Rs105bln stimulus package unveiled to buffer trade from coronavirus

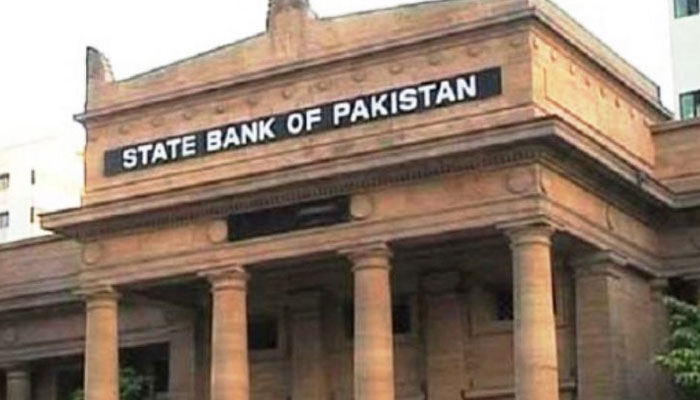

KARACHI: The central bank on Tuesday earmarked more than Rs100 billion in concessionary loans for manufacturing and health sectors to help them combat coronavirus challenges.

The State Bank of Pakistan announced refinance facilities to support manufacturing and health sectors to overcome ill-effects of Covid-19.

The relief came on the heels of 75 basis points reduction in interest rate to 12.50 percent that was less than the market’s anticipation in the wake of economic slowdown.

The SBP said it announced three measures to address the economic and health challenges posed by the spread of Covid-19. First, the monetary policy committee of the SBP cut its policy rate by 75 basis points.

Second, the SBP announced a “temporary economic refinance facility” and its shariah-compliant version to stimulate new investment in manufacturing. Under this scheme, the SBP would refinance banks to provide financing at a maximum end-user rate of 7 percent for 10 years for setting up of new industrial units. The total size of the scheme is Rs100 billion, with a maximum loan size per project of Rs5 billion.

“It can be accessed by all manufacturing industries, with the exception of the power sector, where an SBP refinance facility for renewable energy projects already exists,” the SBP said in a statement. “In line with the SBP's other refinancing schemes, the credit risk will be borne by banks and the selection of projects to finance will also be determined by them. This scheme will help counter any possible delays in the setting up of new projects that investors were planning prior to the coronavirus outbreak. It will be available for one year only, requiring a letter of credit to be opened by end-March 2021.”

The SBP further announced a “refinance facility for combating Covid–19 (RFCC)” and its shariah-compliant version to support hospitals and medical centres in combating the spread of Covid–19. Under this scheme, the SBP would refinance banks to provide financing at a maximum end-user rate of 3 percent for 5 years for the purchase of equipment to detect, contain and treat the coronavirus.

“The SBP will provide this facility to banks at 0 percent. All hospitals and medical centres registered with federal or provincial health agencies and which are engaged in the control and eradication of Covid-19 will be eligible for this facility,” it added.

“The total size of the scheme is Rs5 billion, with a maximum financing limit per hospital or medical centre of Rs200 million. This scheme will help contain the spread of the coronavirus and reduce its human toll. It is available until end-September 2020.”

-

Katie Price Seen With New Hubby Lee Andrews Weeks After Tying The Knot

Katie Price Seen With New Hubby Lee Andrews Weeks After Tying The Knot -

Biggest Order Yet Issued Against Andrew Mountbatten-Windsor: King Charles You Have To’

Biggest Order Yet Issued Against Andrew Mountbatten-Windsor: King Charles You Have To’ -

ByteDance’s Seedance 2.0 Marks New Era Of Cinematic AI-generated Videos: Here’s How

ByteDance’s Seedance 2.0 Marks New Era Of Cinematic AI-generated Videos: Here’s How -

Struggling With Obesity? Here's How To Manage It

Struggling With Obesity? Here's How To Manage It -

How Epstein Scandals Are Impacting King Charles’ Healing As Stress Refuses To Relent: ‘Could Spell His End’

How Epstein Scandals Are Impacting King Charles’ Healing As Stress Refuses To Relent: ‘Could Spell His End’ -

Ciara, Russell Wilson Become Matchmakers For Pals?

Ciara, Russell Wilson Become Matchmakers For Pals? -

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip?

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip? -

Historic Mental Health Facility Closes Its Doors

Historic Mental Health Facility Closes Its Doors -

Top 5 Easy Hair Fall Remedies For The Winter

Top 5 Easy Hair Fall Remedies For The Winter -

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory -

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned'

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned' -

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl?

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl? -

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis -

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’ -

Pregnant Women With Depression Likely To Have Kids With Autism

Pregnant Women With Depression Likely To Have Kids With Autism -

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations