UK housing market slows amid rising demand for tax overhaul

House price growth has declined in the midst of growing pressure for a reform of property taxes

The UK housing market has witnessed a slowdown in prices as calls mount over the property tax reforms in the Autumn budget.

According to data from lender Nationwide, house price growth declined to 2.1 percent. On the other hand, on a month-on-month basis, the trend showed a 0.1 percent drop compared with July.

The fading housing boom came on the heels of emerging reports based on the claims that the government is considering to reform stamp duty and other property taxes aiming to raise more money and boost the housing market.

According to Robert Gardner, chief economist at Nationwide Building Society, “Britain needs a tax system that allows people to move more effectively. It's definitely worth looking at UK property taxes."

Among the widely-discussed reform options include the removal of the capital gains tax relief on selling expensive homes, revocation of stamp duty, roll-out of a National Insurance levy for landlords, and replacement of council tax with national tax.

However, the experts’ views are divided on the tax overhaul. Some economists argued that abolishing stamp duty could uplift the housing market but cost billions in lost tax revenues.

As reported by Nationwide, the average UK home now costs £271,079, based on its own mortgage activity.

-

Timothee Chalamet rejects fame linked to Kardashian reality TV world while dating Kylie Jenner

-

Sarah Chalke recalls backlash to 'Roseanne' casting

-

Willie Colón, salsa legend, dies at 75

-

Touching Eric Dane moment with daughter emerges after viral final words

-

Ryan Coogler explains why his latest project 'Sinners' is so close to his heart

-

Who is Punch? Here’s everything to know about the viral sensation winning over internet

-

Matty Healy sets summer wedding date close to ex Taylor Swift's nuptials

-

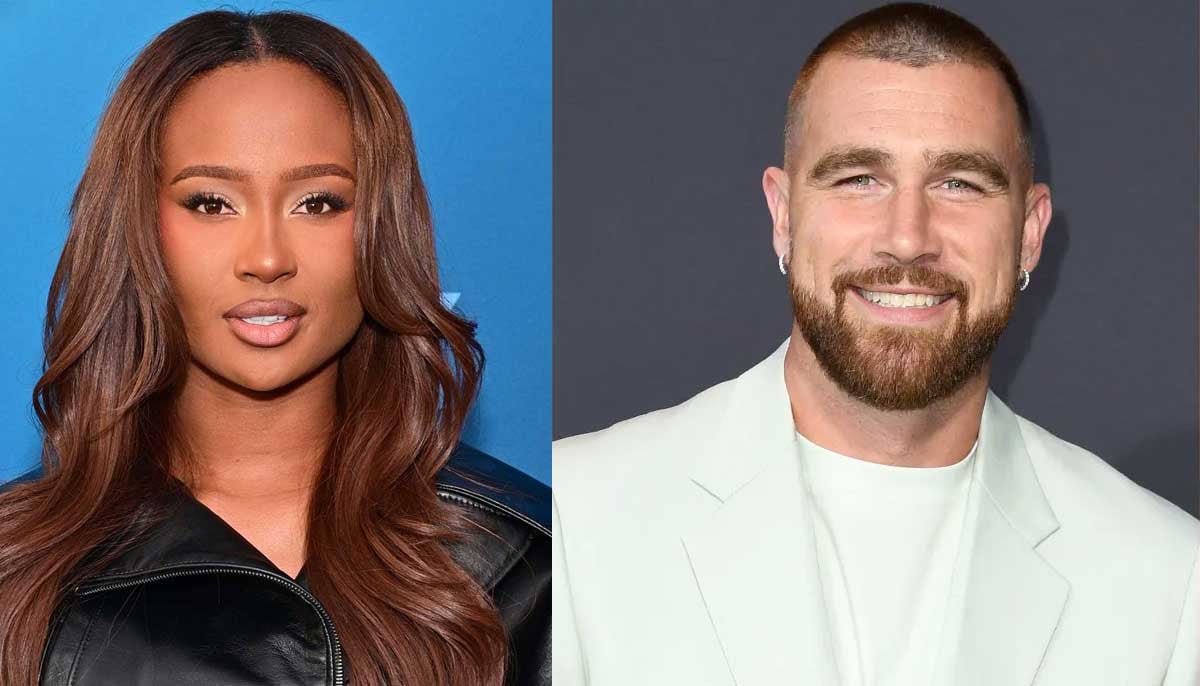

Kayla Nicole reveals surprising reason behind separation from Travis Kelce

_updates.jpg)