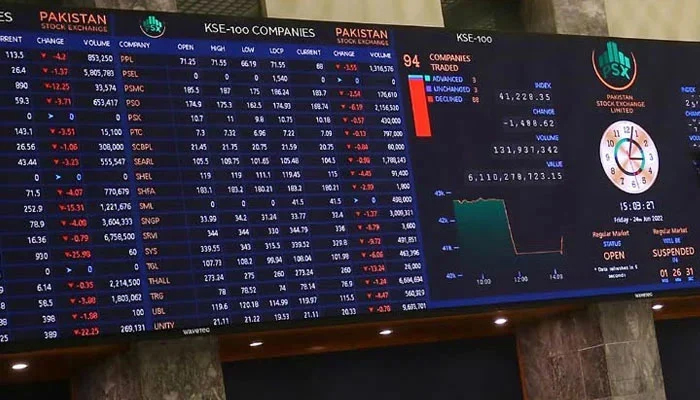

Stocks swing between red and green, settle higher on upbeat data

Bullish activity witnessed amid upbeat economic data on exports surging 22 percent year on year to $2.81 billion

Stocks closed higher on Wednesday, boosted by positive economic data on exports, trade deficit and cement dispatches, as well as investor optimism ahead of corporate earnings announcements and the release of an IMF tranche, dealers said.

The Pakistan Stock Exchange's (PSX) benchmark KSE 100-share Index gained 297.25 points or 0.46 percent to close at 64,646.85 points, after touching a high of 65,244.60 points and a low of 64,219.54 points during the session. The KSE-30 index also increased by 67.48 points or 0.31 percent to close at 21,634.41 points.

“Bullish activity witnessed amid upbeat economic data on exports surging 22 percent year on year to $2.81 billion, trade deficit shrinking by 40 percent year on year to $1.7 billion and cement dispatched rising by 4.6 percent year on year in Dec’23,” said analyst Ahsan Mehanti at Arif Habib Corp.

"The investor speculations ahead of major earning announcements due next week, rupee stability, and the release of the IMF tranche this month played a catalytic role the in bullish close."

Traded shares decreased by 32 million shares to 639.616 million shares from 671.665 million shares. The trading value decreased to Rs20.282 billion from Rs24.451 billion. Market capital expanded to Rs9.359 trillion against Rs9.292 trillion. Out of 366 companies active in the session, 190 closed in green, 159 in red and 17 remained unchanged.

Analyst Ali Najib at Topline Securities said equities had a mixed day. "Contrary to Tuesday’s negative momentum, the day kicked off on a positive note and the benchmark index made an intraday high at 65,241 levels," Najib said. "At the aforesaid level, profit-taking was seen in the market which compelled the benchmark index to shed earlier gains and ultimately settle the day at 0.46 percent up." E&P, fertilizer, tobacco and cement sectors contributed the most as OGDC, PPL, FFC, PAKT and KOHC added 267 points. On the flip side, MTL, MEBL and PSO cumulatively lost 74 points due to profit-taking.

The highest increase was recorded in Pakistan Tobacco Company Limited, which rose by Rs57.89 to Rs1,130 per share, followed by Hoechst Pakistan Limited, which increased by Rs30 to Rs1,350 per share. A significant decline was noted in Pakistan Services Limited, which fell by Rs27.34 to Rs983.67 per share, followed by Colgate-Palmolive (Pakistan) Limited, which closed lower by Rs17.49 to Rs1,607.37 per share.

Brokerage Arif Habib Ltd said the market faced resistance at the weekly target of 65,000 points level, introducing the possibility of a decline towards 63,000 points. OGDC (+3.64 percent) emerged as the primary contributor to index gains, whereas MEBL (-1.34 percent) acted as the largest drag.

The overall outlook remains positive, and the statement suggests that declines in support levels should be viewed as buying opportunities, with an optimistic target of 67,000 points, the brokerage said. "This assessment provides a concise overview of the market's recent performance and outlines a forward-looking perspective for investors."

K-Electric Ltd. remained the volume leader with 127.794 million shares which closed higher by 17 paisas to Rs5.47 per share. P.T.C.L. followed it with 50.431 million shares, which closed higher by 74 paisas to Rs13.49 per share.

Other significant turnover stocks included Pak Refinery, B.O. Punjab, Pak Petroleum, P.I.A.C.(A), WorldCall Telecom, Cnergyico PK, Unity Foods Ltd and Oil & Gas Dev.

A total of 312 companies recorded future shares, of which 151 increased, 156 decreased and 5 remained unchanged.

-

Garrett Morris Raves About His '2 Broke Girls' Co-star Jennifer Coolidge

Garrett Morris Raves About His '2 Broke Girls' Co-star Jennifer Coolidge -

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ?

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ? -

Melissa Joan Hart Reflects On Social Challenges As A Child Actor

Melissa Joan Hart Reflects On Social Challenges As A Child Actor -

'Gossip Girl' Star Reveals Why She'll Never Return To Acting

'Gossip Girl' Star Reveals Why She'll Never Return To Acting -

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested -

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed -

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice'

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice' -

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police -

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging -

US Set To Block Chinese Software From Smart And Connected Cars

US Set To Block Chinese Software From Smart And Connected Cars -

Carmen Electra Says THIS Taught Her Romance

Carmen Electra Says THIS Taught Her Romance -

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes -

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing -

King Charles Still Cares About Meghan Markle

King Charles Still Cares About Meghan Markle -

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release -

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch