SBP likely to deliver 50bps rate cut on March 10: brokerage firm

"Given sharp decline in inflation and stable reserves, a 50bps rate cut appears to be a logical step," reads AHL report

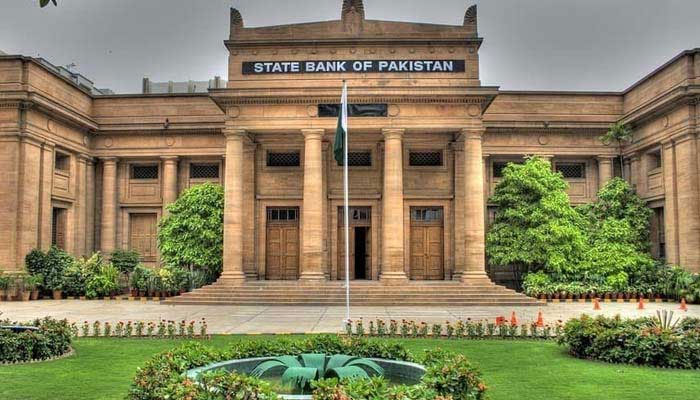

KARACHI: The State Bank of Pakistan (SBP) may be cautious about cutting interest rates this month, despite having room for a further reduction in borrowing costs due to a decline in inflation, according to analysts and surveys.

In January, the SBP reduced interest rates for the sixth consecutive time, lowering its benchmark interest rate by 100 basis points (bps) to 12 per cent. This reduction brings the total rate cut to 1,000bps since June 2024.

The SBP’s Monetary Policy Committee (MPC) is scheduled to meet on March 10 to decide about interest rates, following the arrival of an International Monetary Fund (IMF) team in Pakistan on March 3 for a review of the $7 billion bailout package. This review is set to focus on new revenue targets and budgetary taxation measures, which could influence the inflation outlook.

Arif Habib Limited (AHL), a brokerage firm based in Karachi, noted that the significant decrease in inflation has been the main catalyst for rate cuts. In January, inflation dropped to 2.4 per cent -- the lowest level in 111 months -- while February is expected to see it decline further to 2.2 per cent.

“Given the sharp decline in inflation and stable reserves, a 50bps rate cut appears to be a logical step in the upcoming policy meeting,” the report stated.

However, with core inflation remaining elevated, the current account showing a deficit, and market yields rising, the SBP is likely to take a more cautious approach moving forward. The end of the rate-cutting cycle may be nearer than expected, it added.

“The SBP faces a delicate balancing act on March 10, weighing the need for growth against the imperative of maintaining macroeconomic stability.”

Another brokerage, Topline Securities, indicated that the central bank still has room for further rate cut of approximately 100 bps due to a real interest rate of 300-400bps at the current policy rate of 12 per cent. However, it anticipates that the SBP’s MPC will likely maintain the status quo in the upcoming meeting for several reasons.

Higher import figures for the last two months (averaging $5.2 billion in December and January) and a 1.6 per cent depreciation of the rupee since November 2024 in the kerb market may prompt the SBP to pause further interest rate cuts to carefully assess the impact of previous adjustments, it said.

As of January, the real effective exchange rate reached 104.05, suggesting that the local currency may be overvalued compared with other trading and regional peers, it noted.

In a poll conducted by Topline Securities, market participants expressed varied opinions: 38 percent believe rates will remain unchanged, while 62 per cent anticipate a rate cut of at least 50 bps. AHL’s survey indicated a clear majority favouring a rate cut, with 74 per cent expecting the SBP to ease monetary policy. Among them, 36.8 percent expect a 100 bps reduction, 21.1 per cent predict a substantial cut of over 150bps, 10.5 per cent foresee a 50bps cut, and 5.3 per cent anticipate a 75bps reduction. Meanwhile, 26.3 per cent believe the policy rate will stay the same at 12 per cent.

-

Maxwell Seeks To Block Further Release Of Epstein Files, Calls Law ‘unconstitutional’

Maxwell Seeks To Block Further Release Of Epstein Files, Calls Law ‘unconstitutional’ -

Prince William Issues 'ultimatum' To Queen Camilla As Monarchy Is In 'delicate Phase'

Prince William Issues 'ultimatum' To Queen Camilla As Monarchy Is In 'delicate Phase' -

Winter Olympics 2026: Remembering The Most Unforgettable, Heartwarming Stories

Winter Olympics 2026: Remembering The Most Unforgettable, Heartwarming Stories -

King Charles Hands All Of Andrew Mountbatten-Windsor’s Records And Files To Police: Report

King Charles Hands All Of Andrew Mountbatten-Windsor’s Records And Files To Police: Report -

Eric Dane's Family Shares Heartbreaking Statement After His Death

Eric Dane's Family Shares Heartbreaking Statement After His Death -

Samsung Brings Perplexity AI To Galaxy S26 With ‘Hey Plex’ Voice Command

Samsung Brings Perplexity AI To Galaxy S26 With ‘Hey Plex’ Voice Command -

Fergie’s Spent £13,000 A Day Since Andrew’s Troubles Started: Here’s Where She Fled

Fergie’s Spent £13,000 A Day Since Andrew’s Troubles Started: Here’s Where She Fled -

Eric Dane's Death Becomes Symbol Of ALS Awareness

Eric Dane's Death Becomes Symbol Of ALS Awareness -

Michael B. Jordan Gives Credit To 'All My Children' For Shaping His Career: 'That Was My Education'

Michael B. Jordan Gives Credit To 'All My Children' For Shaping His Career: 'That Was My Education' -

Sun Appears Spotless For First Time In Four Years, Scientists Report

Sun Appears Spotless For First Time In Four Years, Scientists Report -

Bella Hadid Opens Up About 'invisible Illness'

Bella Hadid Opens Up About 'invisible Illness' -

Lawyer Of Epstein Victims Speaks Out Directly To King Charles, Prince William, Kate Middleton

Lawyer Of Epstein Victims Speaks Out Directly To King Charles, Prince William, Kate Middleton -

Microsoft CEO Shares How Gates Doubted $1bn OpenAI Investment

Microsoft CEO Shares How Gates Doubted $1bn OpenAI Investment -

Milo Ventimiglia Calls Fatherhood 'pretty Wild Experience' As He Expects Second Baby With Wife Jarah Mariano

Milo Ventimiglia Calls Fatherhood 'pretty Wild Experience' As He Expects Second Baby With Wife Jarah Mariano -

Chinese Scientists Unveil Advanced AI Model To Support Deep-space Exploration

Chinese Scientists Unveil Advanced AI Model To Support Deep-space Exploration -

Anthropic’s New AI Tool Wipes Billions Off Cybersecurity Stocks

Anthropic’s New AI Tool Wipes Billions Off Cybersecurity Stocks