Pakistan returns to commercial debt market, clinches $1bn loan facility

Islamabad is making arrangements for securing refinancing of a $1.3 billion loan from Chinese banks

ISLAMABAD: In the aftermath of the IMF program, Pakistan has resumed commercial financing from international banks and signed a syndicated loan of $1 billion for five years.

Islamabad is also making arrangements for securing refinancing of a $1.3 billion loan from Chinese banks, and it is expected that a total of $2.3 billion will be obtained by June 30, 2025.

The foreign exchange reserves held by the State Bank of Pakistan are expected to go up in the coming weeks with the help of borrowed dollar inflows. The foreign exchange reserves may go close to $14 billion mark against $11.6 billion standing on June 6, 2025.

The two separate commercial loan facility will help Pakistan to increase its foreign exchange reserves.

According to the Ministry of Finance statement issued on Wednesday, the Ministry of Finance has signed a syndicated term finance facility of $1 billion partially guaranteed by a Policy Based Guarantee of the Asian Development Bank’s (ADB) Program “Improved Resource Mobilization & Utilization Reform”. The sources said that the ADB provided a guarantee of $500 million helping Islamabad to negotiate reasonable deal on the basis of over SOFR (Secured Overnight Financing Rate). The facility is a landmark transaction for the Government of Pakistan that demonstrates strong support from leading financiers in the region.

This transaction also marks the beginning of new partnership of Government of Pakistan with Middle Eastern banks.

-

Why ‘X’ Is Down? Thousands Report Twitter Outage: Here’s What You Can Do

Why ‘X’ Is Down? Thousands Report Twitter Outage: Here’s What You Can Do -

Florida Man Held After Alleged Nail-scattering On Busy Intersections

Florida Man Held After Alleged Nail-scattering On Busy Intersections -

Valeria Nicov: Sean Penn's Athletic Girlfriend Raises Eyebrows With Latest Photos

Valeria Nicov: Sean Penn's Athletic Girlfriend Raises Eyebrows With Latest Photos -

Sharon Stone Lashes Out At Fellow Award Show Attendees After Stealing Accusations

Sharon Stone Lashes Out At Fellow Award Show Attendees After Stealing Accusations -

Gwyneth Paltrow Reveals Real Reason She Said Yes To 'Marty Supreme'

Gwyneth Paltrow Reveals Real Reason She Said Yes To 'Marty Supreme' -

King Charles Says He And Queen Camilla Stand With People Of Ukraine

King Charles Says He And Queen Camilla Stand With People Of Ukraine -

Ben Affleck Argues In Favour Of His Shirtless Scene In 'The Rip'

Ben Affleck Argues In Favour Of His Shirtless Scene In 'The Rip' -

Mississippi Postal Worker Arrested After Complaints Of Marijuana Odour In Letters

Mississippi Postal Worker Arrested After Complaints Of Marijuana Odour In Letters -

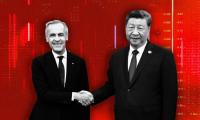

Canada, China Lock Initial Trade Deal On ‘EV,Canola’ To Strengthen Ties: What To Expect Next?

Canada, China Lock Initial Trade Deal On ‘EV,Canola’ To Strengthen Ties: What To Expect Next? -

Melissa Leo On Euphoria Of Winning An Oscar Vs It's Impact On Career

Melissa Leo On Euphoria Of Winning An Oscar Vs It's Impact On Career -

Meghan Markle, Prince Harry Express 'hope' In Latest Major Statement

Meghan Markle, Prince Harry Express 'hope' In Latest Major Statement -

Sophie Turner Backs Archie Madekwe As BAFTA Announces Nominees

Sophie Turner Backs Archie Madekwe As BAFTA Announces Nominees -

Jason Momoa Cherishes Hosting Ozzy Osbourne's Final Gig Ahead Of His Death

Jason Momoa Cherishes Hosting Ozzy Osbourne's Final Gig Ahead Of His Death -

Real Reason Timothee Chalamet Thanked Kylie Jenner At Awards Revealed

Real Reason Timothee Chalamet Thanked Kylie Jenner At Awards Revealed -

Will King Charles Attend Funeral Of Prince Philip's First Cousin, Princess Irene?

Will King Charles Attend Funeral Of Prince Philip's First Cousin, Princess Irene? -

'Furious' Prince William Wants Andrew As Far Away As Possible

'Furious' Prince William Wants Andrew As Far Away As Possible