Bonuses of corporate employees: SC upholds SHC verdict axing 30pc tax

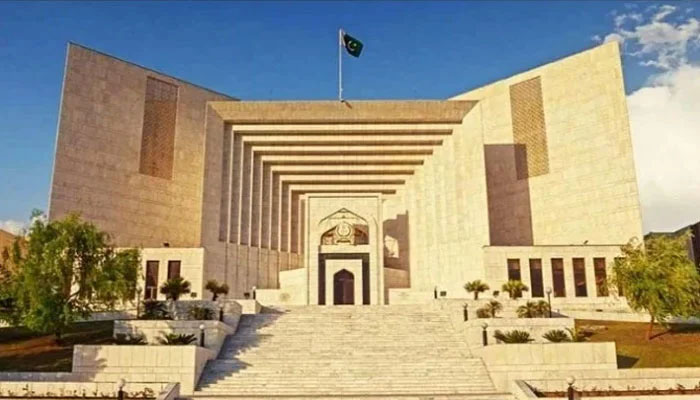

ISLAMABAD: The Supreme Court of Pakistan on Monday dismissed the appeal filed by the Federal Board of Revenue (FBR), challenging the verdict of the Sindh High Court striking down 30 per cent tax on bonuses received by the corporate employees having a taxable income of RsI million or above.

A three-member bench of the apex court headed by Chief Justice Umer Ata Bandial and comprising Justice Qazi Faez Isa and Justice Syed Mansoor Ali Shah heard the appeals of the FBR. The court upheld the decision of the Sindh High Court striking down 30 per cent tax on bonuses received by the corporate employees having a taxable income of Rs I million or above.

On Monday, Additional Attorney General Aamir Rehman and the FBR counsel appeared before the supreme court. During the hearing, Justice Syed Mansoor Ali Shah asked the FBR counsel why discrimination was made while imposing taxes. What was the justification for imposing 30 percent tax on the bonus paid to the corporate employees receiving a salary of Rs 1 million? “We want to know why this was done with discrimination,” the chief justice said. Similarly, Justice Qazi Faez Isa while objecting to the decision of the FBR questioned why should taxes not be levied on businessmen and lawyers? “Many people in Pakistan earn more than a million”, Justice Isa remarked.

The FBR counsel submitted that the 30 per cent tax was imposed on the bonus received by the corporate employees. At this, Justice Mansoor Ali Shah asked whether bonus was not part of income of employees. He said why the bonus was taxed separately, adding that a company gave bonus when it earned profit. “However, you did not impose the tax on the company but taxed the employees,” he said.

Justice Isa told the counsel that he might impose 90 per cent tax but should abstain from making discrimination. Additional Attorney General Aamir Rehman submitted that the government had taxed only the corporate employees, adding that it was the authority of the government to impose tax on whom and how much as well. Later, the court rejected the appeals filed by the Federal Board of Revenue (FBR) after upholding the verdict of the Sindh High Court and disposed of the matter.

Meanwhile, advocate Ahsaan Ahmad Khokhar told The News that initially, 33 private persons challenged before the Sindh High Court the imposition of Internally Displaced Persons tax, imposed through Finance Act, 2009 whereby through amendment in Section 5(51)(a)(1)(b)of the Income Tax Ordinance, 2001 a third proviso was added that Internally Displaced Persons tax (IDPT) would be treated as income on the taxable income of one million rupees or more at the rate of 5%, and in addition to above, another proviso was added in the same Finance Act, 2009 in Section 12(2) of the Income Tax Ordinance that any bonus paid or payable to corporate employees receiving salary income of one million or more shall be charged at the rate of 30% for the tax year 2010.

He said the SHC accepted the contentions of the corporate employees and held that the imposition of IDP tax at the rate of 30% on the bonus paid or payable of above one million and leaving out all other persons who were not working in the corporate class was discriminatory and in violation of Article 25 of the Constitution. He said the parliament had the power to legislate and impose tax through Finance Bill and had the power to classify the persons or properties into categories. According to him, in the present case, only the corporate employees were charged to pay the IDP tax at the rate of 30% but not the other employees in other sectors, drawing salary in the same slab, but they were left out whereas there was no such distinction of definition of employee in Section 2(20) of the Income Tax Ordinance 2001. He recalled that the supreme court had already held that persons placed alike be equally treated not only in conferred privileges but also in liabilities and the courts had power under the Constitution to struck down the law on the grounds which were not reasonably distinctive and classified but found discriminatory in nature.

-

Magic Vs Clippers: Clippers Announce Kawhi Leonard Status After Exit

Magic Vs Clippers: Clippers Announce Kawhi Leonard Status After Exit -

BTC Price Today: Bitcoin Sinks Below $65K On Trade Uncertainty

BTC Price Today: Bitcoin Sinks Below $65K On Trade Uncertainty -

'A Knight Of The Seven Kingdoms': All You Need To Know About The Finale

'A Knight Of The Seven Kingdoms': All You Need To Know About The Finale -

NYC Travel Ban: Mamdani Shuts Down Roads Amid Blizzard Conditions

NYC Travel Ban: Mamdani Shuts Down Roads Amid Blizzard Conditions -

Alicia Keys Celebrates 25 Years Of Breakout Single ‘Fallin’’

Alicia Keys Celebrates 25 Years Of Breakout Single ‘Fallin’’ -

Akinola Davies Jr. Gives His Immigrant Parents A Shoutout In 2026 BAFTAs Acceptance Speech

Akinola Davies Jr. Gives His Immigrant Parents A Shoutout In 2026 BAFTAs Acceptance Speech -

Princess Beatrice, Eugenie Told 'first Thing They Should Do' After Andrew Arrest

Princess Beatrice, Eugenie Told 'first Thing They Should Do' After Andrew Arrest -

Jennifer Garner Reveals What Her Kids Think Of Her Acting Career

Jennifer Garner Reveals What Her Kids Think Of Her Acting Career -

Prince William Should Focus On 'family Business' After Andrew Blunder

Prince William Should Focus On 'family Business' After Andrew Blunder -

Katherine Schwarzenegger Pratt 'brought To Tears' By Sister-in-law's Gesture

Katherine Schwarzenegger Pratt 'brought To Tears' By Sister-in-law's Gesture -

Prince William Makes Bold Claim About Britain's Creative Industry At BAFTA

Prince William Makes Bold Claim About Britain's Creative Industry At BAFTA -

Andrew Mountbatten Windsor Insulting 'catchphrase' That Degarded Staff

Andrew Mountbatten Windsor Insulting 'catchphrase' That Degarded Staff -

Kate Middleton, Princess Beatrice 'undercurrent Tension' Comes To Surface

Kate Middleton, Princess Beatrice 'undercurrent Tension' Comes To Surface -

'Grey's Anatomy' Alum Katherine Heigl Reveals Why She Stayed Silent After Eric Dane Loss

'Grey's Anatomy' Alum Katherine Heigl Reveals Why She Stayed Silent After Eric Dane Loss -

Host Alan Cumming Thanks BAFTAs Audience For Understanding After Tourette’s Interruption From Activist

Host Alan Cumming Thanks BAFTAs Audience For Understanding After Tourette’s Interruption From Activist -

Jennifer Garner Reveals Why Reunion With Judy Greer Makes Fans 'lose Their Minds'

Jennifer Garner Reveals Why Reunion With Judy Greer Makes Fans 'lose Their Minds'