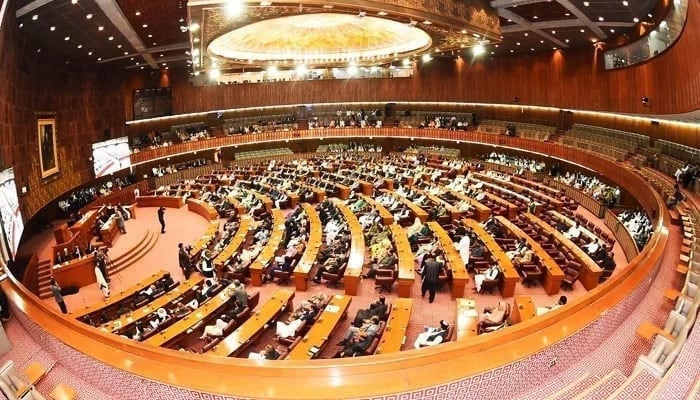

NA finance panel assails govt for sidestepping parliament over tax ordinance

NA panel, which met under chairmanship of Naveed Qamar, directed authorities for laying ordinance before parliament for urgent action

ISLAMABAD: The National Assembly’s Standing Committee on Finance has expressed its displeasure at bypassing of parliament and making legislation through promulgation of the Tax Laws (Amendment) Ordinance 2025 for recovery of billions of rupees from taxpayers, soon after getting a verdict from the courts.

The NA panel, which met under the chairmanship of Naveed Qamar, directed the authorities for laying the ordinance before parliament for urgent action. “The government has urgency to promulgate the ordinance instead of making it part of the Finance Bill (2025-26). We have also the same urgency to review the ordinance,” the NA panel chairman said.

FBR Chairman Rashid Mahmood Langrial argued that there was no abuse of power. The ordinance was cleared by the federal cabinet and President of Pakistan promulgated it.

The representative from the Ministry of Law and Justice informed the committee that the ordinance would be presented as bill in the current National Assembly session, which would subsequently be referred to the committee for consideration.

The FBR chairman requested the committee that the ordinance had a limited time period and the committee should give the board one to two months to see the operations of the ordinance. He explained that the Board only wanted to implement the orders of the high courts. The ordinance introduces only three carefully scoped amendments, addressing urgent legal, administrative, and enforcement gaps in the tax system.

The committee raised serious concerns over the eroding public confidence in the FBR and stressed that any legislative measures pertaining to the FBR must prioritise restoring public trust. Members also recommended enhancing the capacity of FBR officials in tax collection procedures to improve efficiency and facilitate taxpayers, thereby, contributing to greater revenue generation.

-

Alicia Keys Celebrates 25 Years Of Breakout Single ‘Fallin’’

Alicia Keys Celebrates 25 Years Of Breakout Single ‘Fallin’’ -

Akinola Davies Jr. Gives His Immigrant Parents A Shoutout In 2026 BAFTAs Acceptance Speech

Akinola Davies Jr. Gives His Immigrant Parents A Shoutout In 2026 BAFTAs Acceptance Speech -

Princess Beatrice, Eugenie Told 'first Thing They Should Do' After Andrew Arrest

Princess Beatrice, Eugenie Told 'first Thing They Should Do' After Andrew Arrest -

Jennifer Garner Reveals What Her Kids Think Of Her Acting Career

Jennifer Garner Reveals What Her Kids Think Of Her Acting Career -

Prince William Should Focus On 'family Business' After Andrew Blunder

Prince William Should Focus On 'family Business' After Andrew Blunder -

Katherine Schwarzenegger Pratt 'brought To Tears' By Sister-in-law's Gesture

Katherine Schwarzenegger Pratt 'brought To Tears' By Sister-in-law's Gesture -

Prince William Makes Bold Claim About Britain's Creative Industry At BAFTA

Prince William Makes Bold Claim About Britain's Creative Industry At BAFTA -

Andrew Mountbatten Windsor Insulting 'catchphrase' That Degarded Staff

Andrew Mountbatten Windsor Insulting 'catchphrase' That Degarded Staff -

Kate Middleton, Princess Beatrice 'undercurrent Tension' Comes To Surface

Kate Middleton, Princess Beatrice 'undercurrent Tension' Comes To Surface -

'Grey's Anatomy' Alum Katherine Heigl Reveals Why She Stayed Silent After Eric Dane Loss

'Grey's Anatomy' Alum Katherine Heigl Reveals Why She Stayed Silent After Eric Dane Loss -

Host Alan Cumming Thanks BAFTAs Audience For Understanding After Tourette’s Interruption From Activist

Host Alan Cumming Thanks BAFTAs Audience For Understanding After Tourette’s Interruption From Activist -

Jennifer Garner Reveals Why Reunion With Judy Greer Makes Fans 'lose Their Minds'

Jennifer Garner Reveals Why Reunion With Judy Greer Makes Fans 'lose Their Minds' -

Chris Hemsworth Makes Shocking Confession About His Kids' Reaction To His Fame

Chris Hemsworth Makes Shocking Confession About His Kids' Reaction To His Fame -

Wiz Khalifa Reveals Unconventional Birthday Punch Tradition With Teenage Son In New Video

Wiz Khalifa Reveals Unconventional Birthday Punch Tradition With Teenage Son In New Video -

BAFTAs 2026: Kerry Washington Makes Debut In Custom Prada Gown

BAFTAs 2026: Kerry Washington Makes Debut In Custom Prada Gown -

Jennifer Lopez Gets Emotional As Twins Max And Emme Turn 18

Jennifer Lopez Gets Emotional As Twins Max And Emme Turn 18