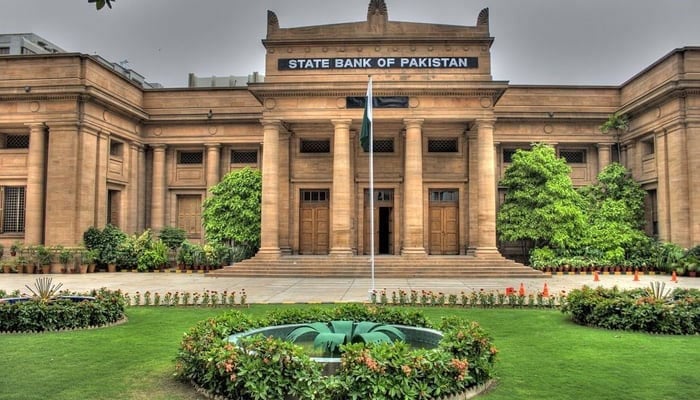

Risks to financial stability appear to be manageable: SBP

KARACHI: The State Bank of Pakistan stated on Friday that overall risks to financial stability seem manageable due to the anticipated moderation of macroeconomic stress and the robust buffers and risk management capabilities of the banking sector.

“The latest stress test results suggest that the banking sector has adequate resilience to withstand the severe but plausible macro-financial shocks in the medium term,” the SBP said in the Financial Stability Review (FSR) for 2023.

“However, policy continuity on structural reforms remains critical for both sustained improvement in the country’s macroeconomic fundamentals and the resilience and performance of the financial sector,” it added.

The review presents the performance and risk assessment of various segments of the financial sector including banks, microfinance banks (MFBs), non-bank financial institutions (NBFIs), insurance, financial markets, and financial market infrastructures (FMIs). It also assesses the financial soundness of major users of credit and financial services, viz the non-financial corporate sector.

The review highlights that the macroeconomic environment remained challenging amid rising inflation, weak FX inflows and pressures on external accounts and the local currency, and low business confidence particularly in the first half of 2023. However, the policy measures and regulatory interventions that were taken to address growing imbalances, coupled with the securing of a nine-month standby agreement (SBA) from the IMF, helped in improving the macroeconomic conditions in the second half of 2023.

Inflation started falling, economic growth recovered, and the exchange rate stabilized towards the year’s end. In this backdrop, the financial sector exhibited strong growth and performance and maintained its financial soundness and operational resilience. The asset base of the financial sector expanded by 27 per cent in 2023, which was mainly driven by the banking sectorWhile volatility in financial markets remained high, the financial sector, particularly the banking sector, remained resilient and grew by 29.5 per cent during the review period, notes the review. The growth in assets was primarily driven by investments in government securities, while private-sector advances contracted in the backdrop of stressed macro-financial conditions. The expansion of the banks’ balance sheet was mainly funded by deposits, which posted a 20-year high growth in a high return environment.

The credit risk, nonetheless, did not present serious concern as the non-performing loans (NPLs) to loans ratio marginally increased to 7.6 per cent by end December 2023 from 7.3 per cent in December 2022, and the provisioning coverage further improved to 92.7 per cent.

Earnings of the banking sector remained healthy on the back of high rates and expansion in earning assets, supporting the solvency position. Accordingly, the capital adequacy ratio (CAR) improved to 19.7 per cent by the end of December 2023, remaining well above the minimum regulatory requirement. Islamic banking institutions continued to maintain growth momentum in 2023 as well. With strong earnings and comfortable asset quality indicators, the resilience of Islamic banks further improved. However, the microfinance banks (MFBs) sector continued to experience stress in 2023.

The review reveals that the non-bank financial sector also showed healthy performance during CY2023. The asset base of development finance institutions (DFIs) and non-bank financial institutions (NBFIs) observed strong expansion. Moreover, despite a slowdown in economic activity, the insurance sector witnessed growth in assets and gross premium.

The overall position of the non-financial corporate sector was encouraging, as solvency indicators and repayment capacity remained satisfactory. Especially, large borrowers of the banking sector exhibited stable repayment capacity, and there were no significant delinquencies during the year under review.

The FSR also highlights the operational resilience of financial market infrastructures (FMIs) during CY2023. E-banking transactions continued to drive growth in retail payments. Importantly, the SBP moved to implement the third phase of Raast’s person-to-merchant (P2M) mode to facilitate digital payment acceptance for merchants and businesses.

-

Milo Ventimiglia Calls Fatherhood 'pretty Wild Experience' As He Expects Second Baby With Wife Jarah Mariano

Milo Ventimiglia Calls Fatherhood 'pretty Wild Experience' As He Expects Second Baby With Wife Jarah Mariano -

Chinese Scientists Unveil Advanced AI Model To Support Deep-space Exploration

Chinese Scientists Unveil Advanced AI Model To Support Deep-space Exploration -

Anthropic’s New AI Tool Wipes Billions Off Cybersecurity Stocks

Anthropic’s New AI Tool Wipes Billions Off Cybersecurity Stocks -

Trump Announces He Is Sending A Hospital Ship To Greenland Amid Rising Diplomatic Tensions

Trump Announces He Is Sending A Hospital Ship To Greenland Amid Rising Diplomatic Tensions -

'Never Have I Ever' Star Maitreyi Ramakrishnan Lifts The Lid On How She Avoids Drama At Coffee Shops Due To Her Name

'Never Have I Ever' Star Maitreyi Ramakrishnan Lifts The Lid On How She Avoids Drama At Coffee Shops Due To Her Name -

Inside Prince William’s Plans For Prince Harry: What Will Happen To Duke Once He’s King

Inside Prince William’s Plans For Prince Harry: What Will Happen To Duke Once He’s King -

Chyler Leigh Pays Moving Homage To 'Grey’s Anatomy' Co-star Eric Dane: 'He Was Amazing'

Chyler Leigh Pays Moving Homage To 'Grey’s Anatomy' Co-star Eric Dane: 'He Was Amazing' -

Did You Know Tech CEOs Limit Screen Time For Their Own Kids?

Did You Know Tech CEOs Limit Screen Time For Their Own Kids? -

Matthew Lillard Admits Fashion Trends Are Not His 'forte'

Matthew Lillard Admits Fashion Trends Are Not His 'forte' -

SpaceX Launches Another Batch Of Satellites From Cape Canaveral During Late-night Mission On Saturday

SpaceX Launches Another Batch Of Satellites From Cape Canaveral During Late-night Mission On Saturday -

Princess Beatrice, Eugenie Get Pulled Into Parents’ Epstein Row: ‘At Least Stop Clinging!’

Princess Beatrice, Eugenie Get Pulled Into Parents’ Epstein Row: ‘At Least Stop Clinging!’ -

Inside Kim Kardashian's Brain Aneurysm Diagnosis

Inside Kim Kardashian's Brain Aneurysm Diagnosis -

Farmers Turn Down Millions As AI Data Centres Target Rural Land

Farmers Turn Down Millions As AI Data Centres Target Rural Land -

Trump Announces A Rise In Global Tariffs To 15% In Response To Court Ruling, As Trade Tensions Intensify

Trump Announces A Rise In Global Tariffs To 15% In Response To Court Ruling, As Trade Tensions Intensify -

Chappell Roan Explains Fame's Effect On Mental Health: 'I Might Quit'

Chappell Roan Explains Fame's Effect On Mental Health: 'I Might Quit' -

AI Processes Medical Data Faster Than Human Teams, Research Finds

AI Processes Medical Data Faster Than Human Teams, Research Finds