Factbox: Universal to list as music streaming picks up

Vivendi, the French media conglomerate, is spinning off Universal Music Group

Vivendi, the French media conglomerate, is spinning off Universal Music Group, the largest part of its business and the label behind singers such as Taylor Swift, in a listing on the Euronext stock exchange in Amsterdam.

The facts about Universal and its levitation are:

From The Beatles to Billie Eilish

In terms of revenue, Universal Music Group or UMG is the largest “Big Three” record label. He represents a wide range of musicians and song catalogs, from Billie Eilish to The Rolling Stones to Bob Dylan.

Major competitors include Sony Music, which is part of Sony, and Warner Music Group. “Big Three” is estimated to account for just under 60% of global sales generated by music rights from catalogs.

Universal began in the early 1930s when the British label Decca Records established a US branch and later merged with another music company. In 2011, Universal stormed EMI’s recording music business for $ 1.9 billion, gaining access to the Beatles, Radiohead, and Pink Floyd catalogs.

The changing music industry

Universal has benefited from the boom in streaming revenue, especially young music fans using their smartphones to listen to songs. We make money from our subscription services through transactions with Spotify and others.

We also have transactions with ad-based social media companies such as TikTok and YouTube, which cover the use of artists’ songs in “User Generated Content” on these platforms, but the terms of these transactions are publicly available. Is not …

Digital piracy affected music sales in the first decade of the century, but now it’s expanding into areas such as music-based social media platforms such as TikTok, fitness applications and video games. I am.

Universal faces competition from indie labels and start-ups trying to release music purely digitally. The company said in its listing prospectus that it expects to grow its streaming business in markets such as South Korea, Brazil, India and Russia.

Vivendi investors, including controlling shareholder Vincent Bolloré, will receive a 60% stake in the company when Universal goes public in Amsterdam, and trading is expected to begin on September 21st.

The company is aiming for a market capitalization of € 33 billion ($ 39 billion). No new shares have been issued.

Vivendi will continue to hold 10% of Universal after the transaction. China’s Tencent-led consortium owns 20%, and billionaire hedge fund investor William Ackman’s Pershing Square Holdings owns 10%.

Universal said in its prospectus that Boroa and Tencent had agreed to discuss dividend policy and some aspects of the board of directors prior to the shareholders’ meeting.

Revenue and the impact of COVID-19

Universal reported interest, taxes, depreciation and profit before interest (EBITDA) of € 1.49 billion against sales of € 7.43 billion in 2020. The company has a net debt of € 2 billion.

In the medium term, Universal forecasts sales growth in the high single digits with an EBITDA margin in the mid-20% range.

Universal said in its outlook that the COVID-19 pandemic initially hit streaming income, including when people who were told to stay home stopped listening to music in the gym or on long commute. rice field. Universal said the main problem was the sale of merchandising, which has been normalized, recovered again and is frequent at concerts.

-

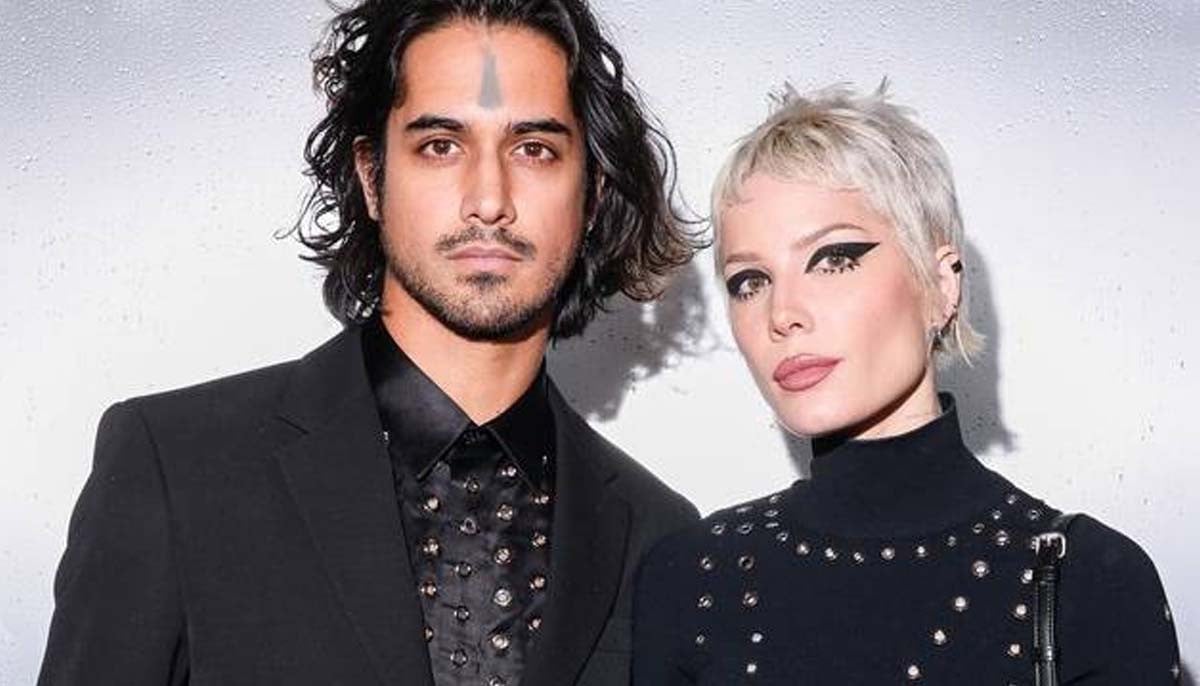

Halsey marks fiancé Avan Jogia's birthday with emotional note

-

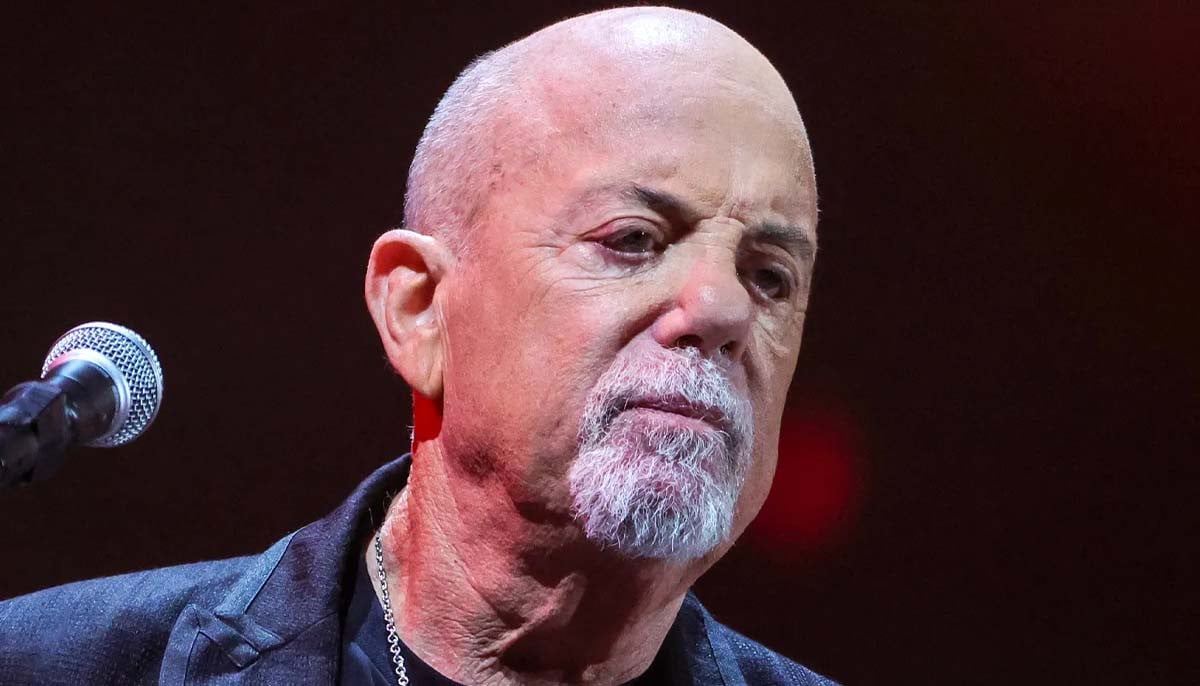

Billy Joel leaves loved ones worried with his 'dangerous' comeback

-

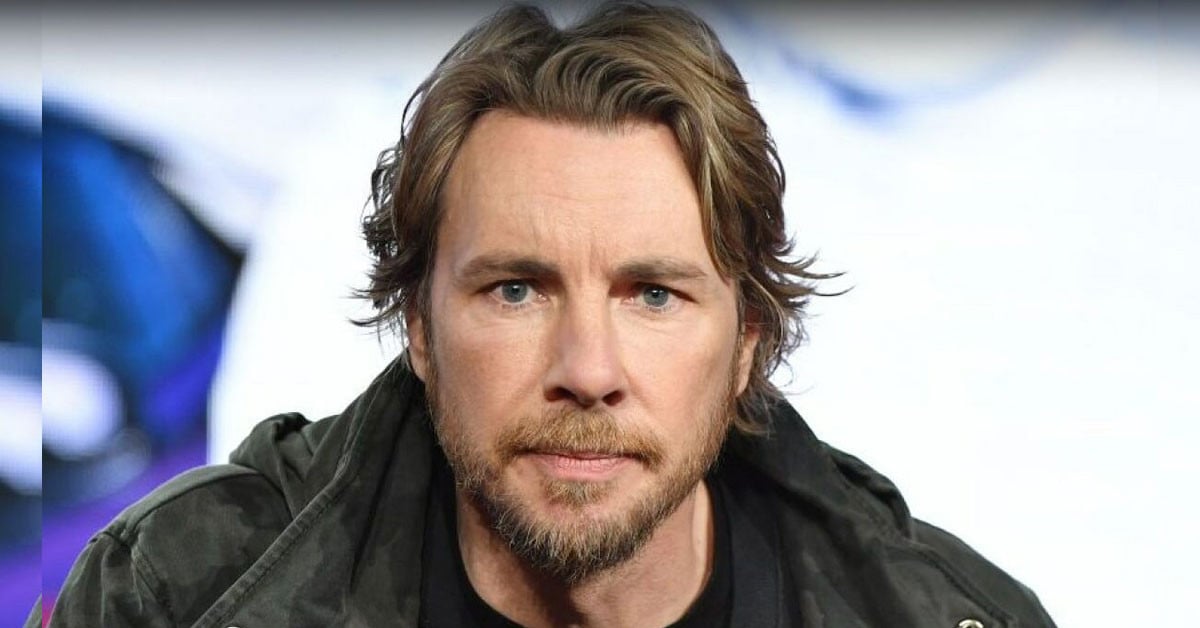

Dax Shepard describes 'peaceful' feeling during near-fatal crash

-

Steve Martin says THIS film has his most funny scene

-

Melissa McCarthy reveals her tried and tested ‘corpse’ night time routine that’s lost her 95lbs

-

Kanye West's tweet about Super Bowl halftime resurfaced after Bad Bunny's show

-

'FBI' star Juliana Aidén Martinez tease her return to 'Law and Order: SVU' after quitting

-

Cardi B's emotional words to pal amid Stefon Diggs rumored breakup revealed