13 years on, watchman’s struggle to get his service record ends nowhere

A man of no means, Sarla doesn’t have funds to hire a lawyer to get justice through court. Nevertheless, he’s not ready to surrender his basic rights promised to him by the Constitution of Pakistan which are codified through different laws.

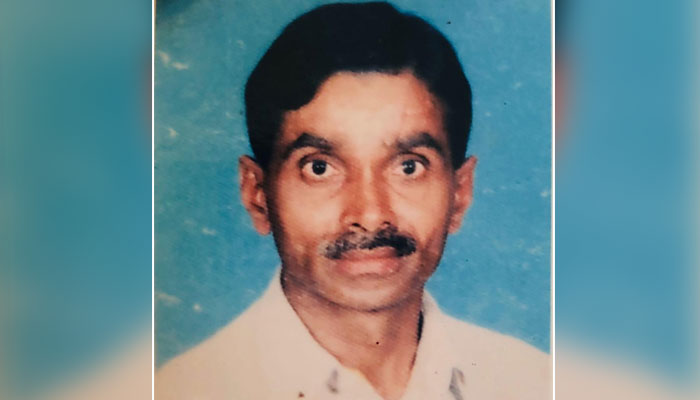

ISLAMABAD: Abdul Samad Sarla was a watchman in a government bank. There he served for 19 years on daily-wage basis. His contract would renew every three months until 2003 when rendering jobless. He has since been demanding of the bank for his record of service there; wrote as many as 71 letters but no answer.

A man of no means, Sarla doesn’t have funds to hire a lawyer to get justice through court. Nevertheless, he’s not ready to surrender his basic rights promised to him by the Constitution of Pakistan which are codified through different laws. His struggle to acquire the service record through writing letters to the bank ended in vain in 2016. In December last year, somebody advised him to invoke Right of Access to Information 2017 Act, commonly known as RTI law.

Before filing RTI application, Sarla sought help from court's Human Rights Cell, National Commission for Human Rights (NCHR), Banking Ombudsman and Federal Ombudsman and Pakistan Citizens Portal set up by Prime Minister Office. Each time, either the forum approached didn’t offer any help or the bank offered different responses when pressed to make the record available.

Human Rights Cell acknowledged Sarla’s right but advised him to seek remedy from appropriate legal forum. NCHR summoned the banking authorities, which said Sarla had never been the employee of the bank. When pressed to give this reply in writing as Sarla insisted he had served at its seven different branches, the bank didn’t respond. Responding to Pakistan Citizen Portal, the bank president took the same view but said, “However, matter is being deliberated at senior management and board of directors level to resolve the issue. As and when any decision taken by them, it shall be conveyed accordingly.” Thus, there is no definitive timeframe to address the grievance. Banking and federal ombudsmen said helping in the provision of service record was beyond their jurisdiction.

As Sarla’s RTI application went unanswered, the matter was finally taken up by Pakistan Information Commission (PIC) which deals with the complaints where RTI requests filed to federal entities are not entertained by the organisations concerned. When served with a notice to give reason for not responding to the applicant’s request, the bank came up with an excuse unrelated to the matter under question. It said that under State Bank’s regulations, the bank is required to maintain for a minimum period of five years “all necessary records on transaction, both domestic and international.”

The PIC took exception to this non-serious response and said the applicant’s service record was under question, not any monetary transaction. It further noted that destroying service record is a punishable offence as this is a public record of an employee and he can ask for it under section 6 (C) of the Right of Access to Information Act 2017. Also the fact remains that public record can’t be destroyed or disposed of without the consent of Director General of National Archive as per The National Archive Act, 1993.

Owing to the foregoing, the PIC ordered the provision of service record within 20 working days of the receipt of the order dated September 5, 2019. More than a month has been passed and the applicant is still waiting to hear from the bank. As a future course of action, the PIC will serve a show-cause notice on the bank, which has not reported its compliance. The PIC can proceed against the bank as it has judicial powers to do so. Meanwhile, Sarla is waiting with fingers crossed. He has turned 55 years now and his fate still hangs in the balance.

Providing him record means the bank will then be asked to regularise his services and of other former daily-wage employees who are also demanding the record. A 2004 Supreme Court verdict in Ikram Bari case had declared that the bank was under obligation to regularise daily-wage employees who have served there at least for three years.

-

China Confirms Visa-free Travel For UK, Canada Nationals

China Confirms Visa-free Travel For UK, Canada Nationals -

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout -

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown -

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis -

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’ -

Prince William's Love For His Three Children Revealed During Family Crisis

Prince William's Love For His Three Children Revealed During Family Crisis -

Murder Suspect Kills Himself After Woman Found Dead In Missouri

Murder Suspect Kills Himself After Woman Found Dead In Missouri -

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files -

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence -

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar -

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’ -

Poll Reveals Majority Of Americans' Views On Bad Bunny

Poll Reveals Majority Of Americans' Views On Bad Bunny -

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death -

Man Convicted After DNA Links Him To 20-year-old Rape Case

Man Convicted After DNA Links Him To 20-year-old Rape Case -

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice -

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’