Credit exclusion major reason behind persistence of poverty

LAHORE: Mudassar Aqil is the Chief Executive Officer of FINCA Bank, the leader in Pakistan on Microfinance lending. In an interview with The News he explained reasons for persistence of poverty in Pakistan and remedial solutions.

Q. Do you think microfinance institutions have been able to address poverty adequately during their two-decade existence in Pakistan?

A. The periodic ups and downs in the economy render the lower segments of society to new challenges that compromise the assistance provided to the poor by microfinance lenders. Still many lower income families that used to fall back to poverty are now surviving in economic downturns because they scaled up their businesses on microfinance loans. The poverty figures would have been much higher if the microfinance institutions were not active.

Q. How can microfinance be more effective in alleviating poverty?

A. The major problem for the poor is exclusion from credit. Most of them still look towards loan sharks that entangle them into debt trap for life as their mark-up is very high. The microfinance institutions are serving mostly the people at the lower end of the poverty pyramid, as their power to extend credit is limited to Rs50,000 (recently enhanced to Rs1 million). Those needing higher finances of up to Rs10 million have no access to formal finance.

Let me explain this point. There are 3.2 million SMEs in Pakistan and only 175,000 are served by commercial banks. Thus, only 5.5 percent of the small entrepreneurs are served by the commercial banks that usually entertain requests for loans of Rs10 million or more. Those operating business at little higher than smaller level and needing finance above Rs1 million have nowhere to go. The commercial banks are not interested in serving them for many reasons that includes absence of collateral and hassle of running after small ticket borrowers. The microfinance institutions cannot serve them because their limit to extend loans is limited to Rs1 million.

Q. How can these entrepreneurs be served?

A. The economic planners and the central bank of the country should realise that the SMEs that now currently need loans of over Rs1 million are the ones that have scaled up their businesses from micro level to this stage. They are also the most talented entrepreneurs in our system. By excluding these upcoming entrepreneurs from credit we are ruining our economy.

The State Bank of Pakistan could make it mandatory for the commercial banks that their loan portfolio should have at least 25 percent component of SME loans. Moreover, the central bank could also enhance the loan limit of SME banks from current Rs1 million to Rs10 million so that the financially excluded segment of business is served.

This will bring prosperity in the country. The SMEs are the backbone of every economy big or small. We have neglected our SME sector to long. It is now time to strengthen it. They cannot upgrade their technology if the budding entrepreneurs are denied credit.

Q. How can commercial banks lend without collateral that SMEs lack?

A. Most of the small entrepreneurs have scaled up from micro to current level by taking loans from microfinance institutions at higher mark-up. They have history of paying creditability. In fact, this has not yet been recorded which we should by establishing credit bureau for microfinance borrowers. Moreover, the banks will have to come up with new banking products as developed by microfinance institutions to make loaning to SMEs feasible. Microfinance institutions are taking help from technology as well in this regard.

Q. What should the state do to enhance microfinance penetration?

A. The government should provide incentive to the financial institutions that support SMEs. The microfinance banks for instance think that it is unjust to subject them to 40 percent income tax (36 percent corporate taxes plus 4 percent super tax).

These institutions are serving the poorer segments of society and the incidence of tax on them should be lower. In fact, the government should also lower the tax rate for commercial banks as well that provide loans in the range of Rs1-10 million. Income from that portion of their loan portfolio should be subjected to lower tax. Moreover, the government should not subsidise loans as it distorts the financial market.

Q. How many borrowers does microfinance serve in Pakistan?

A. There are 7 million microfinance borrowers in Pakistan compared with 3.5 million by commercial banks. We estimate that 20-25 million people in Pakistan need microfinance and we expect to touch one million marks by 2020. It would be a great achievement.

-

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets -

'Fake' Sexual Assault Report Lands Kentucky Teen In Court

'Fake' Sexual Assault Report Lands Kentucky Teen In Court -

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death -

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday -

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months -

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor -

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts -

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI -

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work -

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina -

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud -

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide -

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked -

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable -

Tyler Childers, Wife Senora May Expecting Second Baby

Tyler Childers, Wife Senora May Expecting Second Baby -

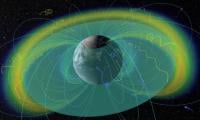

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough