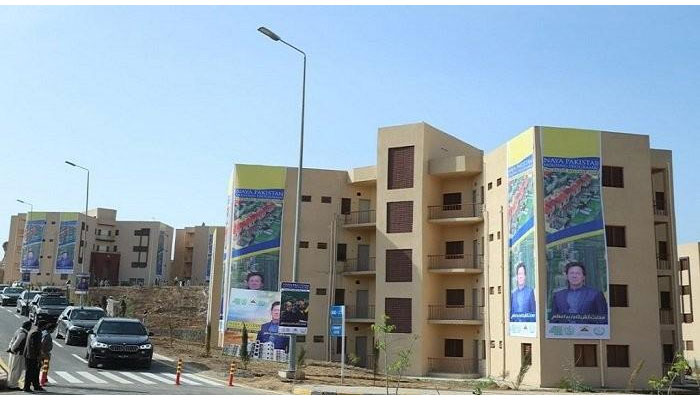

Low-cost housing finance yet to catch momentum

ISLAMABAD: Prime Minister’s housing finance loans from banks have so far failed to get momentum mainly because of inexperienced staff to extend mortgage finance and inability to inspect the property within the stipulated time frame, according to a research study.

Alone in Islamabad under jurisdiction of Capital Development Authority (CDA), it takes almost 9 months to get a construction permit for a residential building having 151 square yards with a value of 6 million rupees.

It costs 3 percent of plot value to get permission.

There are different kinds of sludges for constructing residential and high-rise buildings in the country as it requires different kind of no objection certificates from respective regulators, Civil Aviation Authority (CAA) and Air Headquarters.

The Pakistan Institute of Development Economics (PIDE) launched a report on obtaining residential or high- rise buildings and housing finance in Pakistan in a webinar on Saturday.

It takes around 274 days to get permission from CDA and will cost Rs 185,000 including a bribe of Rs 75,000.

“It is difficult to do business in Pakistan as different kinds of permissions are required to move ahead.”

PIDE Vice Chancellor Nadeem Ul Haq said. “Despite claims about the booming construction sector, there are only few projects under construction in the main Blue Area of Islamabad so it needs to give a boost but it will not be possible if a number of existing sludges are removed by removing unnecessary NOC and permission certificates.”

PIDE’s experts Ahmed Waqar and Idress Khawaja conducted this research study. The entire process of obtaining a construction permit for a house in Islamabad from the CDA consumes around 9 months and makes the individual and his/her family go through a significant level of stress.

No objection certificate from the sewerage division located in a separate building has to be obtained. This can be dealt with within the CDA.

The applicant need not be required to make an application and pursue

this. There is a need to introduce digitisation as submission of application

and documents to CDA should be available.

The option of submitting the application and uploading the documents should be available. The fee payable against the construction permit has to be paid physically at the bank.

For PM’s housing finance scheme, the study shows that the excessive documentation and unaccommodated process were the major challenges and actual processing of loan took four times more than the banks’ described times for approval of housing loans.

The study showed that the processing of housing loans takes four months average time against 15 to 21 days claimed by the banks under the instructions of the State Bank of Pakistan.

Faraz Khalid representing Askari Bank said the housing finance loan is an evolving process and it was not a preferred sectors of banks so it would take some time to get accelerated. The biggest problem for the banks for inspecting property mortgaged on housing loans. If documents are cleaned and all procedures are completed then the processing of the loan do not take much time, he added.

Faisal Jamal, a contractor, said that they were facing immense difficulties getting permissions to kick-start projects. Engineer Khizar Hayat said that the requirement of NOC resulted in delays so cost overrun jumped up the cost of the project resulting in revision of PC-1 of projects.

The PM’s housing scheme is more political slogan than something substantial on ground so the dream of constructing five million housing units could not be materialized within the stipulated time frame.

-

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere -

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source -

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo -

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle -

Brooks Nader Reveals Why She Quit Fillers After Years

Brooks Nader Reveals Why She Quit Fillers After Years -

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix -

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis -

JoJo Siwa Shares Inspiring Words With Young Changemakers

JoJo Siwa Shares Inspiring Words With Young Changemakers -

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M -

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report -

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans -

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced -

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role -

Kate Middleton Proves She's True 'children's Princess' With THIS Move

Kate Middleton Proves She's True 'children's Princess' With THIS Move -

Paul Anka Reveals How He Raised Son Ethan Differently From His Daughters

Paul Anka Reveals How He Raised Son Ethan Differently From His Daughters -

'A Very Special Visitor' Meets Queen Camilla At Clarence House

'A Very Special Visitor' Meets Queen Camilla At Clarence House