Meghan Markle, Prince Harry advised to move company offshore to avoid heavy taxes

Prince Harry and Meghan Markle may have a special plan in place, inspired by Queen Elizabeth II

Prince Harry and Meghan Markle are all set to pocket heaps of cash after their multi-million dollar deal with Netflix.

However, the Duke and Duchess of Sussex may have a special plan in place, inspired by Queen Elizabeth II that could help them avoid heavy taxes.

According to tax adviser, David Lesperance, the Sussex pair appears to have been offered a much greater deal than Barak and Michelle Obama.

He further told Express how some of the amount from the deal would go towards their production company.

“I suspect they have got a very good deal, they appear to have got a greater sum of money than the Obamas. Depending on how the deal is set up, somebody will pay expenses, either Netflix or the production company,” he said.

“Are those expenses to be borne by the Sussexes production company or Netflix?” he said, as he pointed out how the couple will also be required to pay corporate tax as well as individual tax quite possibly.

“Where is that production company going to be located — California?” he said, suggesting there was “no logical reason why it needed to be in the US.”

He went on to say how their global status may bring about attention from all across the world which could be to their benefit as “then you would eliminate, at a minimum, the federal corporate tax rate.”

“If many of the productions are not in the US, I would advise them to set up outside of the US in a zero-tax jurisdiction, of which there are many,” he said.

Lesperance further noted that firm’s investors could also have an influence on the taxes of their company.

“If those investors are international, it’s easier to do it in a non-tax jurisdiction, for example, the Cayman Islands. The reason for that is nothing nefarious, it’s just much more simple,” he said.

“If you put [the production company] in the US and you had an investor from a non-dom, the UK, for example, the corporation will pay tax, the non-dom has to seek a refund,” he added.

“Whereas if they live in the Cayman Islands, there isn’t any tax of that sort. If you think of Cayman as a tax neutral destination, it allows a multitude of investors from a variety of places to invest, and depending on what those investors’ tax situation is, they will do their own tax liability,” he said.

Separately, owing to its royal links over finances, the Cayman Islands is already under scrutiny after the 2017 Paradise Papers’ investigation.

The Queen was also found holding funds in Cayman Islands, worth £10million out of her private money from the Duchy of Lancaster.

Explaining the entire scenario, The Guardian reported back then: “Investors who do not pay tax in the UK can face a tax bill if they invest in certain types of funds in the US, although the Duchy said it gained no tax advantage from investing via the Caymans.”

-

Bruno Mars' Valentine's Day surprise labelled 'classy promo move'

-

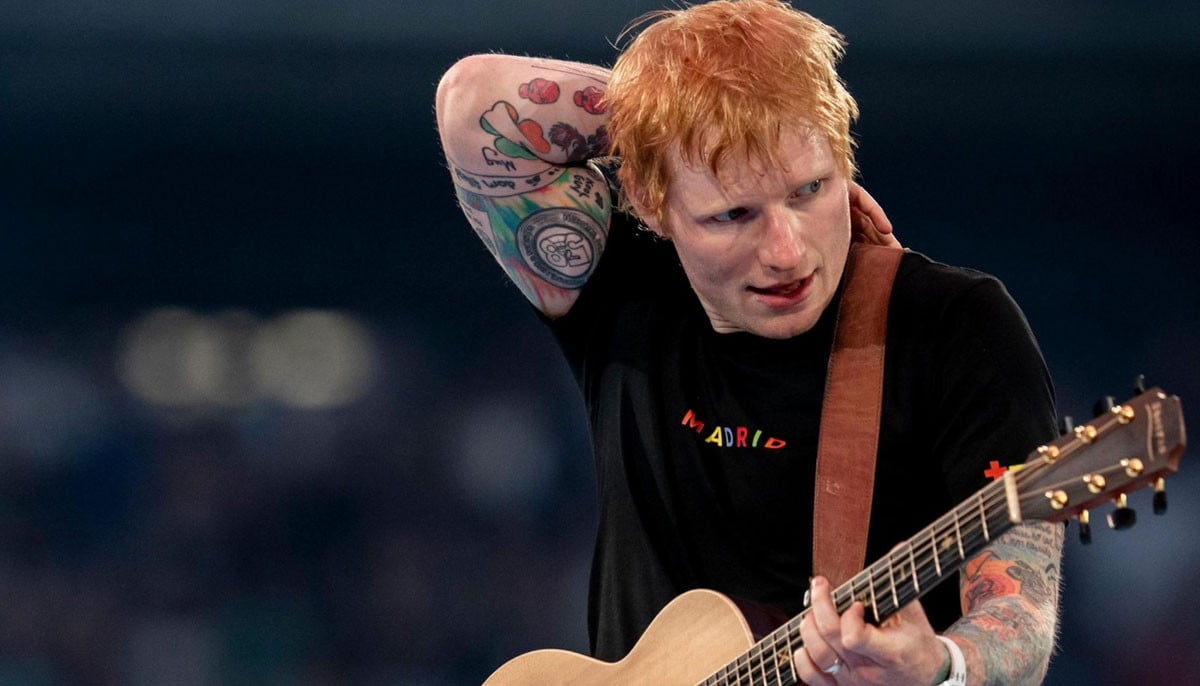

Ed Sheeran shares his trick of turning bad memories into happy ones

-

Teyana Taylor reflects on her friendship with Julia Roberts

-

Keke Palmer on managing growing career with 2-year-old son: 'It's a lot'

-

David E. Kelley breaks vow to cast wife Michelle Pfeiffer in 'Margo's Got Money Troubles'

-

Apple Martin opens up about getting 'crazy' lip filler

-

Amy Madigan reflects on husband Ed Harris' support after Oscar nomination

-

Margot Robbie gushes over 'Wuthering Heights' director: 'I'd follow her anywhere'