SHC declares withholding income tax on judicial allowance ‘unlawful’

KARACHI: The Sindh High Court on Friday held that amount of judicial allowance and special judicial allowance paid to the members of SHC as well and that of sub-ordinate judiciary was not part of their taxable salary income, hence, not chargeable as tax deduction.

Allowing petitions of the high court employees against deduction of income tax on judicial allowance and special judicial allowance, the SHC’s division bench headed by Justice Aqeel Ahmed Abbasi ordered that withholding of income tax on the judicial and special judicial allowance is illegal and without lawful authority. The court directed income tax department not to withhold any amount of income tax from judicial allowance and special judicial allowance of the members of SHC and those of the sub-ordinate judiciary.

It ordered that amount already deducted from their salaries be refunded by the Federal Board of Revenue on their filing refund applications within three months from the date of such claims. The court observed that government's counsel has not been able to assist court as to how the judicial allowance and special judicial allowance does not fall within the category of the allowances covered within the exclusion of section 12(2) of the Income Tax Ordinance, 2001.

The court observed that respondent counsel was asked when both the allowances are not deducted as taxes by the Punjab and Khyder Pakhtoonkhwa governments and the Federal Board of Revenue, why such a discriminatory attitude is being resorted to by Accountant General of Sindh or the Federal Board of Revenue in the case of SHC and subordinate judiciary in the Sindh. However, the respondent's counsel could not explanation on behalf of the federal and provincial governments.

The petitioners had submitted that deduction of income tax on the judicial allowance and special judicial allowance from their salaries at source under section 149 of the income tax Ordinance, 2001, by the Accountant General Sindh is unlawful and requested the court to declare it illegal and without lawful authority.

The federal government counsel opposed the petitions and submitted that every income is chargeable to tax unless exempted.

-

How Liam Payne’s Death Impacted Awareness About Mental Health

How Liam Payne’s Death Impacted Awareness About Mental Health -

Scientists Reveal How Sleeping Can Unlock Your Creative Potential

Scientists Reveal How Sleeping Can Unlock Your Creative Potential -

OpenAI CEO Calls AI Water Concerns ‘fake’

OpenAI CEO Calls AI Water Concerns ‘fake’ -

Taylor Swift Expresses How Negative Body Comments Triggered Her

Taylor Swift Expresses How Negative Body Comments Triggered Her -

Prince William Plans Bold Shake-up To Restore Public Trust Amid Andrew Drama

Prince William Plans Bold Shake-up To Restore Public Trust Amid Andrew Drama -

Apple IPhone 18 Pro Series To Launch In Bold Red Colour: Report

Apple IPhone 18 Pro Series To Launch In Bold Red Colour: Report -

Apple Developing AI Pendant Powered By In-house Visual Models

Apple Developing AI Pendant Powered By In-house Visual Models -

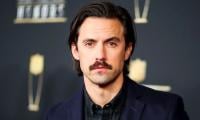

'Gilmore Girls' Milo Ventimiglia Shares How He Would React If His Daughter Ke'ala Coral Chose 'team Dean'

'Gilmore Girls' Milo Ventimiglia Shares How He Would React If His Daughter Ke'ala Coral Chose 'team Dean' -

New AGI Benchmark: Demis Hassabis Proposes ‘Einstein Test’—Ultimate Challenge To Prove True Intelligence

New AGI Benchmark: Demis Hassabis Proposes ‘Einstein Test’—Ultimate Challenge To Prove True Intelligence -

NASA Artemis 2 Moon Mission Faces Unexpected Delay Ahead Of March Launch

NASA Artemis 2 Moon Mission Faces Unexpected Delay Ahead Of March Launch -

Kate Middleton Reclaims Spotlight With Confidence Amid Andrew Drama

Kate Middleton Reclaims Spotlight With Confidence Amid Andrew Drama -

Lady Gaga Details How Eating Disorder Affected Her Career: 'I Had To Stop'

Lady Gaga Details How Eating Disorder Affected Her Career: 'I Had To Stop' -

Why Elon Musk Believes Guardrails Or Kill Switches Won’t Save Humanity From AI Risks

Why Elon Musk Believes Guardrails Or Kill Switches Won’t Save Humanity From AI Risks -

'Devastated' Richard E. Grant Details How A Friend Of Thirty Years Betrayed Him: 'Such Toxicity'

'Devastated' Richard E. Grant Details How A Friend Of Thirty Years Betrayed Him: 'Such Toxicity' -

Rider Strong Finally Unveils Why He Opposed The Idea Of Matthew Lawrence’s Inclusion In 'Boy Meets World'

Rider Strong Finally Unveils Why He Opposed The Idea Of Matthew Lawrence’s Inclusion In 'Boy Meets World' -

Who Was ‘El Mencho’? Inside The Rise And Fall Of Mexico’s Most Wanted Drug Lord Killed In Military Operation

Who Was ‘El Mencho’? Inside The Rise And Fall Of Mexico’s Most Wanted Drug Lord Killed In Military Operation