PRIME welcomes major tariff reforms to boost trade, investment

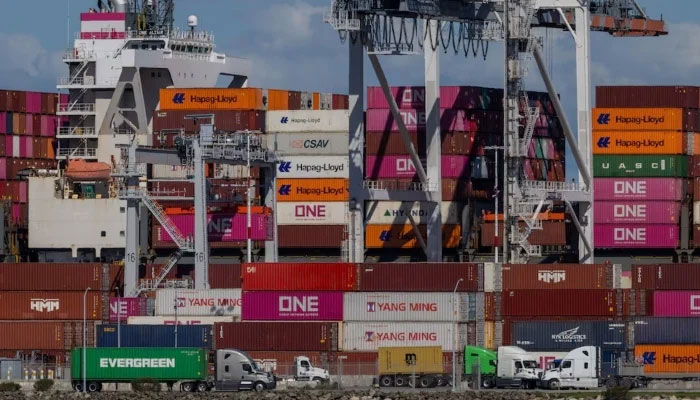

ISLAMABAD: The Policy Research Institute of Market Economy (PRIME), a think tank focused on economic and taxation issues, has welcomed the Pakistan government’s move to implement major reforms in the country’s tariff structure.

Describing the changes as “long-awaited”, PRIME said the reforms represent a positive shift towards simplifying Pakistan’s trade regime, encouraging investment and reducing the cost of doing business -- key priorities the institute has long championed through evidence-based research and policy advocacy.

In a statement issued on Monday, PRIME noted that the government’s plans to phase out regulatory and additional customs duties, reduce tariffs and tariff slabs and streamline the Fifth Schedule of the Customs Act align closely with its core recommendations. These include findings from its recent publications ‘An Empirical Critique of the National Tariff Policy 2019-24’ and the joint ‘PIDE-PRIME Tax Reforms Report (2024)’.

The reports underscore how Pakistan’s complex and distortionary tariff regime has undermined industrial competitiveness, incentivised rent-seeking and contributed to misinvoicing and smuggling.

According to PRIME’s research, 71 per cent of customs duties are collected from just 10 product groups, while nearly half of all imports fall under exemption regimes. These issues have contributed to a narrow tax base and widespread economic inefficiencies. The National Tariff Policy 2019-24, though well-intentioned, failed due to a lack of consensus between the Federal Board of Revenue (FBR) and the Ministry of Commerce.

In contrast, the newly announced reforms offer renewed policy coherence by aiming to reduce exemptions, apply cascading tariff principles more effectively and support import liberalisation as a route to export-led growth.

The PIDE-PRIME Tax Reforms Report also stresses that lowering import tariffs -- particularly on raw materials, intermediate goods and capital goods -- can promote domestic value addition while improving government revenue by curbing smuggling and expanding the formal tax base. Import-related taxes in Pakistan, including GST, FED, WHT, and customs duties, currently amount to 46 per cent, far above the global average of 5.0 per cent. The report highlights Vietnam as a successful example of a country that has increased both trade volumes and customs revenue through similar reforms.

Welcoming the government’s announcement, Executive Director at PRIME Dr Ali Salman said: “This is an important step towards an open and competitive economy. I urge the government to institutionalise these reforms and ensure progress is not reversed by counterproductive measures.” He added: “These changes have been recommended in multiple reform reports. It is now the collective duty of reform advocates to monitor implementation.”

-

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her -

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring -

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried'

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried' -

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere -

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source -

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo -

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle -

Brooks Nader Reveals Why She Quit Fillers After Years

Brooks Nader Reveals Why She Quit Fillers After Years -

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix -

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis -

JoJo Siwa Shares Inspiring Words With Young Changemakers

JoJo Siwa Shares Inspiring Words With Young Changemakers -

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M -

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report -

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans -

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced -

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role