Private sector retires Rs49.4bln debt in July-Oct

KARACHI: Private sector has retired a massive Rs49.4 billion in the first four months of the current fiscal year compared to Rs6.7 billion in the correspondent period a year earlier, the central bank’s latest data showed.

Analysts attributed the debt retirement to back-to-back concessionary financing initiatives taken by the State Bank of Pakistan (SBP) to help lockdown-affected businesses and settlement of refunds that improved liquidity condition.

“The retirement of credit was led by extraordinary payment of sales tax refunds, SBP facility related to payroll financing and interest rate and principal payment reliefs due to Covid-19,” said Muzzammil Aslam, chief executive officer of Tangent Capital Advisors.

“Usually the first quarter is the credit retirement season and it picks up from 2nd quarter on sugarcane and cotton crop arrival.”

Analysts said companies are reluctant to make fresh investments despite low interest rates as there was a fear of second coronavirus-related lockdown. That reflected in tepid growth in M2 money supply that grew mere 0.3 percent year-on-year or Rs76.1 billion in July-October.

The slowdown in the private sector advances in the period of supply disruptions was a result of a weak demand amid economic stress. The countrywide lockdown forced the business closures, restricted physical mobility, and dented the business confidence, leading to a decline in loanable funds.

The advances contribution in asset flows, which averaged around 44 percent since 2016, turned negative for the first time in the last 7 years, the SB said in a report.

The decline in the corporate sector advances was driven by retirement of working capital loans due to contraction in manufacturing activity, it said. “Looming uncertainty about the timing of recovery in the foreign markets could subdue demand from export oriented sectors such as textiles. Besides demand for credit, in case of crystallisation of downside risks, the repayment capacity of the borrowers could weaken that may lead to further rise in non-performing loans.” The SBP allowed relief to the households and businesses in the form of principal payment holidays along with relaxation in regulatory criteria for restructuring/rescheduling of loans. The later facility was for those borrowers whose financial condition required relief beyond extension of principal repayment for one year.

Under the scheme, over 1.5 million borrowers benefitted with over Rs655 billion loans deferred and about Rs200 billion restructured so far. The SBP introduced Rozgar scheme to prevent layoff of workers by financing wages and salaries of all kinds of employees for private sector businesses. Almost 3,000 businesses availed refinancing of over Rs237 billion benefitting over 1.6 million employees or workers. The SBP reduced interest rates by 625 basis points to 7 percent between March and June to support economic growth in response to COVID-19 challenges. The announcement was deferred till September. Analysts expected interest rates to increase by 100 basis points from July next year.

-

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets -

'Fake' Sexual Assault Report Lands Kentucky Teen In Court

'Fake' Sexual Assault Report Lands Kentucky Teen In Court -

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death -

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday -

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months -

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor -

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts -

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI -

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work -

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina -

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud -

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide -

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked -

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable -

Tyler Childers, Wife Senora May Expecting Second Baby

Tyler Childers, Wife Senora May Expecting Second Baby -

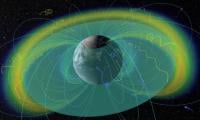

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough