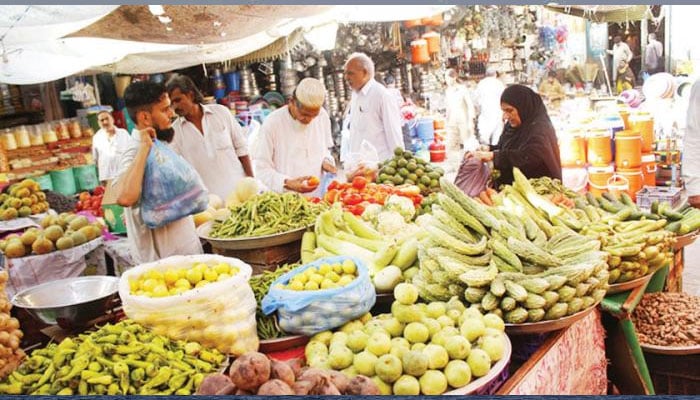

Weekly inflation increases by 1.81pc

KARACHI: The weekly inflation, based on the Sensitive Price Index (SPI), for the week that ended on Nov 11 registered an increase of 1.81 percent for the combined income group, going up from 164.53 points during the week that ended on November 4 to 167.5 points in the week under review.

According to the provisional figures released by the Pakistan Bureau of Statistics (PBS), the average prices of 30 essential items, including tomatoes, diesel, petrol, cooking oil, vegetable ghee, potatoes, etc., rose during the outgoing week.

Prices of six items, including sugar, pulse mash and wheat flour bag declined. Meanwhile, the rates of 15 essential goods remained unchanged. The bureau, in its weekly report, said that among food items, the price of tomatoes increased by a significant 18.7 percent.

Meanwhile, a 5-litre tin of cooking oil, 1kg of vegetable ghee, bananas, bread, eggs, potatoes and onions recorded an increase of 4.27 percent, 3.28 percent, 3.04 percent, 2.84 percent, 1.82 percent, 1.77 percent, and 1.51 percent, respectively.

Among non-food items, prices of diesel, petrol, electricity for Quarter 1 (Q1) rose by 6.04 percent, 5.78 percent, and 2.74 percent, respectively.

During the week under review, the price of sugar dropped by 9.35 percent, while the price of moong (pulse), wheat flour, and garlic recorded a decrease of 0.42 percent, 0.26 percent and 0.04 percent.

The SPI for the lowest income group increased by 0.96% compared to the previous week. The index for the group stood at 178.35 points against 175.63 points in the previous week. On a year-on-year basis, the inflation based on the SPI increased 17.37 percent.

Meanwhile, Pakistani currency dropped Friday to an all-time low of Rs175.73 against the US dollar in the inter-bank market, as demand for the foreign currency stood higher than supply amid an increase in import payments, rising global commodity prices and uncertainty about the resumption of the IMF loan programme.

The local currency depreciated around Rs1.54 against the greenback to settle at Rs175.73 on Friday. Cumulatively, the local currency has lost around Rs5.76 during last seven days. The local currency last dropped to a record low of Rs175.26 against the US currency on October 26.

The government has decided to let the market-based, flexible rupee-dollar exchange rate mechanism determine the value of the rupee against the US dollar, keeping in view the demand and supply of foreign currency in the inter-bank market.

The inter-bank market mostly meets the demand for import payments through receipts of export earnings and workers’ remittances sent home by overseas Pakistanis.

The rupee has maintained the downtrend for the past five months. It has lost 15.4 percent (or Rs23.46) to date, compared to the 22-month high of Rs152.27 recorded in May.

With a fresh decline of 0.88 percent, the rupee has depreciated by 11.54 percent (or Rs18.19) since the start of the current fiscal year on July 1, 2021, data released by the central bank revealed.

Speaking to Geo.tv, Pakistan-Kuwait Investment Company Head of Research Samiullah Tariq said that the local currency has once again plunged due to an expected current account deficit.

“The real effective exchange rate (REER) - the country’s cost of external trade - has dropped to 93 points on the index, suggesting the rupee is trading around fair values these days and there is hardly any space left to drop more,” Tariq said.

Taking to his Twitter handle, senior journalist Shahbaz Rana wrote, “Mishandling of IMF talks [and] breakdown of communication channels have caused more damage to the economy than weak economic fundamentals.”

“[The] stock market is again bleeding today. The rupee is inching towards a historic low of Rs176/dollar. Urgent damage control is needed. PM office has to intervene,” he added.

-

Cuba-Canada Travel Advisory Raises Concerns As Visitor Numbers Decline

Cuba-Canada Travel Advisory Raises Concerns As Visitor Numbers Decline -

Anthropic Buys 'Super Bowl' Ads To Slam OpenAI’s ChatGPT Ad Strategy

Anthropic Buys 'Super Bowl' Ads To Slam OpenAI’s ChatGPT Ad Strategy -

Prevent Cancer With These Simple Lifestyle Changes

Prevent Cancer With These Simple Lifestyle Changes -

Air Canada Flight Diverted St John's With 368 Passengers After Onboard Incident

Air Canada Flight Diverted St John's With 368 Passengers After Onboard Incident -

Experts Reveal Keto Diet As Key To Treating Depression

Experts Reveal Keto Diet As Key To Treating Depression -

Inter Miami Vs Barcelona SC Recap As Messi Shines With Goal And Assist

Inter Miami Vs Barcelona SC Recap As Messi Shines With Goal And Assist -

David Beckham Pays Tribute To Estranged Son Brooklyn Amid Ongoing Family Rift

David Beckham Pays Tribute To Estranged Son Brooklyn Amid Ongoing Family Rift -

Jailton Almeida Speaks Out After UFC Controversy And Short Notice Fight Booking

Jailton Almeida Speaks Out After UFC Controversy And Short Notice Fight Booking -

Extreme Cold Warning Issued As Blizzard Hits Southern Ontario Including Toronto

Extreme Cold Warning Issued As Blizzard Hits Southern Ontario Including Toronto -

Lana Del Rey Announces New Single Co-written With Husband Jeremy Dufrene

Lana Del Rey Announces New Single Co-written With Husband Jeremy Dufrene -

Ukraine-Russia Talks Heat Up As Zelenskyy Warns Of US Pressure Before Elections

Ukraine-Russia Talks Heat Up As Zelenskyy Warns Of US Pressure Before Elections -

Lil Nas X Spotted Buying Used Refrigerator After Backlash Over Nude Public Meltdown

Lil Nas X Spotted Buying Used Refrigerator After Backlash Over Nude Public Meltdown -

Caleb McLaughlin Shares His Resume For This Major Role

Caleb McLaughlin Shares His Resume For This Major Role -

King Charles Carries With ‘dignity’ As Andrew Lets Down

King Charles Carries With ‘dignity’ As Andrew Lets Down -

Brooklyn Beckham Covers Up More Tattoos Linked To His Family Amid Rift

Brooklyn Beckham Covers Up More Tattoos Linked To His Family Amid Rift -

Shamed Andrew Agreed To ‘go Quietly’ If King Protects Daughters

Shamed Andrew Agreed To ‘go Quietly’ If King Protects Daughters