It is ‘all in’ fiscal account: Part II

In the previous article, we had focused on the fiscal policy challenges and how it was driving the current economic crisis. In today’s article, we argue for finding evidence based solutions to tackle our financial challenges and devising a home grown roadmap for equitable prosperity.

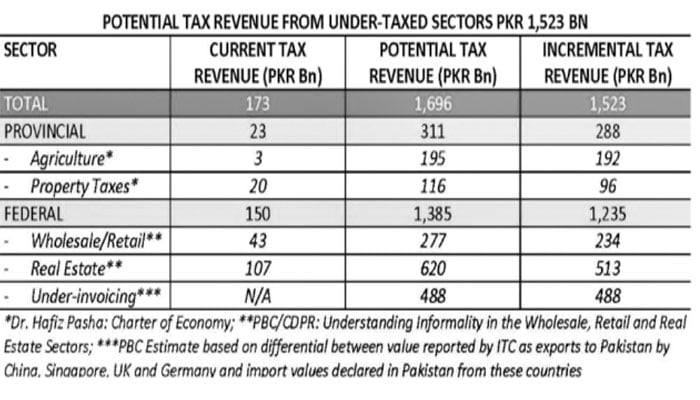

The Federal Board of Revenue (FBR) needs to develop capacity to formulate practical evidence-based policies and implement them. According to the Pakistan Business Council (PBC), there is Rs. 1.8trn tax potential from real estate and retail sectors alone that has currently been ignored.

In our view, each sector and each individual must start paying their due share of taxes, without any exemptions. Thomas Piketty, the eminent French economist, advocates a progressive tax on the wealth of individuals based on the net value of the assets they control. Tax experts have advocated implementing a Minimum Asset Tax, which targets only the wealthiest individuals and businesses, and can potentially add nearly 2% of GDP in revenue for the government. In Norway, the government imposes a 0.85% wealth tax on net assets of 1.5mn Krone. In Switzerland, the government imposes wealth tax of 0.1% to 1% depending on the municipality of residence. This could be called a ‘Robinhood Approach’ to taxation which is the need of the hour in our beloved country.

Pakistan already performs poorly compared to other South Asian nations on the income distribution front. According to the UN, the ratio of the average income of the poorest 10% of the population to the richest 10% in Pakistan is 6.5%. In other words, the average income for the richest is more than 16 times the average for the poorest. The ratio is 7.5% for Bangladesh, 8.6% for India and 11.1% for Sri Lanka, as per UN.

Similarly, on the expenditure side, there are many innovative solutions that can be adopted over the medium term to tackle the financial challenges without burdening the citizens. One of the biggest challenges on the fiscal front is the rising pension liabilities. The pension bill in the current year is estimated at Rs. 1.5trn for federal and provincial governments put together. Since pension liabilities are unfunded, the government has to foot the bill through the budget every year.

Our government is asset-rich but cash-starved. Therefore, a creative solution to this problem lies in setting up a professionally managed pension fund under the Private Public Partnership (PPP) mode and transferring assets that can be made productive, e.g., government lands, with the express purpose of asset monetization, which involves the transfer of dead assets, which generate no income, to the private sector. Through this monetization, the private sector takes ownership and generates income from these assets. This income could be used to partially fund pension liabilities and reduce the government’s budget expenditure.

The policymakers must be mindful of inadequate solutions. There are some advocating restructuring of our local currency debt. This is an absurd idea to say it politely as any domestic debt restructuring will not be sustainable without first implementing sustainable improvements in the fiscal policy. Any gains from this restructuring will be short-lived, and if not complemented by a significant reduction in deficits, will exacerbate our debt challenges. It’s the reforms in our fiscal account that needs to be done and are inevitable, and then no local currency debt restructuring would be necessary.

Similarly, with inflation breaking all records, and headline inflation skyrocketing to 36.4% in April 2023, there are serious question marks on the ability of the monetary policy alone to manage the inflation surge and it’s believed that the current monetary policy stance will help achieve the medium-term inflation target over the next 8 quarters which of course remains subject to significant downside risks from international commodity prices and heightened domestic uncertainty with elections scheduled in October 2023. The lack of clarity on the IMF program is another big unknown in the equation.

We’ve been arguing for a while that the governments in recent times has been trying to check inflation through only ‘interest rates’ which is based on the theological belief that inflation is driven by demand, and perhaps is an easy way out to manifest actions to control inflation as per the text book prescription. The inflation in Pakistan is driven by cost push supply factors, and raising interest rates will have little success in controlling inflation. In our view, the hike in policy rates not only ineffective in controlling inflation, but it might also prove to be counterproductive due to the stress they have induced on the government finances. In other words, this in fact fuels inflation.

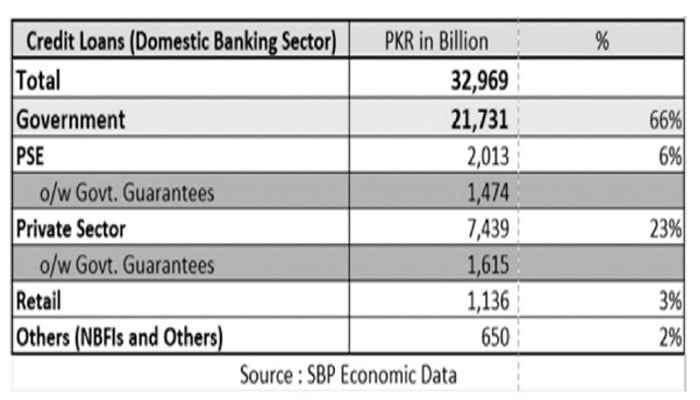

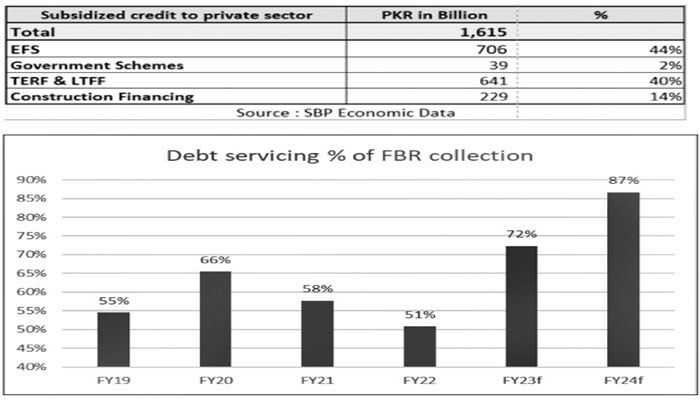

The largest borrower in the market is the government which is the beneficiary of two third of the total liquidity and with the increase in policy rates, its debt servicing is projected to increase to Rs 5.5trn in FY23. How will the government service this debt from the total federal revenue of Rs. 8.5trn, out of which the share of the federal government in the divisible pool is only Rs. 3.6trn.

SBP highlights the fiscal deficits as one of the leading factors driving inflation expectations which is being pushed higher through its policy decisions, particularly related to monetary policy. Credit to private business is merely 23% of the total domestic credit, and out of that 5% is concessionary finance subsidized by SBP and government (less sensitive to interest rate hikes). Any decline in credit to private sector will be more than offset by the increase in demand from government for deficit financing, keeping money supply high.

This can be seen in the latest SBP data. In the current fiscal year money supply growth M2 has increased by Rs 1.5 trillion (Jul-Apr), which is growth of 15.6% y/y compared to the same period last year, where M2 growth was Rs 0.85trn (13.6%). Hence, despite aggressive rate hikes by SBP, money supply has increased due to the heavy government borrowing needs.

Lastly, we need to focus on agriculture productivity on an emergency basis as the solution to our inflation challenges and our rising trade deficits. Food and cotton import bill was recorded at USD 5.5bn in FY2022 and is likely to rise further in the current fiscal year. Pakistan Agricultural Coalition (PAC) report highlights investments required to boost crop yields and produce surplus crops for exports. The report highlights that the adoption of technology and direct access to credit for farmers can enhance farm productivity by 40%. We cannot sustain growth of 6% if our agriculture sector growth remains stagnant.

At the end and in conclusion, it’s the fiscal policy which surely deserves a relook to eliminate the existing subsidy structure and create room to two priorities - 1). direct subsidy for poor and vulnerable using NSER scorecard; and 2). extend performance based subsidy for creating FX liquidity, just to reiterate. This is the way we can address our chronic issue of CAD through fixing our fiscal account where the real challenge rests and the good news is that’s all in our control.

This is the second and last part of the series that began on Monday.

-

Pamela Anderson, David Hasselhoff's Return To Reimagined Version Of 'Baywatch' Confirmed By Star

Pamela Anderson, David Hasselhoff's Return To Reimagined Version Of 'Baywatch' Confirmed By Star -

Willie Colón, Salsa Legend, Dies At 75

Willie Colón, Salsa Legend, Dies At 75 -

Prince Edward Praised After Andrew's Arrest: 'Scandal-free Brother'

Prince Edward Praised After Andrew's Arrest: 'Scandal-free Brother' -

Shawn Levy Recalls Learning Key Comedy Tactic In 'The Pink Panther'

Shawn Levy Recalls Learning Key Comedy Tactic In 'The Pink Panther' -

King Charles Fears More Trouble As Monarchy Faces Growing Pressure

King Charles Fears More Trouble As Monarchy Faces Growing Pressure -

Inside Channing Tatum's Red Carpet Return After Shoulder Surgery

Inside Channing Tatum's Red Carpet Return After Shoulder Surgery -

Ryan Coogler Brands 'When Harry Met Sally' His Most Favourite Rom Com While Discussing Love For Verstality

Ryan Coogler Brands 'When Harry Met Sally' His Most Favourite Rom Com While Discussing Love For Verstality -

Sarah Pidgeon Explains Key To Portraying Carolyn Bessette Kennedy

Sarah Pidgeon Explains Key To Portraying Carolyn Bessette Kennedy -

Justin Bieber Rocked The World With Bold Move 15 Years Ago

Justin Bieber Rocked The World With Bold Move 15 Years Ago -

Sam Levinson Wins Hearts With Huge Donation To Eric Dane GoFundMe

Sam Levinson Wins Hearts With Huge Donation To Eric Dane GoFundMe -

Kate Middleton Steps Out First Time Since Andrew Mountbatten-Windsor's Arrest

Kate Middleton Steps Out First Time Since Andrew Mountbatten-Windsor's Arrest -

Inside Nicole 'Snooki' Polizzi's 'private' Marriage With Husband Jionni LaValle Amid Health Scare

Inside Nicole 'Snooki' Polizzi's 'private' Marriage With Husband Jionni LaValle Amid Health Scare -

Germany’s Ruling Coalition Backs Social Media Ban For Children Under 14

Germany’s Ruling Coalition Backs Social Media Ban For Children Under 14 -

Meghan Markle Shuts Down Harry’s Hopes Of Reconnecting With ‘disgraced’ Uncle

Meghan Markle Shuts Down Harry’s Hopes Of Reconnecting With ‘disgraced’ Uncle -

Liza Minnelli Alleges She Was Ordered To Use Wheelchair At 2022 Academy Awards

Liza Minnelli Alleges She Was Ordered To Use Wheelchair At 2022 Academy Awards -

Quinton Aaron Reveals Why He Does Not Want To Speak To Wife Margarita Ever Again

Quinton Aaron Reveals Why He Does Not Want To Speak To Wife Margarita Ever Again