Britain apologises to migrants removed in Windrush scandal

LONDON: Britain said it would formally apologize to 18 members of the “Windrush generation” who were forced to leave or detained because they were not issued with documents when they came to the country from the Caribbean after World War Two.

The scandal damaged the authority of Prime Minister Theresa May, who had led efforts to tackle illegal immigration when she led the Home Office, and resulted in the resignation of her interior minister Amber Rudd.

May said earlier this year that the treatment of thousands of migrants who were invited to fill labor shortages in post-war Britain on ships such as the Empire Windrush had been “appalling”. The government said 18 people had been identified in a review of removals and detentions affecting Caribbean nationals, of whom 11 went on voluntarily to leave Britain and seven were detained but subsequently released without being removed.

Fourteen of the 18 had been contacted and would be given the option to return, it said. They would also be guided to a compensation scheme. Interior Minister Sajid Javid said the experiences faced by some members of the Windrush generation were completely unacceptable.

“I would like to personally apologize to those identified in our review and am committed to providing them with the support and compensation they deserve,” he said on Tuesday. “We must do everything we can to ensure that nothing like this happens again – which is why I have asked an independent adviser to look at what lessons we can learn from Windrush.”

The government also said 74 people were either detained or removed because they had lost their entitlement to stay in Britain after leaving for more than two years, and a further 72 people were detained temporarily at port but allowed to enter. A task-force set up after the scandal had helped 2,272 people to get the documentation they needed to prove their existing right to be in the UK, the government said.

-

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral -

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain -

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson -

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes -

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show -

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise -

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life -

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement -

Thomas Tuchel Set For England Contract Extension Through Euro 2028

Thomas Tuchel Set For England Contract Extension Through Euro 2028 -

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case -

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty -

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans -

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather -

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments?

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments? -

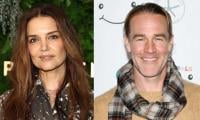

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss'

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss' -

Bella Hadid Talks About Suffering From Lyme Disease

Bella Hadid Talks About Suffering From Lyme Disease