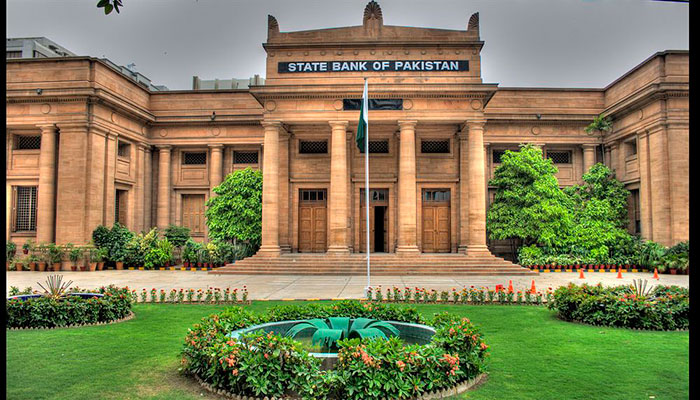

State Bank loosens rules to boost low-cost housing finance

KARACHI: The State Bank of Pakistan (SBP) on Friday unveiled five regulatory relaxations to incentivise banks in a bid to promote low-cost housing finance in the country.

According to the central bank statement, the definition of low-cost housing finance used in the current regulations for banks has been aligned with definition used under Government Markup Subsidy Facility for Housing Finance eligible under tiers I & II of housing finance.

Specifically, in the SBP regulations, the value of housing unit has been increased from Rs3 million to Rs3.5 million with maximum loan size increased from Rs2.7 million to Rs3.15 million.

Consequently, the incentive for low-cost housing finance will increase for banks as they will not only be able to enjoy markup subsidy facility by the government but the regulatory incentives under low-cost housing finance by SBP as well.

Current regulations and banking practices require banks to obtain documentary evidence of income. Provision of this information is difficult for people generating income from informal sources, which are generally in low income segments.

In order to facilitate financing for this segment, State Bank is urging the banks to use alternate methods to identify income sources and assess the credit worthiness of the borrowers. The 2nd and 3rd types of relaxations are being given to facilitate financing for this segment.

Accordingly, under 2nd relaxation, banks have been exempted from the requirement of using ‘verifiable income’ for the purpose of calculating Debt Burden Ratio (DBR) in case of low-cost housing finance where banks are using income proxies and where income of the borrower is not verifiable. Resultantly, borrowers with ‘non-verifiable income,’ estimated by banks using income proxies, will also become eligible to avail low-cost housing finance.

Thirdly, banks have also been exempted from the requirement of observing DBR, in case of low-cost housing finance, where banks are using repayment surrogates like rent, utility bills, telecoms bills, etc to assess repayment capacity of borrower. Hence, borrowers without verifiable or non-verifiable income will become eligible to avail low-cost housing finance.

Fourthly, banks have been exempted from the requirement of Internal Credit Risk Rating System for the low-cost housing finance till September 30, 2022 as their current systems do not specifically cater for low-cost housing finance.

Accordingly, borrowers of low-cost housing finance who cannot avail financing due to banks internal credit rating criteria will now become eligible if the bank is otherwise satisfied. This time barred relaxation will provide banks to develop their Internal Credit Risk Rating Systems for low-cost housing finance.

Finally, in order to provide comfort to the borrowers who have liquid securities or already have a housing unit, banks have been allowed to extend housing finance for purchase/construction of a residential property by accepting existing residential property or liquid securities in lieu of equity contribution for housing finance at the time of calculations of loan to value ratio.

Financing bank will create its lien on existing residential property/liquid securities in addition to mortgage of residential property being financed.

“It is expected that the above regulatory incentives would provide further impetus to SBP’s on-going efforts to accelerate housing and construction finance in Pakistan,” the SBP said in a statement.

Let it be noted that banks have already been given mandatory targets of 5 percent of their private sector advances as housing and construction finance by December 31, 2021.

-

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her -

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring -

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried'

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried' -

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere -

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source -

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo -

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle -

Brooks Nader Reveals Why She Quit Fillers After Years

Brooks Nader Reveals Why She Quit Fillers After Years -

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix -

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis -

JoJo Siwa Shares Inspiring Words With Young Changemakers

JoJo Siwa Shares Inspiring Words With Young Changemakers -

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M -

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report -

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans -

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced -

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role