Link between rising prices of gold, US interest-rate cuts, tariff agendas

Gold prices surge as investors rely on U.S. rate cuts and watch trade war moves

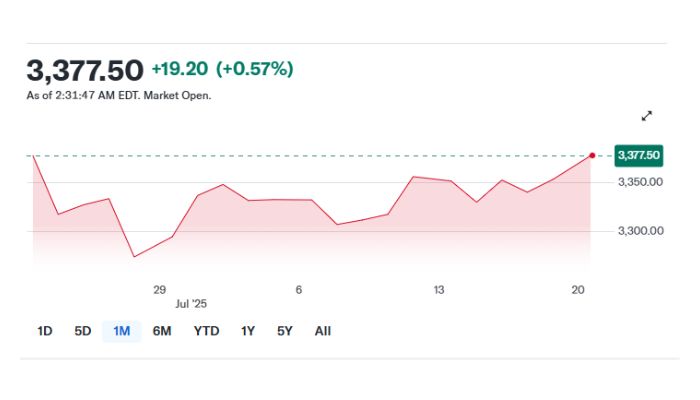

Gold prices skyrocketed as investors chew over the likelihood of United States (U.S) interest rate cuts and heightening trade tensions under President Donald Trump’s tariff policies.

Why Gold prices are rising?

Several factors coincided to increase the prices of gold. It includes:

Two federal reserve officials recently proposed that they’re open to lowering interest rates. This decision makes gold more attractive as there’s no interest on gold unlike saving accounts or bonds.

U.S. President Donald Trump’s push for new tariffs on imports can possibly drive inflation keeping some Fed officials cautious. Under these uncertain circumstances, gold is considered as a safe haven.

Moreover, Trump's criticism of Fed Chair Jerome Powell over high rates is reportedly considering replacements who could cut rates faster, adding to market uncertainty.

What’s Next?

On the trade front, representatives of European Union officials are set to conduct meetings on the U.S. tariffs agenda to a possible no-deal scenario with the US.

Investors have their eyes on progress talks with a raft of trade partners ahead of Trump’s August 1 deadline for imposing alleged reciprocal tariffs. The price of Gold has surged more than a quarter this year with rising geopolitical tension and concerns related to dollar-denominated assets.

As of now:

- Gold: $3,368 per ounce (↑ 0.5%)

- Silver, Platinum, Palladium: Also rose slightly

- U.S. Dollar: Slightly weaker, helping gold’s appeal

Thus, gold is rising because investors expect lower interest rates and are nervous about trade wars. If the Fed cuts rates or trade tensions escalate, gold could keep climbing.

-

Elizabeth Hurley Faces An Impossible Choice As Son Damian, Beau Billy Ray Cyrus Clash

Elizabeth Hurley Faces An Impossible Choice As Son Damian, Beau Billy Ray Cyrus Clash -

Rare Pokémon Cards Worth $100k Stolen In New York Shop Robbery

Rare Pokémon Cards Worth $100k Stolen In New York Shop Robbery -

Chevy Chase Shares Disappointment After 'SNL50: The Anniversary Special' Snub

Chevy Chase Shares Disappointment After 'SNL50: The Anniversary Special' Snub -

Samuel L. Jackson's Old Movie Found New Life: Here's How

Samuel L. Jackson's Old Movie Found New Life: Here's How -

Nobel Prize Snub Hardens Donald Trump's Tone On ‘peace’

Nobel Prize Snub Hardens Donald Trump's Tone On ‘peace’ -

What's Prince Harry's Case Against The Daily Mail's Publisher?

What's Prince Harry's Case Against The Daily Mail's Publisher? -

'Matilda' Star Mara Wilson Breaks Silence On AI's 'deepfake Apocalypse' After Being Abused

'Matilda' Star Mara Wilson Breaks Silence On AI's 'deepfake Apocalypse' After Being Abused -

Meghan Markle 'ruined' Prince Harry's Life?

Meghan Markle 'ruined' Prince Harry's Life? -

Super Bowl Halftime Show Gets Another Attraction Besides Bad Bunny

Super Bowl Halftime Show Gets Another Attraction Besides Bad Bunny -

Princess Irene's Coffin Arrives For Funeral Rites

Princess Irene's Coffin Arrives For Funeral Rites -

Sean Penn's Gay Role Interview Resurfaces After LA Stroll With Valeria Nicov

Sean Penn's Gay Role Interview Resurfaces After LA Stroll With Valeria Nicov -

FBI’s Most Wanted Caught After 10 Years In Mexico

FBI’s Most Wanted Caught After 10 Years In Mexico -

Inside Kate Middleton's Meaningful Nod To Own Milestone

Inside Kate Middleton's Meaningful Nod To Own Milestone -

Zachary Levi 'running' To Build His Future In Politics?

Zachary Levi 'running' To Build His Future In Politics? -

Andrew Lands In Fresh Major Trouble After Princess Eugenie Left Him 'devastated'

Andrew Lands In Fresh Major Trouble After Princess Eugenie Left Him 'devastated' -

Colleen Hoover Shares Major Update About Cancer Treatment

Colleen Hoover Shares Major Update About Cancer Treatment