SBP forex reserves drop by $397m to $9.02bn

The country’s foreign exchange reserves dropped by $369 million to $14.335 billion

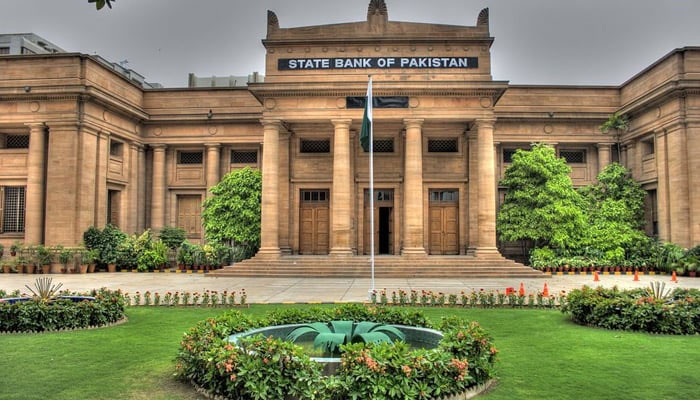

KARACHI: Pakistan’s foreign exchange reserves held by the central bank decreased by $397 million to $9.027 billion in the week ending July 19 due to external debt repayments, the State Bank of Pakistan reported on Thursday.

The country’s foreign exchange reserves dropped by $369 million to $14.335 billion. However, the reserves of commercial banks increased by $28 million to $5.308 billion.This month Pakistan reached a new $7 billion loan deal with the International Monetary Fund to support the struggling economy and manage its growing debts. The agreement is now subject to approval by the IMF Executive Board.

Pakistan will have better financial prospects thanks to the new IMF programme, which would secure funding from other bilateral and multilateral partners to meet its demands for external financing and increase its foreign exchange reserves.

Analysts note that the nation’s external position is still precarious and that the country would need a significant amount of external financing over the next three to five years.According to the latest report from a global rating agency, Fitch, the country has built up significant external liabilities. This includes both official debt issued by the state and private debt owed by non-financial corporations. Except for the central bank’s (limited) reserves, the economy has few FX assets, it said.

Pakistan’s current account deficit fell by 79 per cent to $681 million in the fiscal year 2024 supported by a decline in the trade deficit and a rise in remittances.Analysts anticipate that the current account deficit will be around $5 billion or 1.2 per cent of the GDP in FY25, with remittances amounting to $32 billion. However, Fitch suggests that despite Pakistan’s overall current deficit remaining small at an average of just 1.1 per cent of the GDP over the next five years, the country may face challenges in financing this deficit.

“We expect that Pakistan will remain dependent on imports to meet a large share of its domestic energy and consumer goods needs. While remittances from the country’s large diaspora will help cover these imports, we expect that the current account will remain in deficit over the duration of our forecast period,” it said.“FDI inflows will not be sufficient to cover this shortfall, which will leave the country dependent on portfolio inflows and foreign borrowing,” it added.

-

Savannah Guthrie Expresses Fresh Hope As Person Detained For Questioning Over Kidnapping Of Nancy

Savannah Guthrie Expresses Fresh Hope As Person Detained For Questioning Over Kidnapping Of Nancy -

ByteDance Suspends Viral Seedance 2.0 Photo-to-voice Feature: Here’s Why

ByteDance Suspends Viral Seedance 2.0 Photo-to-voice Feature: Here’s Why -

Tom Hanks Diabetes 2 Management Strategy Laid Bare

Tom Hanks Diabetes 2 Management Strategy Laid Bare -

Bad Bunny Wins Hearts With Sweet Gesture At Super Bowl Halftime Show

Bad Bunny Wins Hearts With Sweet Gesture At Super Bowl Halftime Show -

Why Angelina Jolie Loves Her 'scars' Following Double Mastectomy

Why Angelina Jolie Loves Her 'scars' Following Double Mastectomy -

‘World Is In Peril’: Anthropic AI Safety Researcher Resigns, Warns Of Global Risks

‘World Is In Peril’: Anthropic AI Safety Researcher Resigns, Warns Of Global Risks -

Meghan Markle Receives Apology As Andrew Puts Monarchy In Much Bigger Scandal

Meghan Markle Receives Apology As Andrew Puts Monarchy In Much Bigger Scandal -

Catherine O’Hara Becomes Beacon Of Hope For Rectal Cancer Patients

Catherine O’Hara Becomes Beacon Of Hope For Rectal Cancer Patients -

Nancy Guthrie: Is She Alive? Former FBI Director Shares Possibilities On 10th Day Of Kidnapping

Nancy Guthrie: Is She Alive? Former FBI Director Shares Possibilities On 10th Day Of Kidnapping -

Siemens Energy Profit Surges Nearly Threefold Amid AI Boom For Gas Turbines, Grids

Siemens Energy Profit Surges Nearly Threefold Amid AI Boom For Gas Turbines, Grids -

TikTok's ByteDance To Develop Advance AI Chips With Samsung

TikTok's ByteDance To Develop Advance AI Chips With Samsung -

Princess Beatrice, Eugenie In Dilemma As Andrew, Fergie Scandal Continues

Princess Beatrice, Eugenie In Dilemma As Andrew, Fergie Scandal Continues -

Tumbler Ridge School Shooting Among Canada’s Deadliest — Here’s Where It Ranks

Tumbler Ridge School Shooting Among Canada’s Deadliest — Here’s Where It Ranks -

Suspect Detained As Authorities Probe Nancy Guthrie’s Abduction

Suspect Detained As Authorities Probe Nancy Guthrie’s Abduction -

Tumbler Ridge Tragedy: Nine Killed, 25 Injured After School Shooting In British Columbia

Tumbler Ridge Tragedy: Nine Killed, 25 Injured After School Shooting In British Columbia -

FDA Sends 'refusal-to-file' To Moderna Over New Flu Vaccine

FDA Sends 'refusal-to-file' To Moderna Over New Flu Vaccine