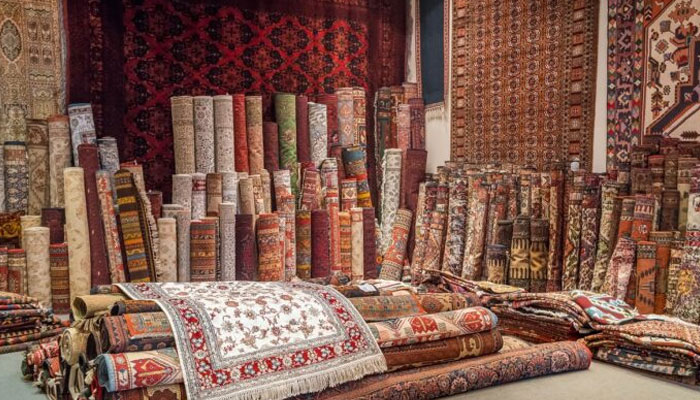

PCMEA’s proposals for 2025-26 budget: Govt urged to address challenges faced by carpet industry

LAHORE: The Pakistan Carpet Manufacturers and Exporters Association (PCMEA) has submitted a set of proposals and demands for the federal budget for the fiscal

year 2025-26 urging the government to address key challenges faced by the industry.

The association has called for a reduction in heavy duties taxes and restrictive measures which they claim are hindering the growth of handwoven carpet exports and putting Pakistan at a competitive disadvantage against global rivals like India.

PCMEA Patron in Chief Abdul Latif Malik Chairman Mian Atiq ur Rehman and Vice Chairman Riaz Ahmed emphasised that Pakistan’s handwoven carpet industry is one of the largest cottage industries in the country. Being 100% export oriented it plays a crucial role in the national economy by generating valuable foreign exchange. The industry relies on raw materials being sent to Afghanistan for partial processing before returning to Pakistan for final value addition and export.

However, under Schedule 5 of the Customs Act 1990 a 25% sales tax on partially processed raw materials entering through the Torkham border has placed a severe financial strain on exporters disrupting cash flow and working capital. The association has proposed reducing this tax to a non-refundable 5% to ease financial pressure support exporters and improve trade facilitation. They argued that this measure would not only stabilise the industry but also help Pakistan to maintain its competitive standing in the global market. Additionally, the association has expressed serious concerns over Circular EF02 (2023) issued by the State Bank of Pakistan which imposes penalties on delayed export earnings.The directive enforces a 3% penalty for delays of up to 30 days 6% for delays of 31 to 60 days and a substantial 9% for payments delayed beyond 60 days.

-

Hilary Duff’s Son Roasts Her Outfit In New Album Interview

Hilary Duff’s Son Roasts Her Outfit In New Album Interview -

Alexandra Daddario, Andrew Form Part Ways After 3 Years Of Marriage

Alexandra Daddario, Andrew Form Part Ways After 3 Years Of Marriage -

Eric Dane Rejected Sex Symbol Label

Eric Dane Rejected Sex Symbol Label -

Avan Jogia Says Life With Fiancee Halsey Feels Like 'coming Home'

Avan Jogia Says Life With Fiancee Halsey Feels Like 'coming Home' -

Kate Middleton's Role In Handling Prince William And Harry Feud Revealed

Kate Middleton's Role In Handling Prince William And Harry Feud Revealed -

Tucker Carlson Says Passport Seized, Staff Member Questioned At Israel Airport

Tucker Carlson Says Passport Seized, Staff Member Questioned At Israel Airport -

David, Victoria Beckham Gushes Over 'fiercely Loyal' Son Cruz On Special Day

David, Victoria Beckham Gushes Over 'fiercely Loyal' Son Cruz On Special Day -

Taylor Swift Made Sure Jodie Turner-Smith's Little Girl Had A Special Day On 'Opalite' Music Video Set

Taylor Swift Made Sure Jodie Turner-Smith's Little Girl Had A Special Day On 'Opalite' Music Video Set -

Eric Dane Says Touching Goodbye To Daughters Billie And Georgia In New Netflix Documentary

Eric Dane Says Touching Goodbye To Daughters Billie And Georgia In New Netflix Documentary -

Channing Tatum Reveals What He Told Daughter After Violent Incident At School

Channing Tatum Reveals What He Told Daughter After Violent Incident At School -

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor -

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return -

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown -

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson -

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’ -

OpenAI To Rollout AI Powered Smart Speakers By 2027

OpenAI To Rollout AI Powered Smart Speakers By 2027