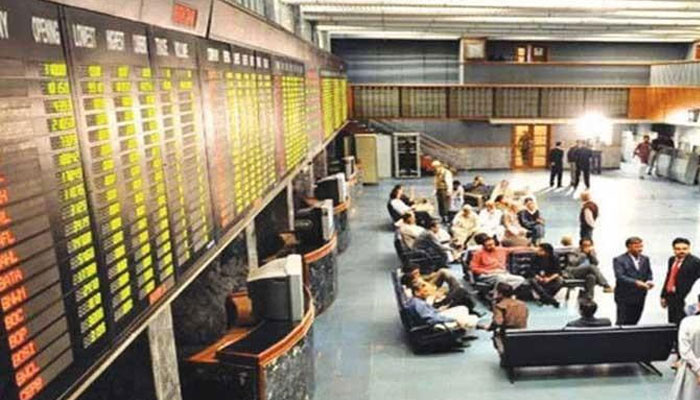

Stocks stay the recovery course led by cyclical, energy

Stocks on Thursday extended gains as the value-driven rally picked up from where it had left on Wednesday, with cyclical, energy, and banking shares receiving most of the investment amid hopes of some robust financial results, dealers said.

The KSE-100 shares index, the benchmark of Pakistan Stock Exchange (PSX), gained 1.26 percent or 503.66 points to close at 40,353.62 points, while ready volumes increased to 476.869 million shares, compared to 431.962 million in the previous session.

Muhammad Saeed Khalid, head of research at Shajar Capital, said, “Despite negativity on the Treasury Single Account (TSA) side, the market remained robust”.

The index performed mainly on the recovery in international crude oil prices along with the gradual buying by mutual funds, he said.

Further, index also performed on the LSMI numbers where investors reacted to the growth witnessed in the industrial activities in August 2020 up 5 percent, Khalid said.

“In addition to this, we have also witnessed strong participation in food and cement stocks as prices of the products have surged during the week,” Khalid added.

KSE-30 shares index also gained 1.63 percent or 274.00 points to end at 17,127.38 points.

A A Soomro, managing director at KASB Securities, said, “The market continued the bull-run from where it had ended on Wednesday”.

The rebound was witnessed after the valuations had dropped due to market correction amid political noise, he said.

"However, the market rejuvenated owing to an uptick in cements, oil exploration and marketing sectors.”

“The trend seems sustainable to us. Currency stability coupled with improving earnings may keep bulls on the floor for short to medium term,” Soomro added.

Of 411 active scrips 240 gained, 155 lost, and 16 remained neutral.

Shahab Farooq, director research at Next Capital said, “The market remained extremely volatile, while retaining upward momentum with healthy volumes”.

The market gained greater momentum in the final hour of the day, he said.

Shahab said all the leading sectors drew investors’ interest and particularly banks, energy, and cement stocks saw healthy price appreciations.

“The recovery rally can be attributed to the value buying especially in banks and energy sectors,” Farooq added.

Arif Rehman, director research at Fortune Securities, said, “Hascol Petrol announced significant losses for the quarterly losses, but recovered sharply afterwards”.

Rehman said in the absence of rights issue it could have relieved some investors, but “we believe losses of such magnitude necessitate equity injection to keep company as going concern”. "The sponsors seems willing to restructure and re-grow the company, he added.

Nestle Pakistan, up Rs82.50 to close at Rs6,600/share, and Bhanero Textile, gaining Rs57.93 to finish at Rs830.43/share, were the top gainers, while Island Textile, down Rs73.33 to close at Rs916/share, and Hinopak Motor, losing Rs12.03 to close at Rs470.33/share, suffered highest losses in terms of value.

Hascol Petrol’s trading volume was the highest with 107.778 million shares, up Rs0.76 to end at Rs17.58/share, whereas Kot Addu Power’s was the lowest with 11.701 million shares, and it gained Rs1.49 to end at Rs26.92/share.

-

Nick Jonas Gets Candid About His Type 1 Diabetes Diagnosis

Nick Jonas Gets Candid About His Type 1 Diabetes Diagnosis -

King Charles Sees Environmental Documentary As Defining Project Of His Reign

King Charles Sees Environmental Documentary As Defining Project Of His Reign -

James Van Der Beek Asked Fans To Pay Attention To THIS Symptom Before His Death

James Van Der Beek Asked Fans To Pay Attention To THIS Symptom Before His Death -

Portugal Joins European Wave Of Social Media Bans For Under-16s

Portugal Joins European Wave Of Social Media Bans For Under-16s -

Margaret Qualley Recalls Early Days Of Acting Career: 'I Was Scared'

Margaret Qualley Recalls Early Days Of Acting Career: 'I Was Scared' -

Sir Jackie Stewart’s Son Advocates For Dementia Patients

Sir Jackie Stewart’s Son Advocates For Dementia Patients -

Google Docs Rolls Out Gemini Powered Audio Summaries

Google Docs Rolls Out Gemini Powered Audio Summaries -

Breaking: 2 Dead Several Injured In South Carolina State University Shooting

Breaking: 2 Dead Several Injured In South Carolina State University Shooting -

China Debuts World’s First AI-powered Earth Observation Satellite For Smart Cities

China Debuts World’s First AI-powered Earth Observation Satellite For Smart Cities -

Royal Family Desperate To Push Andrew As Far Away As Possible: Expert

Royal Family Desperate To Push Andrew As Far Away As Possible: Expert -

Cruz Beckham Releases New Romantic Track 'For Your Love'

Cruz Beckham Releases New Romantic Track 'For Your Love' -

5 Celebrities You Didn't Know Have Experienced Depression

5 Celebrities You Didn't Know Have Experienced Depression -

Trump Considers Scaling Back Trade Levies On Steel, Aluminium In Response To Rising Costs

Trump Considers Scaling Back Trade Levies On Steel, Aluminium In Response To Rising Costs -

Claude AI Shutdown Simulation Sparks Fresh AI Safety Concerns

Claude AI Shutdown Simulation Sparks Fresh AI Safety Concerns -

King Charles Vows Not To Let Andrew Scandal Overshadow His Special Project

King Charles Vows Not To Let Andrew Scandal Overshadow His Special Project -

Spotify Says Its Best Engineers No Longer Write Code As AI Takes Over

Spotify Says Its Best Engineers No Longer Write Code As AI Takes Over