President Alvi urges insurance sector to boost penetration, transparency

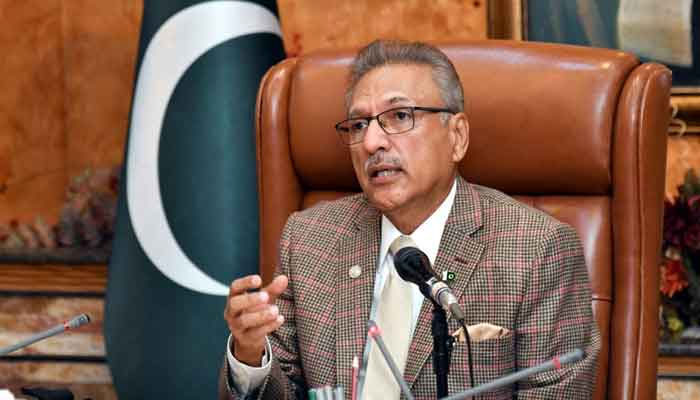

KARACHI: Pakistan's insurance sector needs to overcome low penetration, high costs and deceptive marketing practices to achieve its full potential, President Arif Alvi said on Thursday.

President Alvi, who online inaugurated the second day of the International InsureImpact Conference 2023, organised by the Securities and Exchange Commission of Pakistan (SECP), said insurance was vital for providing social security and disaster risk financing, especially in times of crisis.

He praised SECP for developing a five-year strategy with precise goals and asked the regulator to focus on increasing insurance penetration, which is currently less than 1% of the gross domestic product (GDP).

The President also urged the industry to improve its public image and transparency, and to address the issue of misleading marketing practices by insurance agents. "The insurance sector has to play a very important role in the economic development of the country," Alvi said.

Dr Ishrat Hussain, a former central bank governo, advised SECP to adopt a two-track approach of lighter regulatory oversight for running businesses and handholding for start-ups. He said SECP had a huge potential to mobilize household and corporate savings by developing and energizing the non-banking financial sector.

He also urged the private sector to leverage technology to digitalize distribution channels and tap the huge business potential in the areas of crop insurance, health insurance and disaster risk insurance.

The second day of the conference featured sessions on the potential of the takaful sector, the insurance pool dynamics, the adoption of international financial reporting standards and risk-based capital regime, and the micro and inclusive insurance.

SECP presented its draft report on the topic of “Unlocking the Potential of Micro and Inclusive Insurance in Pakistan”, which highlighted the need and scope for small ticket insurance products that can cater to the low-income and vulnerable segments of the population.

The report also suggested taking steps to include microinsurance under the overall umbrella of the compulsory insurance regime, which currently covers motor third party liability, crop and livestock insurance, and health insurance for government employees.

The panellists at the session agreed that micro and inclusive insurance can prove to be a game changer for the sector, as it can increase the insurance coverage, reduce the poverty gap, and create social impact.

The last session of the day was a grand session on collaboration, technology and innovation, where industry practitioners from various sectors assessed the possibility of association and collaborations between different sectors for the achievement of the ultimate vision of increased insurance penetration in Pakistan.

The speakers highlighted the role of technology in enhancing the efficiency, accessibility, and affordability of insurance products and services.

During the closing remarks, Andres McCartney from the Asian Development Bank (ADB) briefed about ADB’s program of supporting the initiative of increasing insurance coverage in Pakistan.

He said ADB was working with SECP and other stakeholders to develop a comprehensive insurance sector development program, which will include policy reforms, capacity building, and innovation support.

Chairman SECP Akif Saeed in his concluding remarks asked the participants to carry forward the knowledge gained, the connections made, and the inspiration received during the conference to propel the insurance industry to new heights. He also appreciated the five-year strategic plan developed by the SECP and hoped for the successful implementation of this plan.

-

Royal Family Shares Princess Anne's Photos From Winter Olympics 2026

Royal Family Shares Princess Anne's Photos From Winter Olympics 2026 -

Tori Spelling Feels 'completely Exhausted' Due To THIS Reason After Divorce

Tori Spelling Feels 'completely Exhausted' Due To THIS Reason After Divorce -

SpaceX Successfully Launches Crew-12 Long-duration Mission To ISS

SpaceX Successfully Launches Crew-12 Long-duration Mission To ISS -

PlayStation State Of Play February Showcase: Full List Of Announcements

PlayStation State Of Play February Showcase: Full List Of Announcements -

Ed Sheeran, Coldplay Caught Up In Jeffrey Epstein Scandal

Ed Sheeran, Coldplay Caught Up In Jeffrey Epstein Scandal -

Paul Anthony Kelly Reveals How He Nailed Voice Of JFK Jr.

Paul Anthony Kelly Reveals How He Nailed Voice Of JFK Jr. -

US, China Held Anti-narcotics, Intelligence Meeting: State Media Reports

US, China Held Anti-narcotics, Intelligence Meeting: State Media Reports -

Victoria, David Beckham React To Marc Anthony Defending Them Amid Brooklyn Drama

Victoria, David Beckham React To Marc Anthony Defending Them Amid Brooklyn Drama -

Victoria Wood's Battle With Insecurities Exposed After Her Death

Victoria Wood's Battle With Insecurities Exposed After Her Death -

Prince Harry Lands Meghan Markle In Fresh Trouble Amid 'emotional' Distance In Marriage

Prince Harry Lands Meghan Markle In Fresh Trouble Amid 'emotional' Distance In Marriage -

Goldman Sachs’ Top Lawyer Resigns Over Epstein Connections

Goldman Sachs’ Top Lawyer Resigns Over Epstein Connections -

How Kim Kardashian Made Her Psoriasis ‘almost’ Disappear

How Kim Kardashian Made Her Psoriasis ‘almost’ Disappear -

Gemini AI: How Hackers Attempt To Extract And Replicate Model Capabilities With Prompts?

Gemini AI: How Hackers Attempt To Extract And Replicate Model Capabilities With Prompts? -

Palace Reacts To Shocking Reports Of King Charles Funding Andrew’s £12m Settlement

Palace Reacts To Shocking Reports Of King Charles Funding Andrew’s £12m Settlement -

Megan Fox 'horrified' After Ex-Machine Gun Kelly's 'risky Behavior' Comes To Light

Megan Fox 'horrified' After Ex-Machine Gun Kelly's 'risky Behavior' Comes To Light -

Prince William's True Feelings For Sarah Ferguson Exposed Amid Epstein Scandal

Prince William's True Feelings For Sarah Ferguson Exposed Amid Epstein Scandal