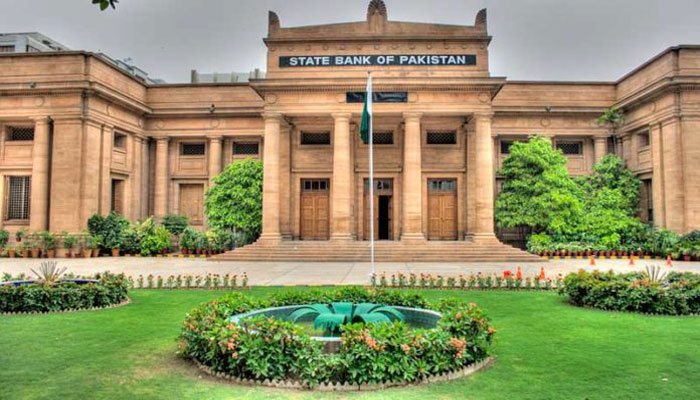

SBP slaps Rs98mln fines on four banks

KARACHI: The State Bank of Pakistan (SBP) has slapped fines of Rs97.6 million on four top banks in the first quarter of the year for failing to comply with the regulatory instructions, it said on Friday.

“These actions are based on deficiencies in the compliance of regulatory instructions and do not constitute a comment on the financial soundness of the entity,” the SBP said in a statement.

The four banks were fined for failure to comply with the regulatory instructions related to foreign exchange and general banking operations, customer due diligence and anti-money laundering, according to the central bank.

Pakistan has been on the Financial Action Task Force’s (FATF) grey list for deficiencies in its counter-terror financing and anti-money laundering regimes since June 2018.

In February, the FATF kept Pakistan on its ‘grey list’, with the country’s status set to be reviewed next at an extraordinary plenary session in June. Pakistan has so far implemented 24 out of 27 points of the FATF roadmap.

Ratings agency Moody’s maintained stable outlook for Pakistani banks. “Pakistan’s banks face slow economic recovery, but solid funding and liquidity underpin stable outlook,” Moody’s said in a report in January.

Moody’s expects the slow economic recovery to affect loan quality, with nonperforming loans expected to rise over the coming months from a sector-wide level of 9.9 percent of gross loans in September 2020.

“Banks’ foreign operations, export-oriented industries and companies reliant on government payments and subsidies will be hit hardest, but loan repayment holidays and other government support measures should help contain some risks,” it said. “Meanwhile, banks’ profitability, which has materially increased during 2020, will come under pressure on lowered margins, higher loan-loss provisions given the challenging operating environment, and subdued business generation.”

Apart from the penal action, the central bank advised these four banks to strengthen its processes with respect to identified areas.

One of these banks was advised to conduct an internal inquiry on breaches of regulatory instructions and take disciplinary action against the delinquent officials. Another was advised to strengthen its processes to avoid recurrence of such violations.

The banking is well capitalised entering the crisis and \financial sector indicators appeared sound as of December 2020. The average capital adequacy ratio stood at 18.6 percent.

-

5 Celebrities You Didn't Know Have Experienced Depression

5 Celebrities You Didn't Know Have Experienced Depression -

Trump Considers Scaling Back Trade Levies On Steel, Aluminium In Response To Rising Costs

Trump Considers Scaling Back Trade Levies On Steel, Aluminium In Response To Rising Costs -

Claude AI Shutdown Simulation Sparks Fresh AI Safety Concerns

Claude AI Shutdown Simulation Sparks Fresh AI Safety Concerns -

King Charles Vows Not To Let Andrew Scandal Overshadow His Special Project

King Charles Vows Not To Let Andrew Scandal Overshadow His Special Project -

Spotify Says Its Best Engineers No Longer Write Code As AI Takes Over

Spotify Says Its Best Engineers No Longer Write Code As AI Takes Over -

Michelle Yeoh Addresses 'Wicked For Good' Snub At 2026 Oscars

Michelle Yeoh Addresses 'Wicked For Good' Snub At 2026 Oscars -

Trump Revokes Legal Basis For US Climate Regulation, Curb Vehicle Emission Standards

Trump Revokes Legal Basis For US Climate Regulation, Curb Vehicle Emission Standards -

DOJ Blocks Trump Administration From Cutting $600M In Public Health Funds

DOJ Blocks Trump Administration From Cutting $600M In Public Health Funds -

2026 Winter Olympics Men Figure Skating: Malinin Eyes Quadruple Axel, After Banned Backflip

2026 Winter Olympics Men Figure Skating: Malinin Eyes Quadruple Axel, After Banned Backflip -

Meghan Markle Rallies Behind Brooklyn Beckham Amid Explosive Family Drama

Meghan Markle Rallies Behind Brooklyn Beckham Amid Explosive Family Drama -

Scientists Find Strange Solar System That Breaks Planet Formation Rules

Scientists Find Strange Solar System That Breaks Planet Formation Rules -

Backstreet Boys Voice Desire To Headline 2027's Super Bowl Halftime Show

Backstreet Boys Voice Desire To Headline 2027's Super Bowl Halftime Show -

OpenAI Accuses China’s DeepSeek Of Replicating US Models To Train Its AI

OpenAI Accuses China’s DeepSeek Of Replicating US Models To Train Its AI -

Woman Calls Press ‘vultures’ Outside Nancy Guthrie’s Home After Tense Standoff

Woman Calls Press ‘vultures’ Outside Nancy Guthrie’s Home After Tense Standoff -

Allison Holker Gets Engaged To Adam Edmunds After Two Years Of Dating

Allison Holker Gets Engaged To Adam Edmunds After Two Years Of Dating -

Prince William Prioritises Monarchy’s Future Over Family Ties In Andrew Crisis

Prince William Prioritises Monarchy’s Future Over Family Ties In Andrew Crisis