FBR refuses to share secret information with NA body

ISLAMABAD: The FBR’s refusal to furnish details about alleged tax evasion cases of individuals or specific companies before parliamentarians triggered a heated debate, however, the chairman Standing Committee on Finance of National Assembly has directed the FBR to share required details today (Tuesday).

The NA panel also took a strong exception of price increase by automotive manufacturers, while the representative of Pakistan Automotive Manufacturers Association (PAMA) blamed duty and taxes for 40 percent contribution into existing domestic prices of vehicles in Pakistan. They proposed reduction in duty and taxes, and incentivising hybrid vehicles instead of electric vehicles to decrease the prices in the domestic market. However, the parliamentarians were not satisfied when they inquired about the changes in tax structure that had fuelled the price of different brands of cars in the country. “We need detailed presentations on what had triggered the price hike in the car sector,” Ayesha Ghous Pasha, MNA from PML-N, inquired during the meeting.

A heated debate occurred when the Standing Committee on Finance and Revenues of National Assembly had taken up the issue of the president of one of the nationalised banks for owning offshore assets abroad during the meeting, held under chairmanship of Faiz Ahmed Kamoka at the Parliament House on Monday. The FBR’s member Inland Revenue (IR), Operation, Dr Ashfaque, told the committee that the tax proceedings of cases are in hand and at an advanced stage. “Tax information submitted to the FBR is confidential under Section 216 of Income Tax Ordinance-2001”, he added.

This response of FBR’s top member triggered a heated debate, where the committee’s secretary cited the rules and stated that the Standing Committees are empowered to seek any official record. All the members, irrespective of their political belongings, seemed united on arguing that they possessed powers to issue warrants for anyone to attain information on any issue of public interest. “The parliament is supreme and if you don’t share information, then this parliament should close down,” the chairman of NA panel, Faiz Ahmed Kamoka, stated categorically.

The FBR’s member Inland Revenue (IR), Policy, Tariq Sheikh, stated that they could get guidance from the Ministry of Law because the income tax law barred the FBR for sharing this information. PPP Parliamentarian Syed Naveed Qamar made it clear that there was no need to seek the advice of Ministry of Law, because in such cases the speaker National Assembly could interpret the rules for running the proceedings of the House or the Parliamentary Committees. But the parliamentarians could not be convinced. At one point of time, the FBR’s Member IR Operation, Dr Ashfaque Ahmed, said the FBR law could go ahead up to prosecution in case of leaking information but on the other hand, the rules of National Assembly bound him to share the whole information.

Dr Ashfaque reminded the parliamentarians that one such secret information was leaked, so an Indian minister had to go before G-20 for assuring that it would not happen again. So in such cases as the FBR obtained information on the basis of exchange of information, any breach of secrecy could have far-reaching impact on continuity of cooperation from such forums or countries in future. Finally, the chairman of NA panel directed the FBR for furnishing the entire information on Tuesday (today). He also hinted to hold such part of the proceedings in camera to avoid sharing details in public. On the issue of FBR performance, the FBR paid up refunds but the pending refunds of income tax stood at Rs313 billion and Rs187 billion for sales tax. The FBR has so far released refunds to the tune of Rs99 billion in the first six months.

About the tax collection, the FBR’s member IR Operation said the tax collection stood at Rs2,205 billion against the set target of Rs2,210 billion as 44 percent of total desired tax target of Rs4,963 billion. Ayesha Ghous Pasha said the FBR paid only 18 percent refunds and so far 82 percent were still pending. She said the FBR required 30 percent growth in second half for achieving the desired target for the current fiscal year. The NA panel also directed the FBR to come up with its strategy for achieving the desired tax collection target of Rs4,963 billion during the current fiscal year.

-

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets -

'Fake' Sexual Assault Report Lands Kentucky Teen In Court

'Fake' Sexual Assault Report Lands Kentucky Teen In Court -

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death -

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday -

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months -

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor -

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts -

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI -

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work -

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina -

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud -

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide -

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked -

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable -

Tyler Childers, Wife Senora May Expecting Second Baby

Tyler Childers, Wife Senora May Expecting Second Baby -

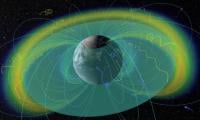

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough