Expedia shares set records as US travel bounce back

Premarket trading reveals Expedia shares annual gross booking revenue

Expedia, an American online travel agency (OTA), is doing its best in the stock market as company shares surged to around 17% in early Friday trading on August 08, 2025.

President Donald Trump tariffs earlier this year made visitors economically concerned and travel booking platform sales weakened.

Travel tech company CEO, Ariane Gorin revealed: "Since the start of July, we have seen an uptick in overall travel demand, particularly in the United States."

Rental service provider is predicting total bookings of 2025 will surge between 3 percent to 5 percent and will add 1% mark to shares forecast.

Morningstar financial analyst Dan Wasiolek believes tech giant reservations booking will grow more than company expectations and in 2026 it will improve to 7%.

Company Q2 profitability margin plunged by 190 basis points, out shining the May 2025, 75 to 100 basis point increase.

Expedia Group shares are trading at $187.61, which is almost 12 times price to earning ratio of their forward profit and standing below the middle value figure of 14.19.

US travelers now look more confident in purchasing flight tickets from Expedia and travel tech has also joined market conglomerates like Airbnb and Marriott in catching high income customers bookings.

-

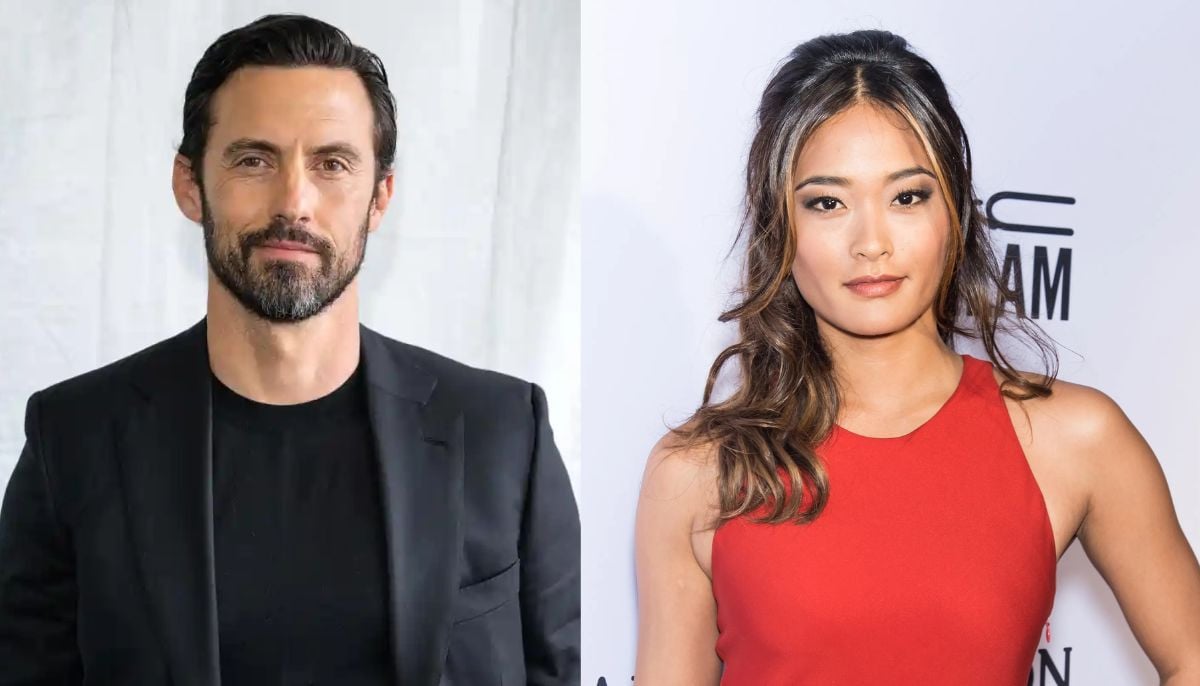

Milo Ventimiglia calls fatherhood 'pretty wild experience' as he expects second baby with wife Jarah Mariano

-

Charli XCX applauds Dave Grohl’s 'abstract' spin on viral ‘Apple’ dance

-

Eric Dane's wife Rebecca Gayheart shares family memories of late actor after ALS death

-

Eric Dane's girlfriend Janell Shirtcliff pays him emotional tribute after ALS death

-

Sam Levinson donates $27K to Eric Dane family fund after actor’s death

-

Timothee Chalamet rejects fame linked to Kardashian reality TV world while dating Kylie Jenner

-

Sarah Chalke recalls backlash to 'Roseanne' casting

-

Willie Colón, salsa legend, dies at 75