PBF submits tax, investment proposals for Budget FY26

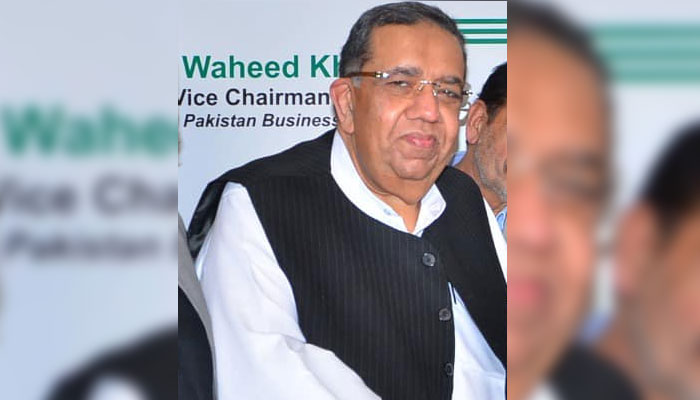

KARACHI: President of the Pakistan Business Forum (PBF) Khawaja Mahboob ur Rehman has submitted budget proposals for fiscal year 2025-26 to the Ministry of Finance.

The proposals outline recommendations aimed at broadening the tax base: call for lowering advance tax slabs for filers and eliminating the 18 per cent sales tax on domestic cotton to align it with tax-free imported cotton under the Export Facilitation Scheme (EFS). The PBF also suggested a seven-year tax exemption for mining and mineral sector investments under the Special Investment Facilitation Council (SIFC) and lease companies engaged in the Green Pakistan Initiative.

To encourage industrial expansion, the forum proposed reducing the minimum tax to 0.25 per cent annually and urged policy support for the construction sector, including the removal of Section 7E of the Income Tax Ordinance and a cut in withholding tax to 1.0 per cent for first-time homebuyers. It also recommended amending Section 8B to allow manufacturers greater access to export markets.

Corporate tax rates should be capped at 25 per cent annually, and the government should review the super tax to ease the burden on businesses, the PBF said. It also advocated for a fixed tax regime for traders, suggesting large traders pay Rs20,000 per month and small traders Rs10,000 per month to expand the tax net.

The Forum urged the government to allocate funds for the development of southern Balochistan, emphasising that the remaining 50 per cent of the Rs540 billion package announced in 2020 should be released. Other proposals include conducting income tax and sales tax audits every four years and amending SRO 250-2019 to stimulate business activity.

To enhance economic competitiveness, the PBF recommended aligning corporate tax rates with those of neighbouring countries and withdrawing tax exemptions granted to industries in Fata and Pata. It also called for lifting the import ban on hybrid cotton seeds to support the agricultural sector.

The PBF’s proposals stress simplifying and streamlining taxes to foster economic formalization and encourage wealth creation. The forum also highlighted structural economic challenges, including high energy costs, currency depreciation and import restrictions that have stifled manufacturing and led to job losses. The group called for comprehensive tax reforms, subsidy rationalisation, and spending cuts to stabilise the economy while promoting local manufacturing and exports.

-

Man Convicted After DNA Links Him To 20-year-old Rape Case

Man Convicted After DNA Links Him To 20-year-old Rape Case -

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice -

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’ -

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday -

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival -

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating -

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew -

Will AI Take Your Job After Graduation? Here’s What Research Really Says

Will AI Take Your Job After Graduation? Here’s What Research Really Says -

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner -

AI Film School Trains Hollywood's Next Generation Of Filmmakers

AI Film School Trains Hollywood's Next Generation Of Filmmakers -

Royal Expert Claims Meghan Markle Is 'running Out Of Friends'

Royal Expert Claims Meghan Markle Is 'running Out Of Friends' -

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move'

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move' -

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones -

Teyana Taylor Reflects On Her Friendship With Julia Roberts

Teyana Taylor Reflects On Her Friendship With Julia Roberts -

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System -

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana