Chinese authorities bust $20 million bitcoin laundering scheme

Kuaishou employees exploited loopholes in the company’s reward system for almost a year

Chinese authorities have unveiled a $20 million Bitcoin laundering operation involving employees of Kuaishou. Kuaishou Technology is a Chinese publicly traded partly state-owned holding company based in Haidian District, Beijing, that was founded in 2011 by Hua Su and Cheng Yixiao.

The case marks as one of the largest crypto-related frauds uncovered in recent years. This highlights the growing effectiveness of blockchain forensics in tracing illicit crypto transactions even when sophisticated obfuscation techniques like mixers and overseas exchanges are used.

How the scheme worked

As reported by People’s Procuratorate of Haidian District, the mastermind behind the fraud was a Kuaishou employee named Feng who oversaw bonus payouts to service providers.

For almost a year, Feng and two external collaborators, Tang and Yang, exploited loopholes in the company’s reward system by submitting fake documents to siphon off 140 million yuan (~$20 million).

To launder the money, the group then funneled the money into shell companies with no real operations. The cash was then converted into Bitcoin using eight overseas crypto exchanges.

Lastly, they used coin mixers to obscure transaction trails before cashing out. The coin mixer helped them to break the link between the sender’s wallet and the recipient’s wallet.

How authorities cracked the case

Despite using mixers, the investigators utilised advanced blockchain analysis to trace the transaction of funds.

To do so, they analysed the transaction patterns across multiple platforms. By exchanging KYC data, they linked Bitcoin addresses to real-world identities.

Lastly, authorities collaborated internationally to track cross-border fund flows. The inquiry led to the recovery of 92BTC that makes up to $11.7 million marking a major win for China’s crackdown on crypto-related financial crimes.

Verdict of court

The Beijing court sentenced the main culprit named Feng 14.5 years in prison and fellow members Tang and Yang were expected to get 3 to 14 years of jail sentence. Along with them, five accomplices were awarded fines and prison terms.

The case revealed several critical trends including the corporate insider threats. It showcases how employees with unchecked access can exploit financial systems. It also debunks crypto’s pseudonymity myth proving that even mixers are unable to fully evade forensic tracing.

To avoid such frauds, businesses must strengthen internal audits to prevent insider fraud. In addition investors should use reputable exchanges with strong KYC/AML policies.

-

Timothee Chalamet rejects fame linked to Kardashian reality TV world while dating Kylie Jenner

-

Sarah Chalke recalls backlash to 'Roseanne' casting

-

Willie Colón, salsa legend, dies at 75

-

Touching Eric Dane moment with daughter emerges after viral final words

-

Ryan Coogler explains why his latest project 'Sinners' is so close to his heart

-

Who is Punch? Here’s everything to know about the viral sensation winning over internet

-

Matty Healy sets summer wedding date close to ex Taylor Swift's nuptials

-

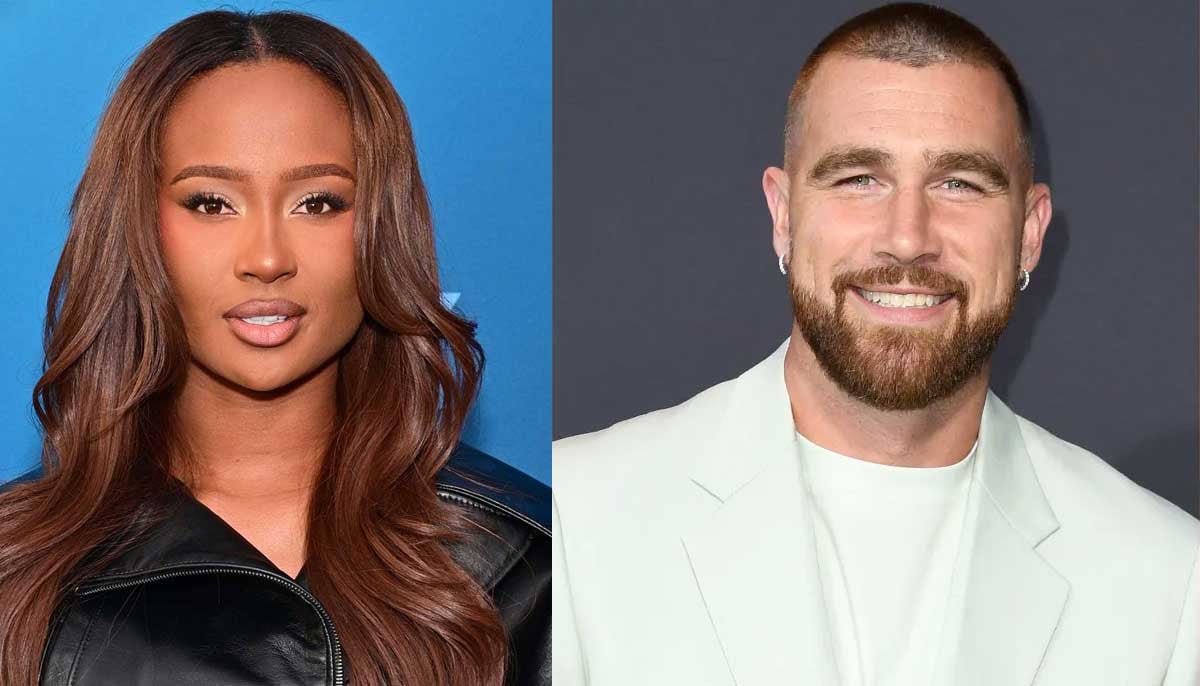

Kayla Nicole reveals surprising reason behind separation from Travis Kelce