Kamyab Jawan Program: Here is all you need to know

Through six flagship initiatives under the Kamyab Jawan Program, the ‘Youth Entrepreneurship Scheme’ will provide subsidised business loans to young aspiring entrepreneurs for the promotion of SME sector.

KARACHI: Prime Minister Imran Khan has launched ‘Kamyab Jawan Program’ offering Pakistani youth a set of opportunities related to education, skill training, entrepreneurship and civic engagement.

The Kamyab Jawan Program - meaning successful youth, will not only secure employment opportunities, but also improve progress of small and medium enterprises by providing loans worth Rs100 billion to youth during five years.

Through six flagship initiatives under the Kamyab Jawan Program, the ‘Youth Entrepreneurship Scheme’ will provide subsidised business loans to young aspiring entrepreneurs for the promotion of SME sector.

Other programs include the ‘Skill for All Program’, ‘Startup Pakistan Program’, ‘Green Youth Movement’, the ‘Internship Program’ and ‘Jawan Markaz’.

Youth Entrepreneurship Scheme

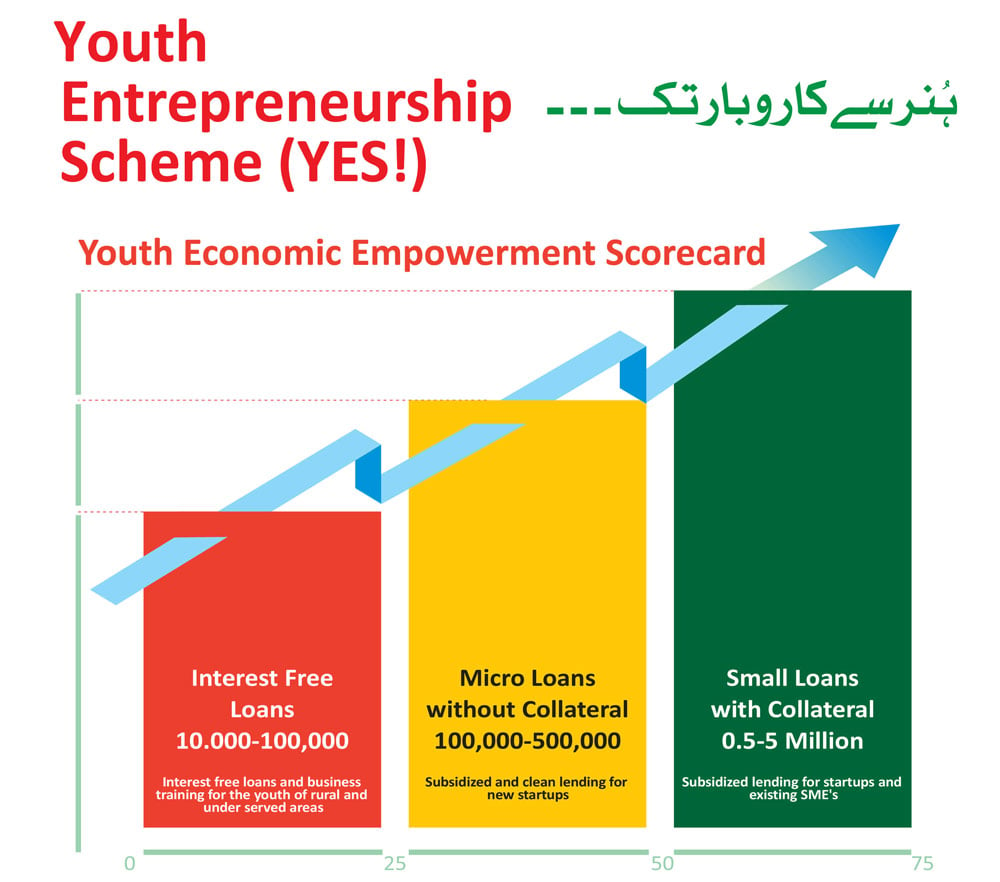

The scheme envisages ‘Hunar se Karobar Tak’, where the youth will be graduated from basic assets transfer to interest free loans to micro and then finally small loans as depicted in the graph.

This is developed in collaboration with three main departments, namely Pakistan Poverty Alleviation Fund (PPAF) which will look after the asset transfer program and the interest free loan program and State Bank of Pakistan (SBP) along with three major banks (National Bank of Pakistan, Bank of Punjab and Bank of Khyber) and Small and Medium Enterprise Authority (SMEDA), which will collaborate together to provide subsidized loan to the youth, along with giving them the basic aptitude to run a successful business.

All the Pakistani youth aged between 21 to 45 years can apply for the loan. About 25 percent of the loans will go to women borrowers.

Two tiers have been set up for the loans. T1 loans- from Rs 100,000 to Rs. 0.5 million and T2 loans- above Rs 0.5 million and up to Rs 5 million.

Loan from Rs10,000 to Rs100,000 will be interest free.

The processing duration of the loan applications is 30 working days.

Applicants can apply for loan online.

-

Security forces gun down 30 terrorists in multiple IBOs in KP: ISPR

-

MQM-P calls for new province in Sindh

-

US report validates Pakistan military edge over India: PM

-

Banned TTP poses serious threat to Pakistan security: UNSC panel

-

CM Afridi clarifies remarks on by-poll after ECP requests army deployment

-

Dubai sees 3.2m Pakistani passengers in 2025 as airport sets new milestone

-

Security forces kill 23 Indian proxy terrorists in KP's Kurram

-

Pakistan to construct island to boost oil exploration: report