Cost of tax breaks to exchequer surges by 73pc to whopping Rs3.9tr in FY24

The sales tax exemption on cellular mobile phones caused a revenue loss of Rs0.33 trillion

ISLAMABAD: Despite remaining under the IMF programme, the cost of tax exemptions provided by the government to powerful sectors continues to jump up every year and in the outgoing Fiscal Year 2023-24, it peaked at Rs3.9 trillion against Rs2.23 trillion in the last financial year.

The cost of tax exemption has witnessed a growth of 73 percent as the powerful sectors managed to secure higher tax breaks of Rs1.7 trillion more in the outgoing fiscal year compared to the same period of the last financial year.

The sales tax exemption on cellular mobile phones caused a revenue loss of Rs0.33 trillion in 2023-24 as compared to Rs1 billion in 2022-23. The GST exemption on POL products remained the largest contributor to increasing the cost of granting exemption.

The Sales Tax exemption (SRO.321(I)/2022) on local supplies of petroleum products caused a massive revenue loss of Rs1.257 trillion during the current fiscal year. The surge in sales tax exemptions was the exemption from sales tax on petroleum products through statutory regulatory orders (SROs), showing a massive revenue loss of Rs1.257 trillion during 2023-24. The sales tax exemption on the import of petroleum products caused a revenue loss of Rs0.81 trillion during this period.

The Economic Survey for 2023-24 launched here on Tuesday showed that out of the total cost of exemptions of Rs3,879.2 billion in 2023-24, the sales tax expenditure remained the highest as compared to the revenue loss on account of income tax and customs duty. All kinds of Sales Tax exemptions/concessions caused a revenue loss of Rs2.858 trillion followed by the customs duty of Rs0.543 trillion and income tax revenue loss of Rs0.476 trillion during the Fiscal Year 2023-24.

The FBR suffered a revenue loss of Rs0.214 trillion on account of sales tax exemption on imports during 2023-24 as compared to Rs0.257 trillion during 2022-23, reflecting a decrease of Rs43 billion. The Sales Tax exemption on local supplies caused a revenue loss of Rs0.461 trillion in 2023-24 as compared to Rs0.133 trillion in 2022-23, reflecting an increase of over Rs0.328 trillion.

The cost of income tax exemptions amounted to Rs0.477 trillion against Rs0.424 trillion. The cost of customs duty exemptions was estimated at Rs0.543 trillion in 2023-24 against Rs0.521 trillion in 2022-23, reflecting an increase of Rs21.8 billion.

The Economic Survey did not mention the revenue loss on account of exempt business income granted to the independent power producers (IPPs). Similarly, the survey has not mentioned any revenue loss from capital gains. The accumulative revenue loss on account of tax credits amounted to Rs24.374 billion in 2023-24 against Rs52.133 billion in 2022-23, showing a decrease of Rs27.75 billion. The income tax exemption from special provisions of the Income Tax Ordinance resulted into a revenue loss of Rs62 trillion during 2023-24 as compared to Rs0.68 trillion during 2022-23.

The income tax exemption from total income has revenue impact of Rs293.460 billion during the period under review. The income tax exemption available to the government income caused a revenue loss of Rs57.517 billion during this period. The income tax exemption available to the deductible allowances caused a revenue loss of Rs5.912 billion in 2023-24 against Rs14.506 billion, showing a decrease of Rs8.594 billion. The reduction in income tax rates has revenue implications of Rs25.492 billion during 2023-24 as compared to Rs24.444 billion in 2022-23, showing an increase of Rs1.048 billion. The FBR has suffered a massive revenue loss of Rs675 billion in 2023-24 as compared to Rs390 billion in 2022-23 due to the sales tax exemptions available under the Sixth Schedule (Exemption Schedule) of the Sales Tax Act. The loss on account of sales tax exemption (import and domestic stage) has increased by Rs285 billion.

The FBR has suffered a loss of Rs357.997 billion in the wake of sales tax exemptions available under the Eight Schedule (Conditional Exemption/reduced rates) of the Sales Tax Act, 1990, during the period of 2023-24 against Rs129.906 billion in 2022-23. The revenue loss from conditional exemptions has increased by Rs228.091 billion.

The total revenue loss from the zero-rating facility granted to various sectors under the Fifth Schedule of the Sales Tax Act, 1990, amounted to Rs206.053billion during the period under review against Rs139.448 billion in 2022-23, reflecting an increase of Rs66.605 billion. The FBR has not specified any revenue loss to the exemptions within the federal excise regime, reflecting no loss occurred on this account. The cost of income tax exemptions increased from Rs423.9 billion in 2022-23 to Rs476.960 billion in 2023-24, reflecting a decrease of Rs53 billion.

The cost of exemptions in respect of customs duty has been calculated at Rs543.521 billion in 2023-24 as compared to Rs521.7 billion in 2022-23, reflecting an increase of Rs21.821 billion. The exemption of customs duty available under Chapter-99 (special classification provisions) of the Customs Act has caused a revenue loss of Rs34.864 billion in 2023-24 against Rs22.240 billion in 2022-23, reflecting an increase of Rs12.624 billion. The concessions under the Fifth Schedule of the Customs Act, 1969 caused a revenue loss of Rs190.688 billion in 2023-24 against Rs172.978 billion in 2022-23, reflecting an increase of Rs17.71 billion.

The FBR suffered a revenue loss of Rs44.107 billion in 2023-24 against Rs102.658 billion in 2022-23 on account of tariff concessions and exemptions available under Free Trade Agreements (FTAs) and the Preferential Trade Agreements (PTAs). The revenue loss has been drastically reduced by Rs58.551 billion. Similarly, exemption of customs duty on the items by the automobile sector, exploration and production (E&P) companies, general concessions and the CPEC caused a loss of Rs146.598 billion in 2023-24 against Rs192.950 billion in 2022-23, showing a decrease of Rs46.352 billion.

-

Taiwan, TSMC To Expand US Investment: A Strategic Move In Global AI Chip Race

Taiwan, TSMC To Expand US Investment: A Strategic Move In Global AI Chip Race -

UN Chief Lashes Out At Countries Violating International Law; Warns 'new Geopolitics' Could Jeopardize World Order

UN Chief Lashes Out At Countries Violating International Law; Warns 'new Geopolitics' Could Jeopardize World Order -

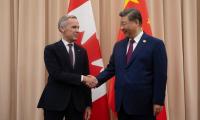

Carney Meets Xi In Beijing: Key Developments Revealed In The New Canada-China Trade Roadmap

Carney Meets Xi In Beijing: Key Developments Revealed In The New Canada-China Trade Roadmap -

WhatsApp Adds New Status Privacy Check For Who Can See Your Updates

WhatsApp Adds New Status Privacy Check For Who Can See Your Updates -

Prince Harry Takes On Dangerous Mission In 2026

Prince Harry Takes On Dangerous Mission In 2026 -

Trump Accepts Nobel Peace Medal From Machado: What It Means For Venezuela Politics?

Trump Accepts Nobel Peace Medal From Machado: What It Means For Venezuela Politics? -

Late-night Snacking Linked To Higher Risk Of Liver Disease

Late-night Snacking Linked To Higher Risk Of Liver Disease -

John Mellencamp Gives Update On Daughter Teddi's Health Struggles: 'She's Suffering'

John Mellencamp Gives Update On Daughter Teddi's Health Struggles: 'She's Suffering' -

‘Disturbing Developments’ Start To Follow Prince William, Kate: ‘This Has The Makings Of A Crisis’

‘Disturbing Developments’ Start To Follow Prince William, Kate: ‘This Has The Makings Of A Crisis’ -

Pamela Anderson Breaks Silence On Fallout With Ex-Tommy Lee: 'I Miss Him'

Pamela Anderson Breaks Silence On Fallout With Ex-Tommy Lee: 'I Miss Him' -

Andrew Warned: ‘You’re Gonna Add Your Own Final Nail In The Coffin Of Reputation’

Andrew Warned: ‘You’re Gonna Add Your Own Final Nail In The Coffin Of Reputation’ -

Ben Affleck Doesn't Want His Kids To Join Showbiz: Here's Why

Ben Affleck Doesn't Want His Kids To Join Showbiz: Here's Why -

George R.R. Martin Calls 'House Of The Dragon' S3 'not My Story'

George R.R. Martin Calls 'House Of The Dragon' S3 'not My Story' -

Jessi Ngatikaura Gets Real About ‘identity Crisis’ From Facial Surgery

Jessi Ngatikaura Gets Real About ‘identity Crisis’ From Facial Surgery -

Timothy Busfield Faces Potential 15-year Prison Sentence If Convicted

Timothy Busfield Faces Potential 15-year Prison Sentence If Convicted -

Kim Kardashian Gushes Over 'baby Girl' Chicago As She Turns 8

Kim Kardashian Gushes Over 'baby Girl' Chicago As She Turns 8