FBR’s audit raises Rs18.7bn tax demand against tractor company

Chief commissioner IR LTO Lahore was directed to verify the content of a complaint

ISLAMABAD: An internal audit conducted by the Federal Board of Revenue (FBR) has raised a tax demand of Rs18.7 billion including a penalty against a tractor manufacturing company for allegedly selling thousands of tractors in the name of dummy farmers.

The Federal Tax Ombudsman had given instructions to the FBR to direct the chief commissioner of Inland Revenue Large Taxpayer Office Lahore to conduct an exhaustive review of the instant case to ensure that Section 2(44) and Section 23 of the Sales Tax Act 1990 and all relevant SROs [Statutory Regulatory Orders] governing tractor manufacturing sector are implemented.

The chief commissioner IR LTO Lahore was directed to verify the content of a complaint, filed by an investor, challenging the genuineness of input tax claims.

It was also directed that DG Anti Benami Initiative FBR should probe the incidence of benami transactions in the tractor manufacturing sector.

The Lahore High Court granted a stay order against post-refund scrutiny for the tax period of 2015/2016 to 2020 for five years in its order dated March 30, 2022 in a writ petition number 1947 of 2022.

However, in the tax audit for the tax year of 2022, the contents of the complaint are similar to all other remaining periods from 2015-16 to 2020.

In that case, the FBR had filed a representation before the president of Pakistan, which was disposed of through an order dated November 6, 2023.

With this background, the FBR’s LTO Lahore conducted the post-refund scrutiny/audit in respect of the tax period of 2022 and issued a show-cause notice to taxpayers u/s 11 (2) (3) of the Sales Tax Act 1990.

According to official documents of the alleged scam available with The News, the FBR’s Large Taxpayer Unit (LTU) Lahore conducted the internal audit to comply with the directions of the Federal Tax Ombudsman. The internal audit of FBR established 11 points out of which two were reconciled and in the remaining 9 points, they raised tax demand of Rs13.286 billion against tractor manufacturers. The FBR also imposed a penalty of Rs5.414 billion so the total tax demand went up to over Rs18 billion.

This correspondent sent out a question to the tractor manufacturer company, seeking its point of view, on its two email addresses given on its website on June 9, 2024, and got no reply.

The sent questions stated whether FBR’s LTO Lahore conducted an audit and generated tax demand along with a penalty of Rs18.7 billion.This correspondent also made efforts to contact the company’s office on the telephone number and left a message to the PAs of top officials for a reply queries, but got no response despite waiting for around 10 days.

-

First Poll Since King Charles' Action Against Andrew Reveals Royal Family's Public Standing

First Poll Since King Charles' Action Against Andrew Reveals Royal Family's Public Standing -

Blake Lively Strengthens Legal Team Ahead Of Justin Baldoni Trial

Blake Lively Strengthens Legal Team Ahead Of Justin Baldoni Trial -

'Back To School!': Palace Shares Details Of Princess Anne's Latest Engagements

'Back To School!': Palace Shares Details Of Princess Anne's Latest Engagements -

Paul Mescal Clarifies Acting Break Comment As He Teases Paul McCartney Role

Paul Mescal Clarifies Acting Break Comment As He Teases Paul McCartney Role -

Kate Middleton's Unexpected Style Of Arrival At Solo Outing Goes Viral

Kate Middleton's Unexpected Style Of Arrival At Solo Outing Goes Viral -

Why ‘X’ Is Down? Thousands Report Twitter Outage: Here’s What You Can Do

Why ‘X’ Is Down? Thousands Report Twitter Outage: Here’s What You Can Do -

Florida Man Held After Alleged Nail-scattering On Busy Intersections

Florida Man Held After Alleged Nail-scattering On Busy Intersections -

Valeria Nicov: Sean Penn's Athletic Girlfriend Raises Eyebrows With Latest Photos

Valeria Nicov: Sean Penn's Athletic Girlfriend Raises Eyebrows With Latest Photos -

Sharon Stone Lashes Out At Fellow Award Show Attendees After Stealing Accusations

Sharon Stone Lashes Out At Fellow Award Show Attendees After Stealing Accusations -

Gwyneth Paltrow Reveals Real Reason She Said Yes To 'Marty Supreme'

Gwyneth Paltrow Reveals Real Reason She Said Yes To 'Marty Supreme' -

King Charles Says He And Queen Camilla Stand With People Of Ukraine

King Charles Says He And Queen Camilla Stand With People Of Ukraine -

Ben Affleck Argues In Favour Of His Shirtless Scene In 'The Rip'

Ben Affleck Argues In Favour Of His Shirtless Scene In 'The Rip' -

Mississippi Postal Worker Arrested After Complaints Of Marijuana Odour In Letters

Mississippi Postal Worker Arrested After Complaints Of Marijuana Odour In Letters -

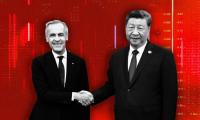

Canada, China Lock Initial Trade Deal On ‘EV,Canola’ To Strengthen Ties: What To Expect Next?

Canada, China Lock Initial Trade Deal On ‘EV,Canola’ To Strengthen Ties: What To Expect Next? -

Melissa Leo On Euphoria Of Winning An Oscar Vs It's Impact On Career

Melissa Leo On Euphoria Of Winning An Oscar Vs It's Impact On Career -

Meghan Markle, Prince Harry Express 'hope' In Latest Major Statement

Meghan Markle, Prince Harry Express 'hope' In Latest Major Statement