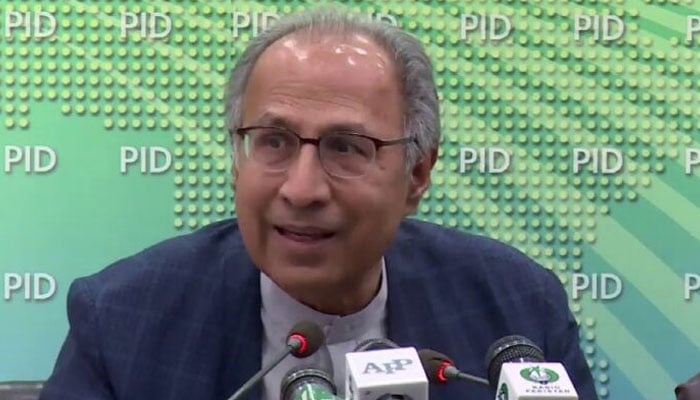

Adviser, FPCCI discuss business issues through video link

ISLAMABAD: Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh has said the government is actively resolving the liquidity related issues of the business community by clearing all outstanding tax refunds through fast-track procedure and taking progressive measures for further ease of doing business and improving the business environment, particularly for the small and medium enterprises.

The office-bearers and members of the Federation of Pakistan Chambers of Commerce & Industry (FPCCI), who held a detailed meeting through video conferencing with the adviser and his team at the Finance Division, apprised them about their issues besides presenting various proposals and recommendations for consideration in the upcoming budget. Chairperson FBR Nausheen Javaid Amjad, Secretary Finance Naveed Kamran Baloch, President FPCCI Mian Anjum Nisar, former president FPCCI Zakria Usman and several other office-bearers and members of the FPCCI also attended the meeting.

Dr Hafeez Shaikh said the government had already issued sales tax refunds to the exporters to the tune of Rs56 billion through the faster system while Rs40 billion refunds had also been issued out of the faster system, while Rs3 billion additional refunds would be paid by the end of this month. He said the government was open to considering any genuine proposal, including the establishment of industrial zones, upgrading of infrastructure, rationalisation of tariff and duties for the promotion of SMEs in the country.

Earlier, the office-bearers of the FPCCI sought attention of the finance adviser on the progress of recently-held meetings with FBR chairperson and her team, working on resolution of their issues such as waiver of demurrage charges for stuck-up containers as well as clearance of vehicles stuck at the ports for want of encashment certificates due to prevailing Covid-19 situation, reduction of regulatory duty on import of tyres. They thanked the adviser and his team for expediting clearance of outstanding tax refunds and conceded that it was for the first time in history that they had been receiving their outstanding tax refunds at their doorsteps without any hassle.

They also shared several proposals and recommendations for facilitating and incentivizing businesses and promoting ease of doing business in the country. Meanwhile, the adviser assured the representatives of business community that the government would resolve all their genuine issues and implement realistic proposals and recommendations for the promotion of business activities in the country.

-

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip?

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip? -

Historic Mental Health Facility Closes Its Doors

Historic Mental Health Facility Closes Its Doors -

Top 5 Easy Hair Fall Remedies For The Winter

Top 5 Easy Hair Fall Remedies For The Winter -

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory -

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned'

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned' -

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl?

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl? -

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis -

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’ -

Pregnant Women With Depression Likely To Have Kids With Autism

Pregnant Women With Depression Likely To Have Kids With Autism -

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations -

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance -

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance -

South Korea: Two Killed As Military Helicopter Crashes During Training

South Korea: Two Killed As Military Helicopter Crashes During Training -

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’ -

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible'

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible' -

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American'

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American'