Zara Tindall, Peter Phillips to face massive inheritance tax bill

Gatcombe Park has been the Princess Royal's home for nearly five decades

Zara Tindall and Peter Phillips are set to face a significant inheritance tax bill due to the new rules introduced by Chancellor Rachel Reeves.

The estate in question, Gatcombe Park, has been the Princess Royal's home for nearly five decades and was originally purchased by Queen Elizabeth II as a wedding gift for Princess Anne in 1976.

Under the recent budget plans, inheritance tax is now charged at 20% on agricultural assets valued above £1 million, and this will affect the Gatcombe Estate, which exceeds the £3 million threshold, reported GB News.

The Grade II-listed house in Gloucestershire, which once belonged to ex-Conservative home secretary Lord Butler, was sold to the Queen for an amount that would be worth nearly £6 million today.

Following new inheritance tax rules, the estate will likely trigger a tax liability when Princess Anne passes. With the property’s value estimated at double the £3 million threshold, Anne's children, Zara and Peter, who both reside on the estate, will face a substantial inheritance tax bill.

Chancellor Rachel Reeves has confirmed that in some cases, the threshold for inheritance tax may be adjusted to about £3 million. However, King Charles and Prince William are exempt from paying inheritance tax due to a ruling made in 1993 by then-Prime Minister John Major, which allowed tax-free inheritance between sovereigns.

This ruling allowed King Charles to avoid paying inheritance tax on the assets inherited from his mother when she passed in 2022, and it continues to apply to assets passed from one sovereign to another.

The same exemption extends to consorts of former sovereigns, as seen after the Queen Mother's passing in 2002, when her fortune of approximately £70 million was passed tax-free to Queen Elizabeth II.

In 1992, Queen Elizabeth II voluntarily began paying income and capital gains tax on her personal income, a practice now followed by King Charles. The King and Prince William also voluntarily pay income tax on the revenue from the Duchies of Lancaster and Cornwall, respectively, although their exact tax contributions are not publicly disclosed.

They do not pay capital gains tax, as they do not personally benefit from any increase in the assets of these duchies. Prince William will also be exempt from inheritance tax when King Charles dies.

Regarding Gatcombe Park, the estate was split between Princess Anne and her first husband, Captain Mark Phillips, after their divorce in 1992. Anne continues to use the home as a country residence with her second husband, Sir Timothy Laurence.

Both Peter and Zara have homes on the estate, with Zara living at Aston Farm, a renovated seven-bedroom farmhouse where she resides with her husband, Mike Tindall, and their children Mia, Lena, and Lucas.

-

Kylie Jenner 'convinced' Gwyneth Paltrow is 'crushing' on Timothee Chalamet: 'It's disrespectful'

-

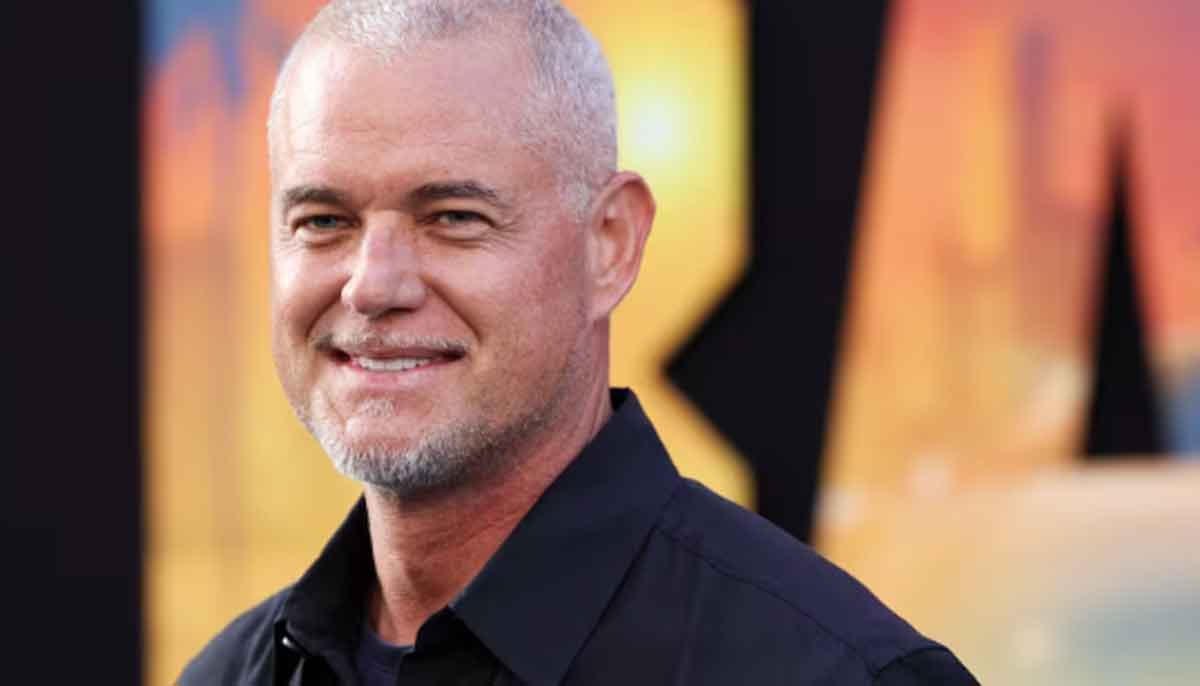

Eric Dane opened up about releasing his memoir just two months before his death due to ALS complications

-

Zendaya, Tom Holland already married? Actress shows off new ring

-

'Vikings' star mourns Eric Dane's death

-

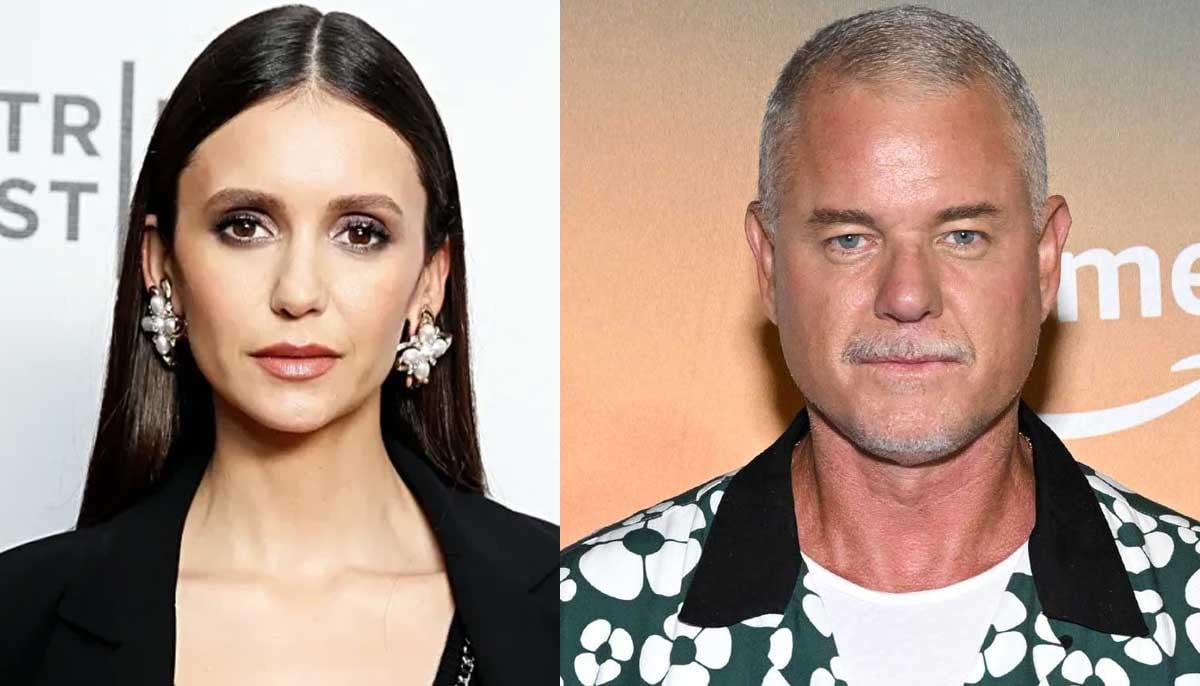

'Heartbroken' Nina Dobrev mourns death of Eric Dane: 'He'll be deeply missed'

-

Alyssa Milano expresses grief over death of 'Charmed' co-star Eric Dane

-

Daniel Radcliffe opens up about 'The Wizard of Oz' offer

-

Brooke Candy announces divorce from Kyle England after seven years of marriage