Money supply shrinks 1.3pc in Q1 as cash holdings drop

KARACHI: Pakistan's money supply contracted by 1.3 percent to Rs31.11 trillion in the first quarter of fiscal year 2023/24, as cash holdings declined and credit to the private sector slowed amid high interest rates, data showed on Wednesday.

The broad money, or M2, a measure of money circulating in the economy, fell from Rs31.53 trillion at the end of June, according to data from the State Bank of Pakistan (SBP) cited by brokerage Arif Habib Limited.

As of September 22, the broad money or M2 stood at Rs31.11 trillion. On a week-on-week basis, M2 decreased by 0.1 percent. As of September 15, it was Rs31.13 trillion.

The currency in circulation (CiC), which reflects the cash holdings of businesses and households, dropped by 8.5 percent to Rs8.37 trillion in the July-September period, reducing its share in the money supply to 26.9 percent from 29 percent in June. According to data, Pakistan's cash holdings have decreased by roughly one trillion rupees during the last three months, a sign that businesses and households have parked their cash in banks due to high deposit rates and a decline in investment in the stock, money, and real estate markets. Banks have seen an uptick in their remunerative deposits.

Total deposits with banks rose 1.7 percent to Rs22.6 trillion in July-September FY2024. The auto industry has also been experiencing a decline in demand as a result of exorbitant prices, stricter rules on consumer credit, and a general decline in purchasing power.

The broad money growth decelerated to 12.7 percent as of September 22 on a year-on-year basis from 14.2 percent observed at the end of June.

"External flows have been minimal, while domestic assets have declined," said Fahad Rauf, the head of research at Ismail Iqbal Securities.

"Private sector credit has dropped due to the weak economic situation and exorbitantly high interest rates, resulting in excess liquidity within the banking system for the period under measurement," Rauf added.

The net domestic assets of the banking system were negative Rs517 billion during July-September FY2024. This compared with Rs655 billion in the same period a year earlier.

The private sector repaid Rs258 billion to the commercial banks in July-September FY2024, compared with Rs697 million a year earlier.

The State Bank of Pakistan, in its last monetary policy statement, said that the expected fiscal consolidation, realization of planned external inflows, and uptick in economic activity would provide space for a moderate expansion in private sector credit this year.

-

Prince Harry Mentions Ex-girlfriend Chelsy Davy In UK Court

Prince Harry Mentions Ex-girlfriend Chelsy Davy In UK Court -

David, Victoria Beckham 'quietly' Consulting Advisers After Brooklyn Remarks: 'Weighing Every Move'

David, Victoria Beckham 'quietly' Consulting Advisers After Brooklyn Remarks: 'Weighing Every Move' -

Meta's New AI Team Delivered First Key Models

Meta's New AI Team Delivered First Key Models -

Prince Harry Defends Friends In London Court

Prince Harry Defends Friends In London Court -

AI May Replace Researchers Before Engineers Or Sales

AI May Replace Researchers Before Engineers Or Sales -

Christina Haack Goes On Romantic Getaway: See With Whom

Christina Haack Goes On Romantic Getaway: See With Whom -

Consumers Spend More On AI And Utility Apps Than Mobile Games: Report

Consumers Spend More On AI And Utility Apps Than Mobile Games: Report -

Aircraft Tragedy: Missing Tourist Helicopter Found Near Japan Volcano Crater

Aircraft Tragedy: Missing Tourist Helicopter Found Near Japan Volcano Crater -

Taylor Swift Lands In Trouble After Blake Lively Texts Unsealed

Taylor Swift Lands In Trouble After Blake Lively Texts Unsealed -

'Prince Harry Sees A Lot Of Himself In Brooklyn Beckham'

'Prince Harry Sees A Lot Of Himself In Brooklyn Beckham' -

Kate Middleton’s Cancer Journey Strengthens Her Commitment To Helping Children

Kate Middleton’s Cancer Journey Strengthens Her Commitment To Helping Children -

Gaten Matarazzo Compares 'Stranger Things' Ending To 'Lord Of The Rings'

Gaten Matarazzo Compares 'Stranger Things' Ending To 'Lord Of The Rings' -

Prince Harry Slams Publisher Over 'dirty Trick' Ahead Of Showing Evidence

Prince Harry Slams Publisher Over 'dirty Trick' Ahead Of Showing Evidence -

Blueface Promises To Change Behaviour If His Ex Comes Back

Blueface Promises To Change Behaviour If His Ex Comes Back -

Prince Harry Makes Crucial Promise To Meghan Markle Over UK Return

Prince Harry Makes Crucial Promise To Meghan Markle Over UK Return -

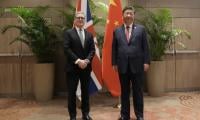

Keir Starmer’s China Visit: UK Follows Mark Carney In Major Reset Of Ties

Keir Starmer’s China Visit: UK Follows Mark Carney In Major Reset Of Ties