Future of Alibaba: What’s next for stocks?

The Chinese e-commerce giant beat the market last year with outstanding performance

Alibaba Group (BABA) group, a Chinese multinational company, specializes in e-commerce, retail, and cloud computing.

Primarily, Alibaba’s stocks is climbing the "Great Wall of Worry". The company’s shares rose over 46% last year, even with concerns about trade and slow revenue growth.

The shares have significantly risen 46% over the past year, despite upcoming commercial conflict concerns and its own lack of material top line growth in recent years.

Alibaba’s online retail platform, Ali Express, is facing significant challenges due to the tariff dispute with the U.S. government.

Meanwhile, after a long period of exponential increase, its revenue has slowed down to single-digit percentages over the past few fiscal years, analysts expect this trend to continue for at least next two years.

Investors will get to know how Alibaba is holding up when it reports results for the first quarter of fiscal 2026.

A lot of riding is at stake since last week, but instead of focusing on the upcoming week, let's have a look at the next 52 weeks. It seems that Alibaba is beating the market a year from now.

However, its flagship e-commerce business is a money-spinner in China. Taobao and Tmall are its consumer-to-consumer and business-to-business platforms, generating a combined revenue of $62 million in the fiscal year 2025.

This further suggests that desired data accounts for 45% of the company’s entire earnings of $137 billion.

According to the Earnings Before Interest, Taxes and Amortization (EBITA), the pivotal point is that these two platforms accounted for $127 billion, which represented the bulk of the company’s adjusted earnings of $23.8 billion.

Alibaba is using the profits from its e-commerce business to support its other ventures, which are currently operating at loss.

Alibaba’s highly profitable business gives it the financial freedom to invest in a wide variety of other ventures.

At present, management is investing $7 billion in promotions to make its fast-growing delivery business more pervasive.

Nonetheless, Alibaba potential is to continue outperforming the market is strong due to its low stock valuation.

The company is trading at a low multiple of its adjusted earnings for both the current and next fiscal year.

The recent approach to invest in the third-party food delivery market may affect the bottom line.

Alibaba’s low price, strategic investments, diverse business ventures, and stable financials make it a compelling bet for the future.

-

Timothee Chalamet rejects fame linked to Kardashian reality TV world while dating Kylie Jenner

-

Sarah Chalke recalls backlash to 'Roseanne' casting

-

Willie Colón, salsa legend, dies at 75

-

Touching Eric Dane moment with daughter emerges after viral final words

-

Ryan Coogler explains why his latest project 'Sinners' is so close to his heart

-

Who is Punch? Here’s everything to know about the viral sensation winning over internet

-

Matty Healy sets summer wedding date close to ex Taylor Swift's nuptials

-

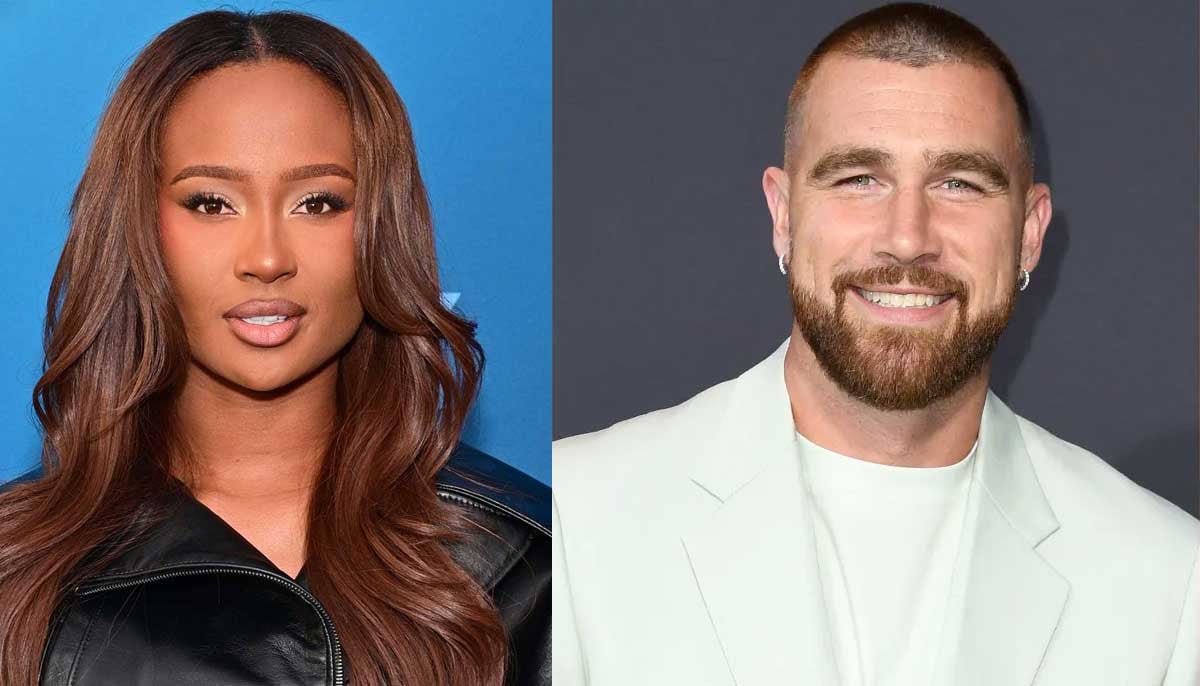

Kayla Nicole reveals surprising reason behind separation from Travis Kelce