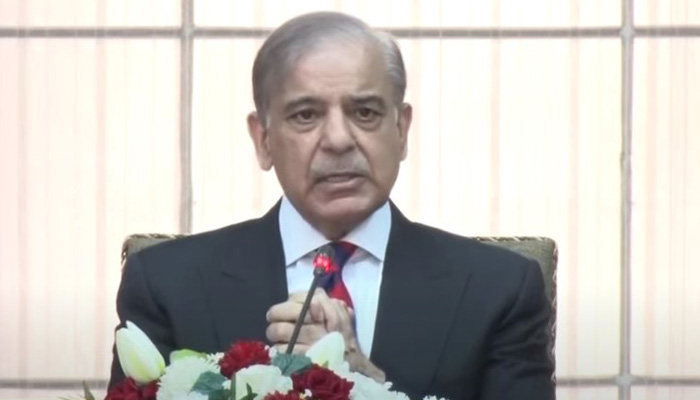

PM Shehbaz says new IMF package likely to continue for three years

Premier emphasises reforms under IMF programme as country needs macroeconomic stability

ISLAMABAD: As Pakistan likely to get final tranche of loan soon, Prime Minister Shehbaz Sharif has signalled that the new International Monetary Fund (IMF) programme is expected to continue for three years.

“New tranche of loan is likely to be received from IMF in a few days, however, we would need another programme,” he said while addressing the session of the Special Investment Facilitation Council (SIFC) apex committee attended by civil-military leadership on Thursday.

The premier said that civil-military leadership, including elected lawmakers from different political parties, gave a clear message of unity for development, and prosperity of the country by attending today’s session.

He added that the former coalition government, comprised of 13 political parties, decided to prioritise the country over their politics.

“There are major challenges to national economy. The SIFC is an important platform which was primarily establishment to remove hurdles in foreign investments, and it held several meetings during the last eight months.”

PM Shehbaz also emphasised on introducing reforms under the IMF programme as the country needs macroeconomic stability. "We have Rs9 trillion revenues, which should be Rs13 to 14 trillion."

The federal government, he said, would digitise the Federal Board of Revenue (FBR). Electricity theft gives an annual financial dent of Rs400 billion to the national exchequer. During the caretaker government, electricity worth Rs87 billion was saved by taking anti-power measures.

He also pointed out that electricity and gas circular debt has soared to Rs5 trillion. “There is a coalition government in the Centre, whereas, different political parties are ruling provinces. The Centre cannot counter all challenges alone, therefore, we should set aside our political differences, and work together to pull the country out of crisis.”

PM Shehbaz also urged to expedite privatisation process of the loss-making state-owned entities, like Pakistan International Airlines (PIA) which is under debt of Rs825 billion.

“We have to take many bitter decisions,” the prime minister said, admitting that subsidies had been granted to elites of the country which should not be repeated. He added that financial burden, following decisions, should be shifted to those segments that could bear it.

Pakistan-IMF strike SLA

With a clear-headed approach adopted by newly appointed Finance Minister Muhammad Aurangzeb, Pakistan and the global lender struck a staff-level agreement (SLA) for the completion of the second review and release of the third tranche of $1.1 billion under the Standby Arrangement (SBA) programme, The News reported.

After striking the SLA, the IMF confirmed that Pakistani authorities expressed interest in a successor medium-term Fund-supported programme to permanently resolve Pakistan’s fiscal and external sustainability weaknesses, strengthening its economic recovery and laying the foundation for strong, sustainable and inclusive growth.

While discussions are expected to start in the coming months, the IMF says the key objectives of the upcoming IMF sponsored programme are expected to include:

(i) strengthening public finances, including through gradual fiscal consolidation and broadening the tax base (especially in undertaxed sectors) and improving tax administration to better debt sustainability and create space for higher priority development and social assistance spending to protect the vulnerable;

(ii) restoring the energy sector’s viability by accelerating cost reducing reforms including improving electricity transmission and distribution, moving captive power demand to the electricity grid, strengthening distribution company governance and management, and undertaking effective anti-theft efforts;

(iii) returning inflation to target, with a deeper and more transparent flexible FX market supporting external rebalancing and the rebuilding of foreign reserves; and

(iv) promoting private-led activity through the above mentioned actions as well as removal of distortionary protection, advancement of state-owned enterprise (SOE) reforms to improve the sector’s performance, and scaling-up of investment in human capital, to make growth more resilient and inclusive and enable Pakistan to reach its economic potential.

-

Security forces gun down 30 terrorists in multiple IBOs in KP: ISPR

-

MQM-P calls for new province in Sindh

-

US report validates Pakistan military edge over India: PM

-

Banned TTP poses serious threat to Pakistan security: UNSC panel

-

CM Afridi clarifies remarks on by-poll after ECP requests army deployment

-

Dubai sees 3.2m Pakistani passengers in 2025 as airport sets new milestone

-

Security forces kill 23 Indian proxy terrorists in KP's Kurram

-

Pakistan to construct island to boost oil exploration: report