Oil up nearly 2pc as weaker dollar offsets China concerns

NEW YORK: Oil prices rose on Tuesday, recouping losses from the previous session, on optimism that China, the world's second-largest oil consumer, could reopen from strict Covid curbs.

Brent crude for January delivery rose $1.53, or 1.7 percent, to $94.34 a barrel at 12:01 p.m. EDT. The December contract expired on Monday at $94.83 a barrel, down 1 percent.

U.S. West Texas Intermediate (WTI) crude rose $1.60, or 1.85 percent, to $88.13 after falling 1.6 percent in the previous session.

An unverified note trending in social media, and tweeted by influential economist Hao Hong, said a "Reopening Committee" has been formed by Politburo Standing Member Wang Huning, and is reviewing overseas COVID data to assess various reopening scenarios, aiming to relax COVID rules in March, 2023. Hong Kong and China stocks jumped on the rumors.

A Chinese foreign ministry spokesman later said he was unaware of the situation.

"Talk on this is gathering some momentum," said Bob Yawger, director of energy futures at Mizuho in New York. "That would definitely be a positive demand event."

The Brent and WTI benchmarks both registered monthly gains in October, their first since May, after the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, a group known as OPEC+, cut their targeted output by 2 million barrels per day (bpd).

The OPEC+ cuts and record U.S. oil export data also support oil price fundamentals, said CMC Markets analyst Tina Teng.

Tamas Varga of oil broker PVM, meanwhile, said that dwindling oil supply, a possible halt to release of oil from the Strategic Petroleum Reserve (SPR) and reinvigotated oil demand growth could also send crude back above $100 a barrel.

An oil investment lag is sowing seeds for a future energy crisis, OPEC secretary General Haitham Al Ghais said on Tuesday.

OPEC raised its forecasts for world oil demand in the medium and longer term on Monday, saying that $12.1 trillion of investment is needed to meet this demand.

These bullish factors have offset demand concerns raised by Covid-19 curbs that lowered China's factory activity in October and cut into its imports from Japan and South Korea. In a further cap to price gains, U.S. crude oil stocks are likely to rise in the week to Oct. 28, a preliminary Reuters poll showed. —News Desk

-

How Liam Payne’s Death Impacted Awareness About Mental Health

How Liam Payne’s Death Impacted Awareness About Mental Health -

Scientists Reveal How Sleeping Can Unlock Your Creative Potential

Scientists Reveal How Sleeping Can Unlock Your Creative Potential -

OpenAI CEO Calls AI Water Concerns ‘fake’

OpenAI CEO Calls AI Water Concerns ‘fake’ -

Taylor Swift Expresses How Negative Body Comments Triggered Her

Taylor Swift Expresses How Negative Body Comments Triggered Her -

Prince William Plans Bold Shake-up To Restore Public Trust Amid Andrew Drama

Prince William Plans Bold Shake-up To Restore Public Trust Amid Andrew Drama -

Apple IPhone 18 Pro Series To Launch In Bold Red Colour: Report

Apple IPhone 18 Pro Series To Launch In Bold Red Colour: Report -

Apple Developing AI Pendant Powered By In-house Visual Models

Apple Developing AI Pendant Powered By In-house Visual Models -

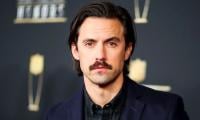

'Gilmore Girls' Milo Ventimiglia Shares How He Would React If His Daughter Ke'ala Coral Chose 'team Dean'

'Gilmore Girls' Milo Ventimiglia Shares How He Would React If His Daughter Ke'ala Coral Chose 'team Dean' -

New AGI Benchmark: Demis Hassabis Proposes ‘Einstein Test’—Ultimate Challenge To Prove True Intelligence

New AGI Benchmark: Demis Hassabis Proposes ‘Einstein Test’—Ultimate Challenge To Prove True Intelligence -

NASA Artemis 2 Moon Mission Faces Unexpected Delay Ahead Of March Launch

NASA Artemis 2 Moon Mission Faces Unexpected Delay Ahead Of March Launch -

Kate Middleton Reclaims Spotlight With Confidence Amid Andrew Drama

Kate Middleton Reclaims Spotlight With Confidence Amid Andrew Drama -

Lady Gaga Details How Eating Disorder Affected Her Career: 'I Had To Stop'

Lady Gaga Details How Eating Disorder Affected Her Career: 'I Had To Stop' -

Why Elon Musk Believes Guardrails Or Kill Switches Won’t Save Humanity From AI Risks

Why Elon Musk Believes Guardrails Or Kill Switches Won’t Save Humanity From AI Risks -

'Devastated' Richard E. Grant Details How A Friend Of Thirty Years Betrayed Him: 'Such Toxicity'

'Devastated' Richard E. Grant Details How A Friend Of Thirty Years Betrayed Him: 'Such Toxicity' -

Rider Strong Finally Unveils Why He Opposed The Idea Of Matthew Lawrence’s Inclusion In 'Boy Meets World'

Rider Strong Finally Unveils Why He Opposed The Idea Of Matthew Lawrence’s Inclusion In 'Boy Meets World' -

Who Was ‘El Mencho’? Inside The Rise And Fall Of Mexico’s Most Wanted Drug Lord Killed In Military Operation

Who Was ‘El Mencho’? Inside The Rise And Fall Of Mexico’s Most Wanted Drug Lord Killed In Military Operation