares Update On Her Divorce From Rodger Berman

Rachel Zoe Shares Update On Her Divorce From Rodger Berman -

Kim Kardashian Officially Takes Major Step In Romance With New Boyfriend Lewis Hamilton

Kim Kardashian Officially Takes Major Step In Romance With New Boyfriend Lewis Hamilton -

YouTube Tests Limiting ‘All’ Notifications For Inactive Channel Subscribers

YouTube Tests Limiting ‘All’ Notifications For Inactive Channel Subscribers -

'Isolated And Humiliated' Andrew Sparks New Fears At Palace

'Isolated And Humiliated' Andrew Sparks New Fears At Palace -

Google Tests Refreshed Live Updates UI Ahead Of Android 17

Google Tests Refreshed Live Updates UI Ahead Of Android 17 -

Ohio Daycare Worker 'stole $150k In Payroll Scam', Nearly Bankrupting Nursery

Ohio Daycare Worker 'stole $150k In Payroll Scam', Nearly Bankrupting Nursery -

Michelle Yeoh Gets Honest About 'struggle' Of Asian Representation In Hollywood

Michelle Yeoh Gets Honest About 'struggle' Of Asian Representation In Hollywood -

Slovak Fugitive Caught At Milano-Cortina Olympics To Watch Hockey

Slovak Fugitive Caught At Milano-Cortina Olympics To Watch Hockey -

King Charles Receives Exciting News About Reunion With Archie, Lilibet

King Charles Receives Exciting News About Reunion With Archie, Lilibet