Protectionist US tariffs pose risk to country: SBP

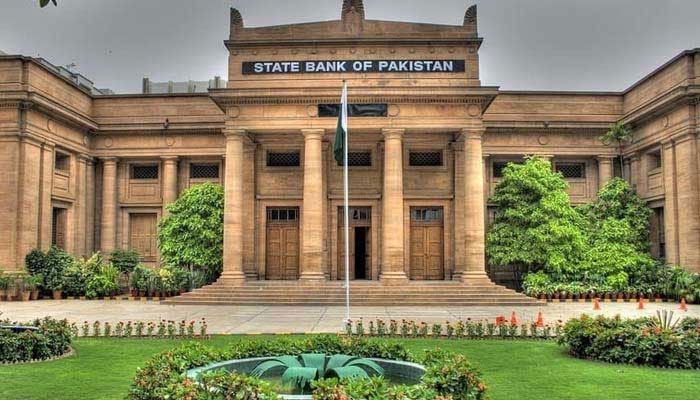

KARACHI: Protectionist policies stemming from steep new US tariffs and their associated impacts on global economic growth may pose challenges for Pakistan’s economy, the central bank said on Thursday.

The State Bank of Pakistan’s Financial Stability Review 2024 said that the global environment presents a mixed picture for the domestic economy. Global commodity prices are trending down, and major central banks in advanced economies, excluding the Federal Reserve, continue to lower key interest rates. “Nonetheless, a change in trade policy by the US may have implications for the Fed’s monetary policy as well as global financial conditions. Moreover, the resultant shift towards protectionist policies by other major economies may adversely affect global growth prospects, bearing repercussions for Pakistan’s economy as well,” it added.

“It deserves an emphasis that although the domestic economy is steadily on a recovery path, sustaining the recovery, which hinges on continued progress on structural reforms, is crucial to build external buffers and reduce external financing risks,” the SBP said in the report.

It said that the results of the latest stress testing assessment of the banking sector revealed that the sector is expected to remain resilient to various severe, hypothetical, but plausible shocks over the projected horizon of three years and is expected to maintain its compliance with minimum capital adequacy requirements.

Financial sector remains financially and operationally resilient

The report highlighted that macroeconomic conditions improved considerably last year, as reflected by receding inflationary pressures and consequent significant monetary easing, fiscal consolidation, stable rupee-dollar parity, pick-up in economic activity and improved external account balance. In this backdrop, the financial sector, growing at a decent pace of 17.8 per cent, maintained its operational and financial resilience during 2024.

Amid a turnaround in the macroeconomic environment, volatility in financial markets subsided. The banking sector exhibited steady performance and maintained its financial soundness. The balance sheet of the banks expanded by 15.8 per cent in 2024.

According to the report, the expansion in banks’ assets was driven by both investment and advances. Private sector advances witnessed a strong rebound due to a revival in economic activity, easing in monetary policy and advances-to-deposit ratio (ADR) linked tax policy for income from government securities. This tax policy also dampened the deposit mobilisation, which further increased the banks’ reliance on borrowings.

The current level of credit risk of the banking sector also remained within a comfortable range, as the non-performing loans (NPLs) to gross loans ratio fell to 6.3 per cent in December 2024 from 7.6 per cent in December 2023.

The provisioning coverage further improved amid the implementation of IFRS-9, with allowances and provisions held for loan losses exceeding the stock of outstanding NPLs, indicating a minimal net credit risk to solvency.

The earning volume remained steady, while key profitability indicators witnessed moderation over the year. The capital adequacy ratio, however, improved to 20.6 per cent by the end of December 2024 and remained well above the minimum regulatory requirements. Within the banking sector, Islamic banking institutions witnessed a strong increase in asset base and a marked expansion in branch network, which also reflects SBP’s focus on promoting Shariah-compliant financial services. Along with contained credit risk, the resilience of the Islamic banks remained steady in 2024. Nonetheless, microfinance banks continued to remain under stress.

The review showed that the non-bank financial sector presented a mixed performance. The balance sheet of DFIs contracted while that of NBFIs manifested a remarkable expansion. Moreover, the insurance sector continued to perform steadily. Whereas the supply side of the financial sector presented a comfortable position, the demand side was affected by the erstwhile tighter financial conditions and subdued economic activity. In particular, the sales of the non-financial large corporate sector witnessed pressure and moderation in earnings. However, the liquidity profile and repayment capacity of the sector remained comfortable. Encouragingly, though, the creditworthiness and repayment capacity of the large borrowers of the banking sector remained steady during the last year.

The digital transactions continued to drive the momentum of the retail transactions. To facilitate and support remittances from the Gulf region, SBP signed a memorandum of understanding with the Arab Monetary Fund to enable the integration of Raast with Buna, a cross-border payment system. Moreover, Raast maintained the momentum of strong growth, which particularly gained traction after the introduction of the person-to-merchant module in late 2023.

-

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor -

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return -

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown -

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson -

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’ -

OpenAI To Rollout AI Powered Smart Speakers By 2027

OpenAI To Rollout AI Powered Smart Speakers By 2027 -

Is Dakota Johnsons Dating Younger Pop Star After Breakup With Coldplay Frontman Chris Martin?

Is Dakota Johnsons Dating Younger Pop Star After Breakup With Coldplay Frontman Chris Martin? -

Hilary Duff Tears Up Talking About Estranged Sister Haylie Duff

Hilary Duff Tears Up Talking About Estranged Sister Haylie Duff -

US Supreme Court Strikes Down Trump’s Global Tariffs As 'unlawful'

US Supreme Court Strikes Down Trump’s Global Tariffs As 'unlawful' -

Kelly Clarkson Explains Decision To Quit 'The Kelly Clarkson Show'

Kelly Clarkson Explains Decision To Quit 'The Kelly Clarkson Show' -

Inside Hilary Duff's Supportive Marriage With Husband Matthew Koma Amid New Album Release

Inside Hilary Duff's Supportive Marriage With Husband Matthew Koma Amid New Album Release -

Daniel Radcliffe Admits To Being Self Conscious While Filming 'Harry Potter' In Late Teens

Daniel Radcliffe Admits To Being Self Conscious While Filming 'Harry Potter' In Late Teens -

Director Beth De Araujo Alludes To Andrew's Arrest During Child Trauma Talk

Director Beth De Araujo Alludes To Andrew's Arrest During Child Trauma Talk -

'Harry Potter' Alum Daniel Radcliffe Gushes About Unique Work Ethic Of Late Co Star Michael Gambon

'Harry Potter' Alum Daniel Radcliffe Gushes About Unique Work Ethic Of Late Co Star Michael Gambon -

Video Of Andrew 'consoling' Eugenie Resurfaces After Release From Police Custody

Video Of Andrew 'consoling' Eugenie Resurfaces After Release From Police Custody -

Japan: PM Takaichi Flags China ‘Coercion,’ Pledges Defence Security Overhaul

Japan: PM Takaichi Flags China ‘Coercion,’ Pledges Defence Security Overhaul